Interest rates: lock it in, experts say

Interest rates: lock it in, experts say

Posted on Thursday, August 29 2013 at 10:23 AM

Property investors should consider locking in their interest rates, according to some financial service providers.

Jane

Slack-Smith, owner of Investors Choice Mortgages, says borrowers should take

advantage of currently low interest rates as they look likely to rise into next

year.

“We

have interest rates as low as they’ve ever been and you should really consider

tapping into your equity now before it gets tougher,” she says.

Slack-Smith

says although the property market has strengthened, lenders are looking to

tighten their criteria.

“Economists are saying that overseas economies are

looking better, business confidence worldwide is looking positive, and there

are predictions of the Australian dollar falling.

“At the moment Sydney, Perth and Canberra are at

their highest median prices, Melbourne is 4.4 per cent below its highest

historical median and Brisbane is 10 per cent below.

“What’s going to happen to interest rates long term

if the economy is improving is that they’ll begin to start going up.”

Belinda Williamson, head of corporate affairs at

Mortgage Choice, says although there are competitive offers from lenders right

now, some have already begun increasing their interest rates.

“We’ve noticed that the one, two and three-year

swap rates started to edge up since about mid-August.”

Williamson

says lenders have competitive offers at present that borrowers should look at.

“Lenders currently have offers of fixed rates for

less than five per cent. Even this week we’ve seen four lenders drop their

fixed rates, so over the shorter term we’re likely to continue seeing fixed

rates fall, however it’s worth noting that there are glimpses of very marginal

increases in longer term fixed rates.

“Typically, fixed rates are higher than variable

rates so given that many fixed rates at the moment are lower than variable rates,

it certainly is a consideration for many borrowers at this point in time.”

Mark

Toole, owner of mortgage broker Custom Finance Group, says picking movements is

difficult and events that influence rate changes need to be monitored

continuously.

“The

things that have happened since Christmas (2012) have kept the trend going

down, but that can stop very quickly.

“I

had one client who locked in around March because she was under the impression

rates were going to go up. Since then we’ve had half a per cent reduction.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/17ijn_kPfxc/interest-rates-lock-it-in-experts-say

Hidden gem suburbs hiding next door

Hidden gem suburbs hiding next door

Posted on Monday, August 26 2013 at 5:12 PM

Have you been dying to buy into Sydney’s Manly, Melbourne’s Toorak or Brisbane’s Paddington? It might seem like nothing beats blue-chip real estate but that’s not the case, if you’re keen to own your home outright as fast as possible.

The top 10 suburbs in our main cities where Australians can buy a home

at a lower price than the more popular neighbouring suburb have been revealed.

Westpac’s general manager of retail banking Gai MacGrath says buyers who

truly want to own their home sooner can find real value by simply considering a

suburb which is a stone’s throw from their preference.

“For example, if you wanted to buy a house in the third most popular

suburb in Sydney, Baulkham Hills, you could consider travelling just eight

kilometres away in Seven Hills, where the average house price is 34 per cent

cheaper,” she says.

“You’d still be in the booming northwest of Sydney, but you could own

your home 18 years and five months sooner and save $435,028 in both purchase

price and interest repayments over time.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Hidden gem suburbs hiding next door

Melbourne prices impacted by elections

How much are you worth?

Australia’s fastest-growing monthly magazine

Queensland property laws set for overhaul

Arrest in Nigeria over WA real estate fraud attempt

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/eFrdlZESQmY/hidden-gem-suburbs-hiding-next-door

Arrest in Nigeria over WA real estate fraud attempt

Arrest in Nigeria over WA real estate fraud attempt

Posted on Friday, August 16 2013 at 1:04 PM

Imagine if someone tried to steal your house and you knew nothing about it! That’s what happened to a Western Australia landlord who was renting out his property in Falcon, roughly 50 kilometres south of Perth.

A Nigerian man

allegedly contacted the property manager in December 2012, purporting to be the

owner of the home, and requested documents relating to the rented property,

which were sent to him. He then used a Yahoo email address in the name of one

of the real owners, who is a Johannesburg resident, and requested that all

future correspondence be forwarded to the new email address and all phone

contact be made through a new number.

