Property industry is cautiously optimistic about the future

Posted on Thursday, October 18 2012 at 11:34 AM

Property professionals believe the mining boom is far from over, capital city home values are on the up and the commercial market is set for a big year.

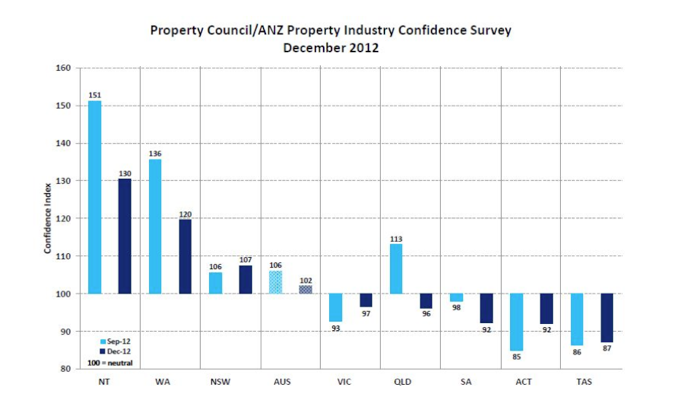

The latest Property Council of Australia-ANZ Property

Industry Confidence Survey shows views are mixed across the country,

with confidence in resource-rich states slipping in the past three months.

A softer outlook in mining-dominated

regions is responsible for a “closing gap” between resource states and the rest

of the country.

More than 3500 property and construction

professionals from all states and territories were polled on their

forward-looking views.

General sentiment in the December 2012

quarter was 102 on the index, down from 106 in September.

The overall ranking was dragged down by

weaker sentiment in resource-rich jurisdictions like Queensland, Western

Australia, the Northern Territory and South Australia, the report concludes.

Despite the weaker outlook, Property

Council chief executive Peter Verwer says there was a recovery in sentiment

elsewhere.

“Respondents in (NSW and Victoria) have

more faith in their local economy than the national economy, and expectations

for forward work have improved,” Verwer says.

Source: Property

Council of Australia-ANZ Property Industry Confidence Survey

The poll found 68 per cent of property

professionals don’t believe the mining boom is over. Only 27 per cent believe

their business is reliant on the mining sector.

Sentiment for residential capital values

shifted from negative to positive, from 93 on the index to 101. It’s the first

positive result in the history of the survey. Housing construction expectations

also rose.

ANZ chief economist Warren Hogan says while

house prices remain soft in most capitals, there are tentative signs we’ve

reached “a floor” following recent interest rate cuts.

“May and June (Reserve Bank of Australia)

rate cuts are expected to be further supported by the October rate cut,” Hogan

says. “Residential auction activity has increased and auction clearance rates

are at the highest level since 2010.”

Property professionals believe the office

market has the strongest investment potential over the next 12 months, followed

by residential, industrial and retirement living.

Most also have a rosy view of the domestic

economy, with only 13 per cent of respondents believing growth will weaken over

the next year. That’s a slight increase of nine per cent in the previous

quarter.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nAP3dwWSxm8/property-industry-is-cautiously-optimistic-about-the-future