Queensland property buyers to benefit from paperwork reforms

Posted on Tuesday, October 23 2012 at 3:31 PM

Property buyers in Queensland will benefit from changes to the Property and Motor Dealers Act (PAMDA), according to the State Government.

Attorney-General

Jarrod Bleijie says the Act will be simplified and split, to make buying and

selling property much easier.

“Consumers are

often overwhelmed by pages of paperwork, so they just sign on the dotted line

without reading the fine print, which can be dangerous,” Bleijie says.

“These changes

will simplify the process for consumers, while ensuring their rights are

protected and also make life easier for industry.”

The reforms

involve splitting the PAMDA into four separate Acts, to better reflect and

represent each of the sectors, according to the Real Estate Institute of

Queensland (REIQ).

REIQ chairman

Pamela Bennett has welcomed the changes and says the REIQ has campaigned for

such changes for many years.

“The

simplification of the legislation will not only make life easier for all those

who work in the real estate profession, but will also provide significant

benefits to consumers during the buying and selling process,” she says.

Bleijie adds the

PAMDA warning statement will also be written into the contract of sale in

future, removing unnecessary duplication from the buying process.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Queensland property buyers to benefit from paperwork reforms

76% of Australians expect property prices to rise or stay steady

Perth rents on the rise

Negative equity doesn’t mean mortgage stress

Property industry is cautiously optimistic about the future

Apartment floor space shrinks to capture investors

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/J4MLiVwZzRo/queensland-property-buyers-to-benefit-from-paperwork-reforms

Property industry is cautiously optimistic about the future

Posted on Thursday, October 18 2012 at 11:34 AM

Property professionals believe the mining boom is far from over, capital city home values are on the up and the commercial market is set for a big year.

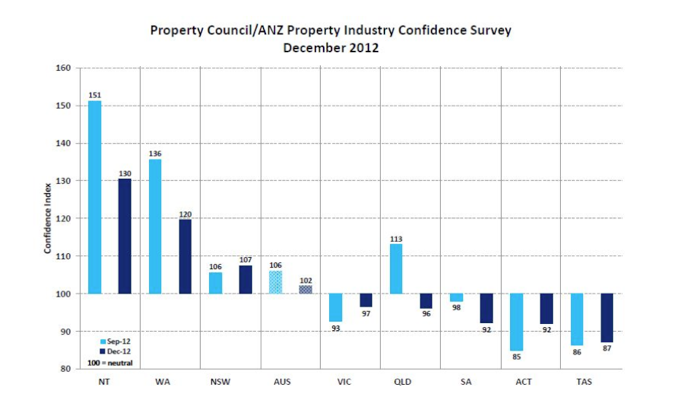

The latest Property Council of Australia-ANZ Property

Industry Confidence Survey shows views are mixed across the country,

with confidence in resource-rich states slipping in the past three months.

A softer outlook in mining-dominated

regions is responsible for a “closing gap” between resource states and the rest

of the country.

More than 3500 property and construction

professionals from all states and territories were polled on their

forward-looking views.

General sentiment in the December 2012

quarter was 102 on the index, down from 106 in September.

The overall ranking was dragged down by

weaker sentiment in resource-rich jurisdictions like Queensland, Western

Australia, the Northern Territory and South Australia, the report concludes.

Despite the weaker outlook, Property

Council chief executive Peter Verwer says there was a recovery in sentiment

elsewhere.

“Respondents in (NSW and Victoria) have

more faith in their local economy than the national economy, and expectations

for forward work have improved,” Verwer says.

Source: Property

Council of Australia-ANZ Property Industry Confidence Survey

The poll found 68 per cent of property

professionals don’t believe the mining boom is over. Only 27 per cent believe

their business is reliant on the mining sector.

Sentiment for residential capital values

shifted from negative to positive, from 93 on the index to 101. It’s the first

positive result in the history of the survey. Housing construction expectations

also rose.

ANZ chief economist Warren Hogan says while

house prices remain soft in most capitals, there are tentative signs we’ve

reached “a floor” following recent interest rate cuts.