In January, 2013,

the agency received a request to sell the property and a sales agreement with

false signatures was completed. Fake passports of the two owners were also sent

to the agent, as well as a forged document from the Australian High Commission.

Fortunately,

suspicions were raised by staff at the agency, who had attended an anti-fraud

education seminar, and they contacted police.

With the help of

detectives, the agency then faked a sale of the property and were told to

deposit $785,000 into a bank account in southeast Asia.

This helped WA

police and the Australian Federal Police track the alleged offender down in

Nigeria. He was apprehended by Nigerian authorities when he attended an

international courier office and attempted to collect documents with a forged

driver’s licence.

WA police detective

senior sergeant Dom Blackshaw says landlords should keep up to date with their

property managers and obtain regular statements from them.

“Investigations

are continuing into other people who may be involved and also into whether

there are links between this case and the two successful and five attempted

frauds reported in WA over the past five years,” he says.

“Six of the seven

cases involved owners who live in South Africa, have investment properties in

Perth, which are rented, and have had their identities stolen.

“We’re not

exactly sure how the offenders come to know about the South African-based

owners and their investment properties, but it would appear they’re somehow

intercepting correspondence between the owners and their agent in Perth. This

could be physically by intercepting letters sent through the postal service, or

electronically by owners having their email account, or perhaps their

computers, hacked.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/5ogRtSgTlxA/arrest-in-nigeria-over-wa-real-estate-fraud-attempt

Melbourne prices impacted by elections

Melbourne prices impacted by elections

Posted on Thursday, August 22 2013 at 8:39 AM

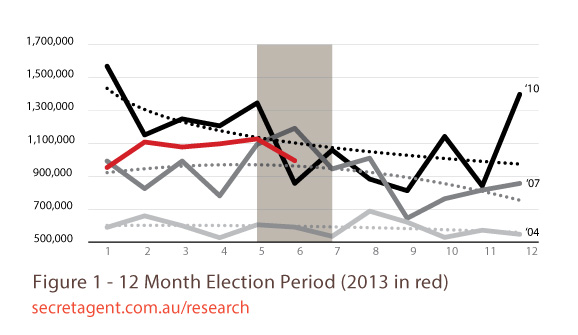

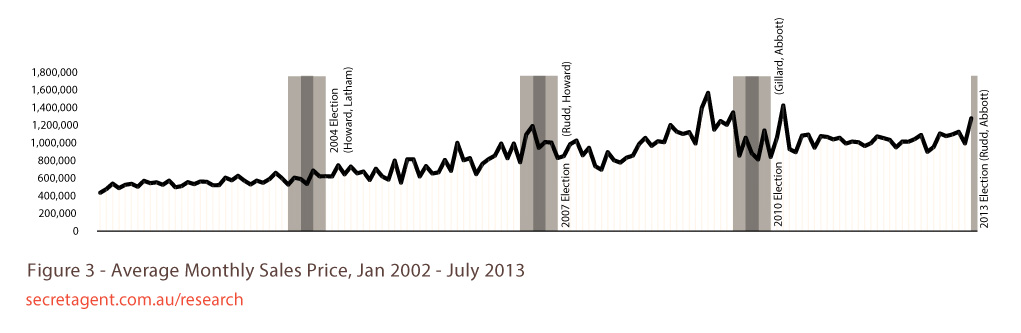

Historical analysis shows federal elections have had a short-term negative impact on Melbourne’s property values.

Secret Agent Buyers’ Advocacy has released data from

the 2004, 2007 and 2010 campaign periods indicating a decline in average inner-city property prices in the six months leading

up to an election.

“These declines were particularly evident for

the 2007 and 2010 election periods when looking at the last decade of property

prices,” the report says.

Secret Agent studied 112,000 inner-city sales

between January 2002 and July 2013 in order to track the trends.

