Private sales on the rise

Private sales on the rise

Posted on Tuesday, August 21 2012 at 1:14 PM

With the property market relatively soft in Melbourne, fewer homes are being listed or going under the hammer, according to buyers advocate company, Infolio.

Sam Gamon,

director and auctioneer at Chisholm and Gamon Property, says off-market sales

are on the rise as vendors look for ways to minimise advertising costs.

“They’ll quite

often approach agents on the basis of a quiet and discreet private sale,” he

says.

“Sometimes this

is cost driven and other times it’s due to a vendor having a desire for

privacy.

“Invariably, we

meet all sorts of different vendors and while their ultimate objective is to

achieve a sale, they have different motivations and goals.”

Buyers advocate

at Infolio, Cameron Deal, adds selling off-market can take away the uncertainty

of going to auction for the vendor, but most importantly, give the buyer the

opportunity to get a good deal.

“You’re not

competing with the wider market, therefore you should be able to buy a property

for the right price rather than (a price) inflated by auction conditions,” Deal

says.

“On behalf of our

clients, we recently purchased an off-market property in arguably one of

Melbourne’s best streets, St. Vincent Place, Albert Park, for $3.375 million

rather than $4 million, which is what we could have paid had it gone to

market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Private sales on the rise

Call for crackdown on illegal parking in unit complexes

Major expansion of Bowen Basin gas project

Calls for easements to be compulsory in Queensland

Development red tape scaled back in Queensland

API readership increasing by thousands

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Upkaa3WT0Ps/private-sales-on-the-rise

Property market warming up for spring

Property market warming up for spring

Posted on Thursday, August 09 2012 at 4:08 PM

Are you thinking of selling this spring? You could be entering very favourable market conditions, according to RP Data.

Research analyst

Cameron Kusher says the lead up to the spring selling season is looking more

positive than the same time last year and the housing market is now in a

stronger position.

“In comparison to

recent years, we wouldn’t expect the housing market to power along through

spring in the manner it has previously,” Kusher says.

“On the other

hand, a number of measures are more positive than the 10-year average and these

are likely to be a positive for the housing market. These measures range from a

lower number of new property listings entering the market and other measures

such as inflation, which is well below average levels.”

It’s also

important that investors looking to buy analyse how the economy is tracking

compared to a longer-term average to achieve a better understanding of the

overall state of the economy, Kusher adds.

For example,

retail trade has increased by 5.4 per cent over the past 12 months and interest

rates remain low, with the cash rate at 3.5 per cent.

The number of

newly advertised properties for sale has also fallen and are at their lowest in

27 weeks.

“Overall, we’ve

seen some positive movement for home values, with new stock being added to the

market lower and each of the vendor metrics – selling time, vendor

discounting and auction clearance rates – all showing improvement.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Major expansion of Bowen Basin gas project

Calls for easements to be compulsory in Queensland

Development red tape scaled back in Queensland

API readership increasing by thousands

Property market warming up for spring

Housing market recovery imminent: CommSec

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nhv0EvP5cL4/property-market-warming-up-for-spring

API readership increasing by thousands

API readership increasing by thousands

Posted on Friday, August 10 2012 at 10:19 AM

New data by Roy Morgan Research reveals thousands more Australians are turning to Australian Property Investor magazine, the country’s leading source of property information and news.

While the magazine posted an impressive readership figure

of 122,000 in the 12 months to March 30, 2012, it has defied the odds in a slow property market to achieve an even higher audience reach of 128,000 in the year to June 30, 2012, according to the latest Roy Morgan readership survey.

This represents a 30% year-on-year readership increase.

API editor Eynas Brodie attributes the title’s increasing popularity to

a number of factors.

“We have an incredibly talented bunch of writers on our team, among

them renowned demographer Bernard Salt, Rismark’s Christopher Joye and Residex

chief John Edwards who are widely recognised as experts in their fields,” she

says.

“Why do so many Australians put their trust in API? Partly because

we’ve been around the longest – since 1997 – but also because we protect our

editorial integrity quite fiercely.

“Our readers have a strong say in the magazine we produce, which is why

they relate to it so well. It’s their magazine and we have a great dialogue

with them in terms of what stories they’d like to see and what they most enjoy.

Whether they’re looking for inspiration from like-minded investors, up and

coming hotspots to invest in, tips and information on investment strategies and

even warning stories from buyers who have been burnt, API is their one-stop

resource.”