“May and June (Reserve Bank of Australia)

rate cuts are expected to be further supported by the October rate cut,” Hogan

says. “Residential auction activity has increased and auction clearance rates

are at the highest level since 2010.”

Property professionals believe the office

market has the strongest investment potential over the next 12 months, followed

by residential, industrial and retirement living.

Most also have a rosy view of the domestic

economy, with only 13 per cent of respondents believing growth will weaken over

the next year. That’s a slight increase of nine per cent in the previous

quarter.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nAP3dwWSxm8/property-industry-is-cautiously-optimistic-about-the-future

Negative equity doesn’t mean mortgage stress

Negative equity doesn’t mean mortgage stress

Posted on Thursday, October 18 2012 at 4:40 PM

Splashed across mainstream news headlines this week were claims of negative equity scenarios occurring across more than one-third of Australian properties purchased since 2008, however what was missing from the panic headlines were that the majority of those facing negative equity were first homebuyers who bought post-2008, rather than investors and other owner-occupiers.

This differential means that

first homebuyers are the ones being challenged to refinance or borrow further

to renovate as a result of the stagnant capital growth and limited or even zero

equity accrued in the timeframe since 2008, according to the J.P. Morgan

Australian Mortgage Industry Report Volume 16 released earlier this

week.

However what it doesn’t mean is

that recent first homebuyers are under mortgage stress or that they need to

panic, particularly as interest rates decline, says Australian Property

Monitors senior economist Andrew Wilson.

Wilson provides a clear context

of the situation, enough to wield away those panic button pushers just pulling

the figures and placing them into big headlines.

“It’s an interesting theoretical

model (number of negative equity mortgagees) that gathers attention but it’s

not a real position unless it’s a forced sale or someone wants to access

equity,” Wilson says.

He adds that forced sales only

occur in times of major job losses. “And while there are some signs that our

employment growth has dropped a little, it’s still strong.

“The real picture is in looking

at the equity position over eight years, because six to eight years is the

average for property turnover in Australia.”

As the market peaks and troughs

and carries on with growth again, many buyers are bound to find themselves in a

paper position of negative equity if they’ve just bought the property on a high

loan-to-value ratio at a peak in the market, adds Wilson. “It depends when you

choose to take that snapshot though.”

Someone who bought between June

2010 and today across most capital cities in Australia won’t have seen much

growth, if any, Wilson says.

“But any negative equity will

switch to positive equity over time, particularly when historically Australian

property sees 10 per cent plus capital growth per annum over the long term.”

It’s also important to note that

first homebuyers most likely in a negative equity or zero equity position

bought property with government incentives post-2008 at propped-up prices, at

high loan-to-value ratios, yet also with the least amount of risk exposure to

the property market compared to investors and other owner-occupiers.

As referenced in the report

released Tuesday, RP Data states: “Value accumulation is not just a fluctuation

of market conditions but also the length of time a home is owned for. With a

short length of ownership there has been a shorter period of time to accumulate

value, however the fact that value accumulation levels are so low on those

homes purchased after 2008 also highlights just how subdued the housing market

conditions have been since 2008”.

In the same report, some

interesting comments from J.P. Morgan reveal that investor loan demand is

actually “holding ground” and the overall value of repayments, particularly

from owner-occupiers, have actually “accelerated”.

The mortgage industry report

also states that the typical response for why investor loan demand has held its

ground is because of the investor’s preference to move away from equity markets

given the current volatility and the “continued growth in rents against

declining interest rates”.

J.P. Morgan suggests that the

key driver of the steady finance demand from investors compared to

owner-occupiers relates to the repayment profile of the loan, for example the

popular interest-only loan and the tax-deductible benefits allowable.

APM’s Wilson says the media

likes to jump on the fear factor bandwagon from time to time, however he

believes the general conversation about the bubble bursting has recently

switched to chatter about the bubble becoming inflated again, a sign that

recovery is under way.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/LH7bJuiby9M/negative-equity-doesnt-mean-mortgage-stress

Apartment floor space shrinks to capture investors

Apartment floor space shrinks to capture investors

Posted on Tuesday, October 16 2012 at 3:52 PM

High-rise apartments are likely to shrink as developers squeeze out as much profit as they can in a soft market and chase investor demand, according to Colliers International.