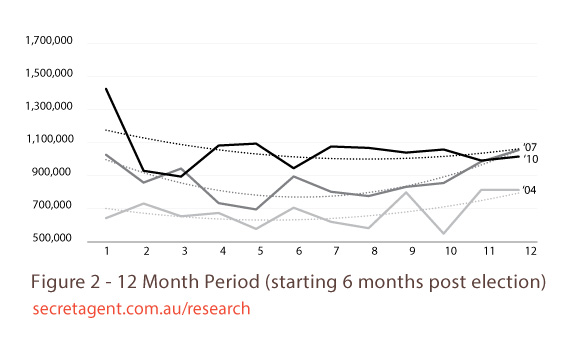

It wasn’t until six months after the elections

that housing prices began to fluctuate less and experience steadier, upward

growth.

The report says, based on the data, the same trend

is expected during this year’s election, although there are other factors

impacting prices.

“This year could be unique, however, as it marks

the first election campaign period that the average property price in these

inner-city suburbs is lower than that of the previous election.”

Paul Osborne, founder of Secret Agent, says

businesses and buyers remain cautious and slow down investment until there’s a

result when elections are looming.

“Afterwards, you probably don’t see an immediate

effect but there seems to be a confidence lifting in the 12 months after the

election.”

Osborne believes these results could be mirrored

in other cities.

“We’d love to grab the data and do it. I think

you’d find a very similar finding across all markets.”

Andrew Wilson, a senior economist at Australian

Property Monitors, thinks this election in particular will see a different

outcome.

“The cyclical factors will tend to override what’s

happening in terms of electoral factors, however if we have a strong policy

scenario that can impact buyer decision making. I don’t think we have that

now.”

Wilson believes the currently improving

Melbourne market will continue to grow.

“The trend has certainly been moving into mid

seventies (in percentages) for auction clearance rates in Melbourne, which

signifies a market moving from ‘solid’ to ‘strong’. It’s the trend of the cycle

at the moment that we need to be mindful of, and that’s certainly upward while

three years ago it was downward.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2qgfug2rIto/melbourne-prices-impacted-by-elections

How much are you worth?

How much are you worth?

Posted on Wednesday, August 21 2013 at 4:04 PM

If you’re part of an ‘average’ Australian household, chances are you’re now worth nearly three-quarters of a million dollars.

A report released

by the Australian Bureau of Statistics (ABS) says the average wealth of

households in 2011-12 was $728,000. If you live in Canberra, you’re probably

worth even more, according to ABS director of the living conditions, Caroline

Daley.

“Wealth varied

greatly across the states and territories,” she says.

“The ACT had the

highest level of wealth at $930,000, which was around 28 per cent higher than

the Australian average. Western Australia, New South Wales, Victoria and the

Northern Territory all had levels of wealth close to the Australian average.

“South Australia,

Queensland and Tasmania had levels of wealth less than the Australian average,

with Tasmanian households having the lowest level of average wealth at around

$600,000. Household wealth was more concentrated in capital cities, where the

average net worth of households was $781,000, compared to $637,000 outside of

capital city areas.”

Not surprisingly,

most household wealth is thanks to Australians owning a principal place of

residence. More than two-thirds of Australian households own their own home

outright or have a mortgage.

“Households that

owned their own home outright, 2.7 milllion households, had an average net

worth of $1,237,000. Households with a mortgage on their home, 3.1 million

households, had an average net worth of $790,000, and the average net worth for

households that rent their home was $160,000.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/4jXqFpOTsEc/how-much-are-you-worth

Australia’s fastest-growing monthly magazine

Australia’s fastest-growing monthly magazine

Posted on Monday, August 19 2013 at 1:17 PM

Australian Property Investor is the country’s fastest-growing monthly magazine, with officially audited data showing a 26.9 per cent increase in circulation in the first six months of the year.

The independently published title recorded the

largest year-on-year growth of any monthly magazine between January and June

2013, according to Australian Buruea of Circulation figures released Friday.

“We put this phenomenal result down to a rebounding

property market, our continued push towards providing more innovative and

engaging content, growth in new distribution channels and our ongoing position

as the most respected title in our field,” API editor Eynas Brodie says.

The magazine, which celebrated its 16th

year of operation in 2013 and its 150th issue in August, kicked off

the year with a redesign.

“We foresaw the recovery in the residential property

market and took this as an opportunity to reintroduce ourselves with a

redesigned and refreshed look in January.

“The cleaner and more modern layout has been

complemented by an extensive overhaul of our bonus digital content, with most

features and profiles now including exclusive QR coded videos, podcasts, photo

galleries or forums.”