More than half of API magazine buyers are long-term subscribers, an

achievement not many magazines can lay claim to.

“I think this speaks volumes about the credibility API has,” Brodie

says

“It helps that a lot of the property journalists at API are investors

themselves,” she adds. “Like our readers, we love all things property!”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/IpETV7F3mB0/api-readership-increasing-by-thousands

Major expansion of Bowen Basin gas project

Major expansion of Bowen Basin gas project

Posted on Monday, August 13 2012 at 2:54 PM

Arrow Energy has announced plans for a significant expansion of its coal seam gas (CSG) operations in the Bowen Basin region in Queensland.

The energy company has flagged its

intention to develop up to 7000 new gas wells in a staged development over the

next three to four decades.

Arrow Energy has been producing CSG in the

area since 2004. Under the plan, production will grow at exploration tenements

around Moranbah and from Glenden in the north to Blackwater in the south,

according to chief executive officer Andrew Faulkner.

Property investment expert Michael Yardney

of Metropole says the expansion news is another boost for the region’s

long-term prospects.

“This announcement shows that despite what

some are predicting, Australia’s economic boom will not be over in a year or

two,” Yardney says.

The Bowen Basin is already

home to dozens of resource industry projects with many more on the way.

There are more than $100

billion worth of projects either planned, in progress or recently completed.

Based on projections, at least 30,000 extra workers will be needed by 2020.

Today’s announcement will also

be reassuring news for Moranbah property investors who’ve faced a tougher year

as a result of falling rents.

While yields are still as high as 10 per cent in many cases,

demand for housing has eased as a result of the long-running industrial dispute

between project operators BHP Billiton-Mistubishi Alliance (BMA) and unions,

coupled with the indefinite closure of the Norwich Park

mine.

Faulkner says the Bowen Gas Project will

supply gas via a high-pressure pipeline to Gladstone, where it would be

processed before being transported to nearby Curtis Island for export.

“This project area is a crucial part of

Arrow’s LNG (liquefied natural gas) project which consists of two gas areas in

the Bowen and Surat basins, linked by two major pipelines and a (LNG) plant on

Curtis Island,” Faulkner says.

As more planning projects

enter development and operation stages, Yardney believes Australia will

transition to “the next phase” of the resources boom.

“We’re entering a new economic

stage – not a resources boom, because they come to an end, but a time of

(continued) prosperity that’s underpinned by our resources sector.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9kOT6H7VdDI/major-expansion-of-bowen-basin-gas-project

Development red tape scaled back in Queensland

Development red tape scaled back in Queensland

Posted on Friday, August 10 2012 at 2:30 PM

New amendments have come into effect in Queensland that aim to cut red tape and provide time and cost savings for development approval applicants.

Changes to the Sustainable Planning

Regulation will scrap a number of triggers requiring the referral of

development applications to state agencies.

Deputy Premier and Minister for State

Development, Infrastructure and Planning Jeff Seeney says the amendments will

result in 1500 fewer referrals each year.

“These referrals were mostly for agencies

to provide advice only, and were adding to the regulatory and cost burden for

applicants (and) councils,” Seeney says.

Referral triggers to be removed include:

- Advice

referrals for conservation estate areas, cultural heritage premises, and

wetlands - Advice

referral for premises affected by acid sulfate soils - Concurrence

referral for particular applications for preliminary approval - Concurrence

referrals for purposes of community uses, places of worship, and

education-care service premises-child care centres.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Calls for easements to be compulsory in Queensland

Development red tape scaled back in Queensland

API readership increasing by thousands

Property market warming up for spring

Housing market recovery imminent: CommSec

Interest rates on hold again

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/sjySxHBm4Do/development-red-tape-scaled-back-in-queensland

Calls for easements to be compulsory in Queensland

Calls for easements to be compulsory in Queensland

Posted on Friday, August 10 2012 at 4:11 PM

Queensland-based property advisory group THG is lobbying the State Government to introduce statutory easements on smaller lots.

It’s also calling

for the reduction of red tape around the titling of small lot sizes.

Director Peter

Sippel says the changes would allow for more affordable housing.

“The building

sector is developing a range of innovative housing products in response to the

need for increased affordability in housing and THG is leading the way,” Sippel

says.

“(We) recently

negotiated a record freehold lot size of 74 square metres with Moretan Bay

Regional Council as part of a pilot housing project in Warner Lakes. “As we see

an increase in these types of housing innovations, it follows that the titling

system needs to be capable of responding to protect property rights in ways

that don’t add unwarranted additional cost.