Strongest buyer demand in new Brisbane apartments currently exists in the smaller stock, a trend that’s likely to map the future for developers and their project choices, says Colliers International Brisbane residential director Andrew Roubicek.

Investors are heading the new apartment buyer pack, representing around 85 per cent of all buyers in this sector, he says.

“Investors are very price sensitive in terms of what they’re willing to commit to, and with no desire to live in the property they’re buying, they’re purely looking at the return, and the best returns can currently be found in one-bedroom apartments.

“The yields for one-bedroom apartments are more attractive because they’re at a lower price point and that’s driving buyer interest for one-bedroom apartments over two-bedroom apartments.”

The one-bedroom apartment ranging in size between 45 square metres and 52 square metres, priced from $345,000 to $425,000, and achieving a six per cent rental yield, is where the demand is strongest, says Roubicek.

With demand strongest from investors, Roubicek says it would make sense to build stock to attract this market, while still considering the owner-occupier demand for the larger apartment when the owner-occupier returns to the market. “The ideal mix might be 70 per cent one-bedroom apartments and 30 per cent two-bedroom apartments.”

Roubicek says many of the owner-occupiers buying into the new apartment market are over-55s who want to move into the five-kilometre radius from the CBD and be close to amenity.

“While they’re typically looking to downsize from their house in the suburbs, a 50-square-metre apartment isn’t big enough for them. They will have come from around 220 square metres and in the majority of cases will want at least a two-bedroom apartment and will have a budget of around $550,000 or $600,000.”

While the future of high-rise apartments appears destined to feature smaller floor spaces, what this will mean is that the existing stock on the market with larger floor spaces will become more unique and experience greater demand, says Colliers International Gold Coast director of residential project marketing Mark Worth.

Existing apartment stock on the Gold Coast is a good example, he adds.

“Most of the current stock available was built towards the peak of the market in 2007 and was aimed at lifestyle investors and owner-occupiers. Consequently, we saw an oversupply of supersized apartments designed to cater for that market, which crashed in late 2007 due to the global financial crisis.

“Many of these were 300 square metres to 400 square metres and commanded prices of up to $6 million at the peak of the market, and this product has now largely been cleared.”

New high-rise apartments will continue to shrink, not only in Brisbane but also on the Gold Coast, because developers won’t be able to profitably build larger units, says Worth.

“They’re more likely to build the smaller one-bedroom plus study, and maybe two-bedroom apartments, while the larger two-bedroom-plus apartments will be harder to come by.

“This is what’s happening now in Brisbane, and the Gold Coast will follow once the current stock is exhausted and new developments take shape.

“We’re now seeing these larger unit developments selling out so there’s a constant reduction in stock levels and this will be the last of it for some time to come.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Kr6x64AXEoY/apartment-floor-space-shrinks-to-capture-investors

How one year can make all the difference

How one year can make all the difference

Posted on Thursday, October 11 2012 at 2:24 PM

Tyron Hyde of quantity surveyor firm Washington Brown used to advise investors to purchase a property built in 1986.

An unusual loophole meant dwellings built between July 18, 1985 and September 15, 1987 could attract a four per cent building depreciation rate over a 25-year lifespan.

Properties built after that period attract a 2.5 per cent rate over a 40-year lifespan.

“The net result of purchasing properties in this odd period was increased tax deductions, and therefore cash flow, at a faster rate,” Hyde says.

As of September this year, the loophole effectively closed and any properties built prior to September 1987 don’t incur any building allowance, he says.

“However if you buy a property where construction commenced in 1988, you’ve still got 16 years to depreciate the building. That’s more than 40 per cent of the original construction cost left to claim. I know which I’d prefer.”

Investors in the market now should research the date of construction, especially if they suspect it was some time in the mid to late-1980s.