This deeper, richer level of interactivity and

engagement is above and beyond what readers could hope to receive at competing

titles, Brodie says.

Advertisers continue to enjoy access to a strongly

engaged and loyal readership, and this year saw expanded opportunities in the

digital space with new e-newsletters and an exciting partnership with online

podcast program Real Estate Talk.

API also invested in sponsorship of the Home Buyer

and Property Investor Show in Brisbane, Sydney and Perth, where current and new

readers had the opportunity to meet journalists, profiled investors and

columnists.

As the longest-running, API has a proud reputation

of being the most trusted and widely read property investment magazine in the

country, Brodie says.

“These results solidify that position. We continue

to provide unbiased, independent and expertly backed content to our existing

readers as well as a whole host of new ones.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/NbPV9Ly-910/australias-fastest-growing-monthly-magazine

Queensland property laws set for overhaul

Queensland property laws set for overhaul

Posted on Friday, August 16 2013 at 1:21 PM

Property law experts have been called in to overhaul Queensland’s property industry in a bid to remove red tape and “unnecessary regulation”, according to Attorney General Jarrod Bleijie.

Bleijie has

announced the

Queensland Property Law Act 1974, Land Sales Act 1984 and Body Corporate and

Community Management Act 1997 will be reviewed by an independent

panel.

With the help of

the Queensland University of Technology, Professor Bill Duncan, Professor

Sharon Christensen and Dr Bill Dixon the review will initially examine seller

disclosure requirements and body corporate lot entitlements.

The first two

issues papers are expected to be released early in 2014.

Bleijie says the

review will streamline how Queenslanders buy, sell and manage property.

“To put it simply, property law in this state needs a

makeover and we are determined to provide a first class framework that will

meet the needs of Queenslanders well into the future,” Bleijie says.

The announcement

follows a similar review of the Property Agents and Motor Dealers Act that saw the

requirements for providing sustainability declarations deleted.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Queensland property laws set for overhaul

Arrest in Nigeria over WA real estate fraud attempt

Gold Coast real estate recovery under way

Changes to commercial depreciation

Mortgage uptake highest in three years

Alpha coal project given environmental approval

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jONyCvnkas4/queensland-property-laws-set-for-overhaul

Housing market growth to remain steady

Housing market growth to remain steady

Posted on Friday, August 09 2013 at 2:18 PM

Improvements in the property market will continue but the strength of the recovery is uncertain, according to today’s quarterly statement on monetary policy released by the Reserve Bank of Australia (RBA).

The statement suggests a

continued rise in dwelling investment in the short-term future due to lower

interest rates and with housing prices six per cent above their 2012 trough.

“The demand for housing finance

has continued to strengthen, consistent with rising dwelling prices and lower

interest rates, with the value of housing loan approvals rising at an

annualised pace of 25 per cent over the past six months,” according to the

report.

In addition, households are also

paying down their debt more quickly.

With households maintaining

their higher pace of mortgage prepayments much of the growth in loan approvals is

due to repeat buyers and investors with growth in the level of housing credit

relatively modest, according to the report.

The increase in total building

approvals is also expected to continue, the statement says, aided by “an

ongoing recovery in the established housing market, relatively high rental

yields, low borrowing rates and government support to first home buyers.”

Although the report also

found first home buyer approvals remained subdued due to changes to first home

buyer incentives, which refocused government assistance towards purchases of

newly built homes.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Alpha coal project given environmental approval

Housing market growth to remain steady

WA hikes land tax, scales down first homebuyer grant

Government hosts free seminars on new rental rules for WA landlords

Stronger market awaits election outcome

RBA cuts cash rate in further boost to property market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/XJW5jKR4ORI/housing-market-growth-to-remain-steady

Alpha coal project given environmental approval

Alpha coal project given environmental approval

Posted on Friday, August 09 2013 at 3:13 PM

Clive Palmer’s $6.4 billion mine in Queensland’s Galilee Basin has been given environmental approval by the State Government.

The Waratah Coal project in Alpha is expected to create 3500

construction jobs and more than 2300 operational jobs, according to the Deputy

Premier and Minister for State Development, Infrastructure and Planning Jeff

Seeney.