“While community

title legislation accounts for the public protection of adjoining property

owner rights, there’s no such convention for freehold titles.

“This means small

lot owners with freehold titles who have the requirement to build on the

boundary line are faced with creating a myriad of easements to cover the rights

to support, shelter, drainage, access and so on.

Complicated and

exhaustive easement arrangements not only add cost to the initial purchase

price of the product, but also significant conveyance costs to future

purchasers, he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Calls for easements to be compulsory in Queensland

Development red tape scaled back in Queensland

API readership increasing by thousands

Property market warming up for spring

Housing market recovery imminent: CommSec

Interest rates on hold again

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/dr-ppm_geAE/calls-for-easements-to-be-compulsory-in-queensland

Housing market recovery imminent: CommSec

Housing market recovery imminent: CommSec

Posted on Wednesday, August 08 2012 at 2:32 PM

There are several “encouraging” signs of improvement in housing activity, backed up by positive data, which indicate a housing market recovery is imminent, according to CommSec.

There was a lift in the number of new

owner-occupier housing loans in June of 1.3 per cent. The value of all home

lending increased by 2.3 per cent.

CommSec economist Savanth Sebastian says

substantial rate cuts and consolidation in house prices over the past year have

enticed potential buyers out of the woodwork.

The average home loan across Australia now

stands at $295,000, which is up for the fourth consecutive month since

bottoming out earlier this year.

Investor activity is also on the rise,

thanks to improving job security and low rental vacancy rates across Australia.

“And even the anecdotal evidence across

Commonwealth Bank seems to suggest there’s a healthy pick up in the number of

housing recoveries,” Sebastian says.

General consumer confidence also “looks

like shifting in the right direction”, which is crucial for a turnaround in

property, he says.

In coming months, these sustained positive

factors are likely to translate to a bigger pickup in building activity, he

says. Construction loans in June saw their biggest rise in almost three years.

“The fundamentals for the housing sector

certainly remain sound. It is clear that the attractiveness of property as a

long-term investment continues to garner interest.”

He believes there are also strong signs

that home prices have bottomed.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing market recovery imminent: CommSec

Interest rates on hold again

High-end Sydney rentals hurting

More land releases for Blackwater and Moranbah

Population boom for Perth and Brisbane

Capital city home values increase for the second consecutive month

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/J1Z8xvVYZaw/housing-market-recovery-imminent-commsec

More land releases for Blackwater and Moranbah

More land releases for Blackwater and Moranbah

Posted on Monday, August 06 2012 at 4:43 PM

Buying an investment property in the Queensland mining towns of Blackwater and Moranbah could soon be more affordable, with more than 1000 land allotments about to be fast tracked.

Queensland Deputy

Premier Jeff Seeney says the government will initially spend $15 million over

the next nine months delivering 185 housing allotments in Moranbah and

Blackwater.

“That land will

be available by next March,” Seeney says.

“I have also

tasked the Urban Land Development Authority (ULDA) transition team to work

closely with Isaac Regional Council to assist it in the early delivery of its

Belyando Estate (in Moranbah), which will deliver 1000 lots to the market.

“Secondly, I have

tasked my department and ULDA team to collaborate with Western Downs and

Maranoa Regional Councils and the Gladstone Regional Council to identify

projects that they can accelerate to deliver housing more quickly in the Surat

Basin and Gladstone respectively.”

Premier Campbell

Newman says the process of land releases will also expand to other Queensland

towns, including Mackay, the Darling Downs, Burnett and Central Queensland

coasts, Cairns and Mt Isa.

“Under the

previous government, the ULDA’s activity was focused on delivering housing at

the low end of the market and was limited to small releases at a time,” Newman

says.

“This will be

totally turned around, where appropriate. Land held in urban development areas

by the ULDA will be released to the market for housing development.

“There has been

obvious market failure in towns like Moranbah and Blackwater where there’s an

inadequate supply of land and therefore of affordable housing.

“Our action now

will change that in the shortest possible time.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

More land releases for Blackwater and Moranbah

Population boom for Perth and Brisbane

Capital city home values increase for the second consecutive month

Flood-proof plan for Queensland

Mining boom far from over

Brisbane most affordable mainland capital

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/WnTXlpCb5Uw/more-land-releases-for-blackwater-and-moranbah

Population boom for Perth and Brisbane

Population boom for Perth and Brisbane

Posted on Thursday, August 02 2012 at 10:57 AM

Perth’s population growth has not only led the national race over the past decade alongside Brisbane, but its estimated population over the next 44 years is also well ahead of the pack. So are infrastructure and house prices keeping pace? API investigates.