“It could make quite a difference,” he says. “The Australian Taxation Office identifies quantity surveyors as appropriately qualified to determine the original cost of construction, if those (figures) are unknown.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Investors expected to return as Queensland’s first homebuyer incentive is axed

How one year can make all the difference

Australia’s top rental markets keep rising

Workers’ camp to take pressure off Darwin’s rental crisis

Large percentage of property insurance policy holders underinsured

Darwin becomes Myer’s next target

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/qpYol4Rf4B8/how-one-year-can-make-all-the-difference

Investors expected to return as Queensland’s first homebuyer incentive is axed

Posted on Thursday, October 11 2012 at 5:47 PM

From tomorrow, the axing of Queensland’s First Home Owner Grant could trigger a race back to the market for investors buying in the mid $500,000 price range, according to the Real Estate Buyers Agents Association of Australia (REBAA).

To spark housing construction and jobs across the state, the Queensland Government last month kicked off the $15,000 cash giveaway to first-time buyers purchasing newly-constructed or off-the-plan properties, a move that may see more first homebuyers investing in new properties, REBAA Queensland spokesman Scott McGeever says.

Tomorrow the government will remove the $7000 First Home Owner Grant, a move McGeever believes could potentially bring more investors back to the market due to the reduced competition from first homebuyers.

Investors can still take advantage of depreciation allowances on near-new yet established properties but first homebuyers can’t when buying new, he explains. This means a larger number of first homebuyers purchasing new property could actually turn investors off targeting new dwellings.

“First homebuyers are certainly an important part of the market but there are also a lot of investors out there looking in the same space,” McGeever says

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Investors expected to return as Queensland’s first homebuyer incentive is axed

How one year can make all the difference

Australia’s top rental markets keep rising

Workers’ camp to take pressure off Darwin’s rental crisis

Large percentage of property insurance policy holders underinsured

Darwin becomes Myer’s next target

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/J6xn2yx-VMc/investors-expected-to-return-as-queenslands-first-homebuyer-incentive-is-axed

Large percentage of property insurance policy holders underinsured

Posted on Tuesday, October 09 2012 at 1:21 PM

Soft market conditions may have given property owners a false sense of security that their properties are over insured, however it’s not the case, with many property owners left vulnerable, according to Propell National Valuers.

A large proportion of properties are actually under insured,

says Propell National Valuers national quantity surveying manager Isik Bozdag.

A property is considered under insured if an

insurance policy only covers 90 per cent of rebuild costs, according to the

Australian Securities and Commission.

However property prices aren’t related to replacement

costs of building materials, Bozdag says.

“Building costs are increasing, driven by a number of

factors including changes in building codes and fluctuations in the price of

labour and materials. This means that in some areas the replacement costs

associated with property may have risen, resulting in more cost to rebuild than

the property is insured for.”

Misconceptions about the relationship between

property prices and insurance policy coverage are due to the lack of interest

in taking the time to review and shop around for policies, which are often

lengthy and daunting, says Bozdag.

“Policy elements that should be checked thoroughly

include coverage for termite damage, the extent of flood protection and maximum

periods a property may be unoccupied,” he says.

Depreciation is another area property owners should

be particularly mindful of, adds Bozdag.

“Over time the building materials in a dwelling will

depreciate in value, which may be factored into some insurance policies.

“When claiming against property damage, these policy

holders may find they don’t have sufficient coverage to rebuild their home to

its original condition.”

He adds that investors should find a policy that

doesn’t factor depreciation into the coverage, even if it comes at a higher

premium.

“Experienced quantity surveyors and valuers can

provide peace of mind by assisting homeowners with property matters including

insurance, tax depreciation schedules, valuations and portfolios.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/kG0QJpqwLII/large-percentage-of-property-insurance-policy-holders-underinsured