It will produce more than 40 million tonnes of thermal coal

for export each year over an expected life of about 30 years.

“It’s another major infrastructure decision for development

of the Galilee Basin and I very much hope the Commonwealth doesn’t now hold up

its approval and delay another vital project for the Queensland economy,”

Seeney says.

The massive thermal coal mine has been approved following an

Environmental

Impact Statement (EIS) study by Clive Palmer’s company, Waratah

Coal.

Coordinator-General Barry Boe says the project is also being

assessed in a parallel EIS under the Commonwealth Environment Protection and Biodiversity

Conservation Act 1999 and also needs Commonwealth approval before it

can commence.

The project, also known as the China First Project, is

proposed to consist of a combination of open cut and underground mining. It

involves the development of a new coal mine and a rail line linking Alpha to

Abbot Point, near Bowen.

Boe says the release of his evaluation report, including the

conditional approval, came after more than four years of environmental

assessment and public consultation.

“The conditions establish clear principles and procedures to

manage matters, including surface and groundwater impacts, rail line flooding

and social impacts,” he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Alpha coal project given environmental approval

Housing market growth to remain steady

WA hikes land tax, scales down first homebuyer grant

Government hosts free seminars on new rental rules for WA landlords

Stronger market awaits election outcome

RBA cuts cash rate in further boost to property market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/szcLKVzu5rk/alpha-coal-project-given-environmental-approval

WA hikes land tax, scales down first homebuyer grant

Posted on Friday, August 09 2013 at 9:55 AM

Property owners in Western Australia will be slammed with a 12.5 per cent hike in land taxes as the resource state grapples with soaring costs and flatteing revenue.

In a further bid to cut costs, it has become the final state

to gouge its first homebuyer grant for existing properties, although the

government refrained from scrapping it completely in yesterday’s Budget.

The current $7000 incentive for first-time purchasers of an

established dwelling will be cut back to $3000.

However the government will bump up the grant for anyone

buying a newly built or off-the-plan home, offering $10,000.

That tweak is one of a variety of cost-saving measures

outlined in the resource state’s 2013-14 fiscal blueprint, which forecasts 3.25

per cent economic growth in the next year.

That’s the fastest economy of all other states and

territories and dwarfs the national economy’s projected 2.5 per cent growth

rate.

Despite that, Treasurer Troy Buswell says WA faces a debt

issue and the next year’s expected surplus of $386 million could be the last

time the balance book is in the black. A deficit is on the cards for 2014-15,

the government concedes.

“An imbalance has emerged between growth in the state’s expenditure and

growth in revenue,” Buswell says. “This brings

significant financial challenges, as major resource projects transition from a

construction phase to a production phase, the demand for labour has begun to

ease, and so has growth in the State Government’s tax revenue.

“The challenges are exacerbated by WA’s declining share of GST revenue. It

has already fallen to a historic low of just 45 cents for every dollar of GST

raised here – that means WA loses $477 million in revenue.”

That pressure has forced the government to find $6.2 billion in savings

over the next four years, from spending cuts and revenue-raising measures to

public service redundancies.

One such cash grab includes a 12.5 per cent across-the-board increase to

land tax, which Buswell says will offset lower than expected land valuations.

Workers on 457 visas will have to pay $4000 per year to send their kids to

school, solar panel owners will get a lower feed-in tariff, public service wage

increases will be capped and authorities will re-prioritise infrastructure

spending.

Purse string tightening aside, the government will invest a staggering $4.5

billion of new money in infrastructure this year, bringing the total program

commitment to $27 billion over the next four years.

That includes funding the MAX light rail project, the airport rail link and

the Swan Valley bypass, more commonly referred to as the Perth to Darwin

Highway.

On roads, the government will invest $1.8 billion in improvements over the

next 12 months. Health services will receive a major boost with $1.1 billion

allocated to hospital rebuilding efforts, while $580 million will be spent on

school infrastructure.

“This State Budget reflects tough but necessary

decisions undertaken by the government to secure our economic future,” Buswell

says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/0VISXn4ehc0/wa-hikes-land-tax-scales-down-first-homebuyer-grant