According to the recently

released Australian Bureau of Statistics (ABS) 2011 Census, Perth and Brisbane

tied in first place for population growth between 2001 and 2011, ahead of all

other capitals.

In this period Perth and

Brisbane boosted population figures by 25.2 per cent, while Darwin followed in

second place with 20.8 per cent growth, Melbourne took third place at 18.3 per

cent, Canberra recorded 15.2 per cent, Sydney posted 11.6 per cent, Hobart

achieved nine per cent and Adelaide grew by 8.8 per cent.

The ABS’ population

projections also report that Perth and Brisbane will be the clear winners into

the future to 2056, with Perth’s population estimate a mighty 116 per cent

climb between 2007 and 2056 and Brisbane’s estimated population up 114 per

cent.

Perth-based buyers agent

Damian Collins of Momentum Wealth says the western capital is on the cusp of a

positive evolution with major planning and transport reforms already under way

to support the projected population boom.

Unlike most other capitals,

house prices are already rebounding, he adds, reflecting the increasing demand

from the growing population.

Collins says Perth’s

waterfront facelift is under way, with a flourishing bar, café and cultural

life and increasing development of more diverse housing styles. “There are

signs of vibrant change everywhere.

“It’s a case of more

people, more social activity, more cultural activity and more demand for

housing,” he says.

“Evolution is under way and

20 years from now this city will look very different.”

While the Perth market has

been in the doldrums since 2007, Collins says there are many positive signs for

the city’s future, reflected in the 14 per cent population increase in the five

years to the 2011 ABS Census.

Collins says some

properties in some Perth suburbs are now 10 per cent higher than one year ago

and with rental vacancies now at 1.7 per cent, rents have risen five per cent

since the end of 2011.

Prices aren’t likely to

slow down either, says Collins, as he expects the next few decades to see

significant structural transformation occurring in the Perth property market to

accommodate the massive influx of workers required to service the booming

resource sector.

Projections indicate that

Perth will ultimately grow from a relatively small population of under two

million to a city of four million, “similar in nature to Sydney and Melbourne”,

says Collins.

He notes that some key

features of this structural change include more infill development closer to

the city and, as a consequence of this, greater congestion of the city’s roads.

“Like Sydney and Melbourne,

demand will markedly grow for property that is close to public transport,”

Collins says.

“The changes will have an

impact on demand for both residential and commercial property that is close to

public transport.

“While Perth’s workforce

has predominantly been happy to drive to work, people will increasingly seek

workplaces and homes that can easily be reached by either train or bus.”

Collins says the Western

Australian Government’s Directions 2031 planning document, which

stipulates that 47 per cent of new dwellings must be infill development,

provides the blueprint for a vastly different looking city.

“On a world scale Perth’s

housing is very low density and while we have seen more infill development

closer to the city over the past five years, there’s still reluctance to it in

some areas,” he notes.

“However an ageing

population, a new generation of homebuyers who want to be close to the city and

an influx of immigrants who are more accustomed to different housing styles

will drive demand for increased density living.”

The planning changes under Directions 2031

present great opportunities for investors, but Collins warns against investing

in high-rise apartment developments close to the revamped city centre.

“CBD properties may perform

well in the short term, however they will underperform over the longer term as

developers bring on substantial supply,” he says.

“Instead, investors should

look towards suburbs that are near public transport and within easy reach of

the CBD or places of employment and where available property is in limited

supply.”

On behalf of his clients,

Collins selects properties near key amenities and infrastructure, which possess

other desirable attributes such as renovation or redevelopment potential.

Even in what’s generally

been a flat market, certain properties have increased as much as 10 per cent in

the past 12 months, says Collins.

“For example, a property

purchased in Padbury 12 months ago that was purchased for around $425,000 is

now worth between $460,000 and $480,000.

“In Morley a property

purchased for around $460,000 in 2011 is now worth between $490,000 and

$500,000 and another one in Dianella purchased at the same time for $390,000 is

today worth $440,000.

“So, when buying it’s not

just about the suburb, it’s also about buying the right property in that

suburb.”