Looking for the next price growth hotspots? Follow the big bucks, expert says

Posted on Thursday, October 04 2012 at 11:25 AM

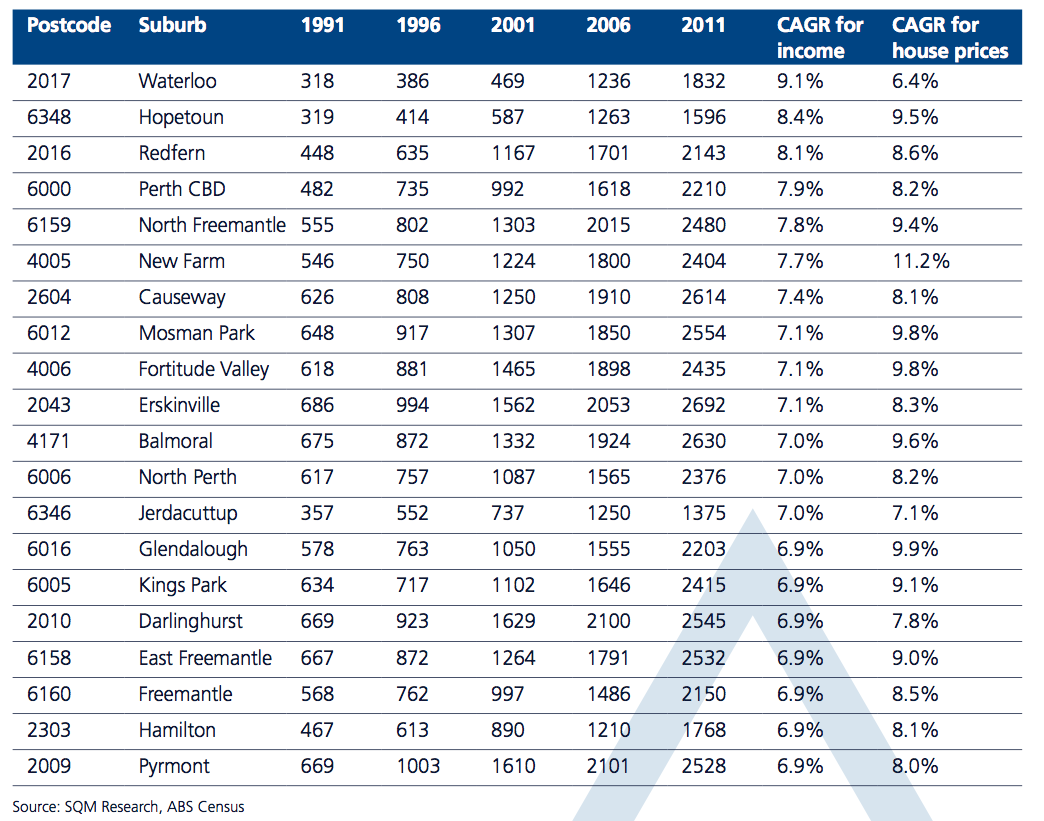

Suburbs where incomes are growing the fastest could also be tomorrow’s property price hotspots, one analyst believes.

SQM Research’s annual Housing Boom and Bust Report

includes a list of 20 locations where incomes have increased the quickest over

the past two decades.

Louise Christopher, founder of SQM Research

and author of the report, believes the analysis could provide insight into

future home value movements.

Postcodes in inner Sydney, Perth and

Brisbane dominate the list. Christopher says it’s most likely because

high-income earners generally reside in inner-ring reas, plus the resources

boom is driving prosperity in Western Australia.

Income growth is usually a main contributor

to the performance of property prices, he says.

In Sydney, many young professionals are

flocking to inner city suburbs like Waterloo and Redfern. There’s upward

pressure on house prices and demand as a result.

Waterloo tops the list of fastest income growth

areas, with a 9.1 per cent compound average annual increase, while Redfern came

in third at 8.6 per cent.

A couple of areas in Brisbane also feature,

with suburbs such as New Farm (sixth with a 7.7 per cent compound average

annual increase in income) attracting younger, more affluent professionals who

demand inner city dwellings.

“Recent developments in the suburbs

surrounding and making up Brisbane’s CBD have encouraged well-paid individuals

to reside in these localities, pushing industrial-based activities to other

parts of (Brisbane) and driving up income growth in the area.”

Perth

postcodes made a “significant contribution” to the list, he says. The resources

boom influenced this trend and these suburbs could be susceptible to any type

of “sustained downturn” in mining.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Darwin becomes Myer’s next target

New strategy unveils faster commute from Sydney’s west

Looking for the next price growth hotspots? Follow the big bucks, expert says

Capital city home values continue to rise, signalling a market recovery

RBA cuts interest rates

Mackay’s property sector an economic driver

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/o3Spv0ApdsY/looking-for-the-next-price-growth-hotspots-follow-the-big-bucks-expert-says

Darwin becomes Myer’s next target

Darwin becomes Myer’s next target

Posted on Friday, October 05 2012 at 3:05 PM

The green light for a $34 billion Inpex LNG (liquefied natural gas) project coupled with Darwin’s rapid population growth over the past six to 12 months is not only attracting serious attention from investors, but also major retail tenants.

Myer recently announced it’d

swing open its doors at Casuarina Square in one of Darwin’s northern suburbs,

Casuarina, by 2016.

As part of Myer’s lease

agreement, the GPT Group, operator of Casuarina Square, will now finalise its

design process for an expansion of the commercial centre and lodge a

development application to proceed.

The Northern Territory

Government will also need to firm up its financial commitment on public

infrastructure for Bradshaw Terrace, a major arterial into the shopping centre,

by including an improved bus interchange.

Independent property valuer

Terry Roth of Herron Todd White says Darwin doesn’t currently have a major

department store so the announcement of a new Myer is “big news” for the city.

“You read about retailers across

the nation doing it tough, even David Jones is struggling. However Myer has

decided to bite the bullet by coming up to Darwin; they’ve obviously done their

research,” Roth says.

The problem in attracting and

keeping new workers in Darwin has been the absence of department store

shopping, he believes. “Perhaps it’ll make Darwin more attractive to many, and

less people will feel the need to fly to other cities to shop.”

CBD retailers are very

disappointed Myer didn’t select the city centre as its location, he says. “Casuarina

Square tends to soak up the shoppers in Darwin these days so I guess that’s why

Myer chose the shopping centre as its site.”

Palmerston residents might also

be a little disappointed Myer didn’t nab a site in their southwest region, he

adds. “However the Masters Group is talking about doing something in Palmerston

– they’ve even set aside a site for this reason. This move makes sense because

if you look at a map of Darwin you’ll see the demographic shifting southwest.”

Roth believes Myer’s presence will

have a positive impact on the entire city, sending a message that Darwin is

truly rattling ahead, although he doesn’t think property prices and rents will

be particularly impacted in surrounding suburbs.

“Darwin is a small place so

residents already do, and will continue to, travel from right across the city

to shop at Casuarina Square. Myer will just be another incentive.

The move sends a positive

message that Darwin is ready to do business, he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/D6EMyYFMr-A/darwin-becomes-myers-next-target

New strategy unveils faster commute from Sydney’s west

Posted on Thursday, October 04 2012 at 3:07 PM

The New South Wales Governments’ latest State Infrastructure Strategy was released yesterday, outlining moves to improve access for Sydney’s west and an extended rail line toward Maroubra.

Urban Taskforce Australia chief

executive officer Chris Johnson says the strategy provides enormous detail and

cost benefit for Sydneysiders.

“The most

important project is the WestConnex, where the M4 is connected to the M5 in a

manner that helps commuters travelling from western Sydney get into the city

while also improving the flow of freight in containers from Port Botany out to

western Sydney,” he says.

“Importantly,

the strategy raises the potential for urban renewal along the new

infrastructure routes and it’s critical this is reflected in the Metropolitan

Strategy, due to be released by the Planning Minister in the near future.

“Communities will

need to see a positive future for their neighbourhoods as a trade-off for the

new infrastructure. They’ll also need to take a ‘whole of city’ approach to

change.”

The proposed rail

line extension towards Maroubra would tie in with the renewal of the peninsula,

Johnson adds. “Generally, there are low densities in that area and a number of

government-owned sites could lead to urban renewal.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

New strategy unveils faster commute from Sydney’s west

Looking for the next price growth hotspots? Follow the big bucks, expert says

Capital city home values continue to rise, signalling a market recovery

RBA cuts interest rates

Mackay’s property sector an economic driver

Great buying opportunities in Tasmania as Gunns hangs its hat

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/JpAmskFmxt8/new-strategy-unveils-faster-commute-from-sydneys-west