Collins says quite a few

suburbs within a 15-kilometre radius of the city, which are currently off the

radar of investors, have the potential to outperform the market.

Just as Melbourne’s St

Kilda and Port Melbourne gentrified into trendy and highly sought after suburbs,

many Perth suburbs will become increasingly desirable to those on higher

incomes, he notes.

South of the Perth CBD,

Victoria Park is becoming increasingly desirable to more affluent buyers, while

the near airport suburbs of Belmont, Redcliffe and Cloverdale will rise in

popularity, Collins says.

“Similarly suburbs such as

Bayswater, Bedford, Dianella and Yokine will become more attractive to the

upwardly mobile.”

In Brisbane, the second

capital in line for a projected population boom behind Perth, buyers agent

Scott McGeever of Property Searchers says the winning suburbs will be the

transport hubs where rezoning has either already occurred or is under way.

He lists Indooroopilly,

Toowong, Carindale and Mount Gravatt as some examples.

Investors should also look

to where the mining executives are buying and renting. “These tend to be in the

green and leafy areas in Brisbane’s west and northwest. Suburbs like Ashgrove,

Bardon and Toowong.”

While the green and leafy suburbs are easily

accessible to the Brisbane Airport for fly-in, fly-out mining executives and

workers via the Inner City Bypass and the recently opened Airport Link road

infrastructure, buyers agent Zoran Solano of Metropole Properties Brisbane says

suburbs such as Clayfield, Nundah, Albion and Windsor are also likely to

increase in demand due to their even closer access to the Brisbane Airport for

fly-in, fly-out mine workers seeking lock-and-leave units or apartments.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/MZHbMLctmzI/population-boom-for-perth-and-brisbane

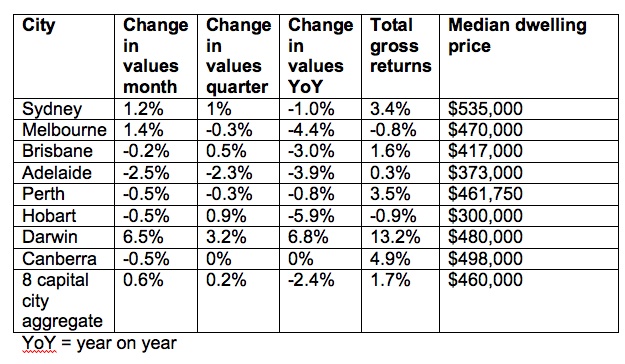

Capital city home values increase for the second consecutive month

Posted on Wednesday, August 01 2012 at 2:24 PM

Investors who spent the earlier part of the year buying up big could have gotten in at the perfect time, while those still sitting on the fence could be running out of time.

According to the

latest figures from RP Data, property prices are finally starting to rise as

investors respond to lower interest rates on mortgages.

Although prices

haven’t risen by huge amounts, the latest figures indicate the market is bottoming

out.

RP Data reports

dwelling values across capital cities recorded a second month of gains in July,

with values up by 0.6 per cent over the month following a one per cent rise in

June.

Research director

Tim Lawless says the July results were heavily influenced by improving values

across the most expensive capital city markets.

“The July rise

wasn’t as broad-based as the June results, with the month-on-month increase

primarily being associated with the Sydney and Melbourne markets where dwelling

values rose 1.2 per cent and 1.4 per cent respectively,” he says.

“The July result,

when viewed together with the positive June result, suggests housing markets

may be starting to respond to lower mortgage rates.”

Rismark chief

executive officer Ben Skilbeck adds rental rates are also continuing to rise.

Across the capital cities, weekly rents have risen by 3.3 per cent over the

first seven months of the year.

The largest rents

over the year to date have been in Perth, up a massive 13.7 per cent, and

Darwin, up 5.4 per cent.

Lawless adds

other indicators show some further signs of improving conditions in the market.

“Auction

clearance rates were recorded at 56.8 per cent over the last week of July, the

highest clearance rate since February last year. We’re also seeing average

selling time and vendor discounting both at healthier levels than what was

recorded a year ago and effective supply levels have also seen some improvement

from their highs of late last year.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Capital city home values increase for the second consecutive month

Flood-proof plan for Queensland

Mining boom far from over

Brisbane most affordable mainland capital

Small office space in big demand in Adelaide

Gold Coast land sales rise in June quarter

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/OiwzXdwjTmU/capital-city-home-values-increase-for-the-second-consecutive-month