Is it time to get in the zone?

Rezoning

A strategy that has appealed to investors in Brisbane has been to seek post-war homes in low- to medium-density residential (LMR) zoned streets, particularly since the release of the City Plan in 2014.

Depending on the zoning, size and location of the block in question, there are plentiful opportunities to replace an established house with multiple dwellings.

A two- or three-storey LMR zone precinct can allow for a mix of dwelling types, including low-rise apartments, townhouses and dual-occupancy dwellings. Development is predominantly permitted for two storeys, with three storeys sometimes allowed within 400 metres’ walking distance of a rail or busway station. As with all strategies, this game plan has both potential benefits and drawbacks.

Upside potential

An advantage of this approach is that it presents the investor with choices. You can “landbank” the home as a rental in its current form, perhaps with a moderate initial cash outlay on renovations work to make the home attractive to prospective tenants.

Alternatively, you might look to develop the opportunity at the optimal stage of the construction cycle, ideally when prices for new medium-density dwellings such as townhouses are approaching their cyclical peak.

LMR precincts are often zoned accordingly because they’re suburbs or locations in need of gentrification, so there may be capital growth upside as the tone of the neighbourhood steadily improves.

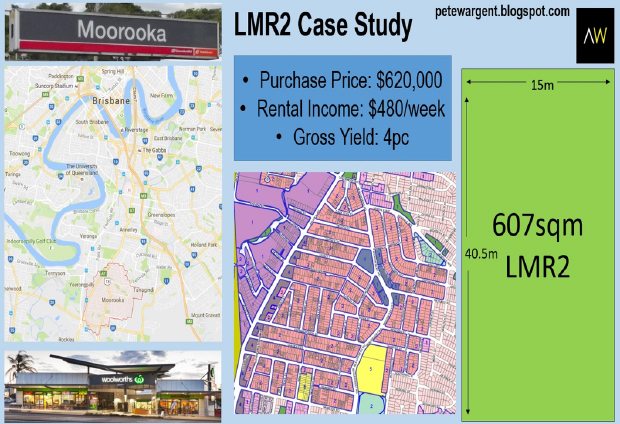

Case study: LMR2 zoned house in Moorooka

A popular strategy for investors has been to buy post-war houses in suburbs such as Moorooka in Brisbane, wherein many more of the streets have been zoned as LMR2 since 2014.

Their goal is typically either to redevelop into townhouses immediately or to landbank until a future market cycle, when sentiment and prices for medium-density dwellings are more favourable.

Since development of multiple dwellings may be restricted to blocks of at least 600 square metres and by a 45-per-cent “site cover” and building envelope, the superior opportunities tend to be regular-shaped blocks, encompassing a minimum of 600 square metres and a frontage of 15 metres or greater.

As a rule of thumb, detached houses on flood-free blocks with development potential have been selling for around $1000 per square metre of land. For a suburb located on a direct train link only seven kilometres from the CBD, this represents an attractive price entry point compared to equivalent suburbs in Sydney or Melbourne.

Gross rental yields tend to be moderate on these often-dated dwellings, however, and after holding costs, the net rental returns can be comparatively weaker still. Consequently, these aren’t ideal assets for yield-focused investors.

Houses in the magenta-shaded LMR2 zoned streets are often tired, post-war homes in need of some loving care and attention, and as such both net rental returns and depreciation benefits tend to be moderate at best.

Steady recovery

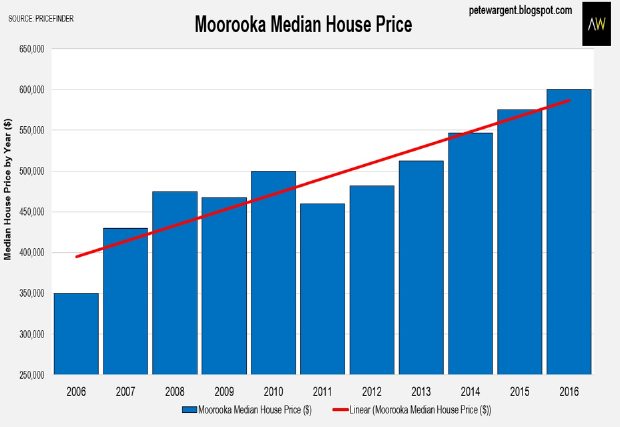

As with many suburbs in Brisbane, median house prices in Moorooka have undertaken a studious recovery following twin setbacks in 2008-9 and 2011.

Median prices can be distorted or skewed by changes to the nature and composition of the dwelling stock – particularly where streets have been rezoned – but houses on attractive blocks of land have delivered a solid compounding annual growth rate of around 5 per cent over the past decade.

Once famous predominantly for its “magic mile” of car dealerships, but more lately for its shifting demographics and a symbolic Woolworths upgrade, being only minutes from the city Moorooka will gentrify, at times perhaps imperceptibly, over the medium term.

It’s reasonable to expect that house prices in more affordable Moorooka will gradually converge over time with those of some of its agreeable and adjacent suburbs.

A trade-off?

All strategies have both their benefits and downsides, and no one strategy is appropriate for everybody. Frequently the houses in question with such development potential are older property types in need of upgrading or maintenance, which can be a drain on cash.

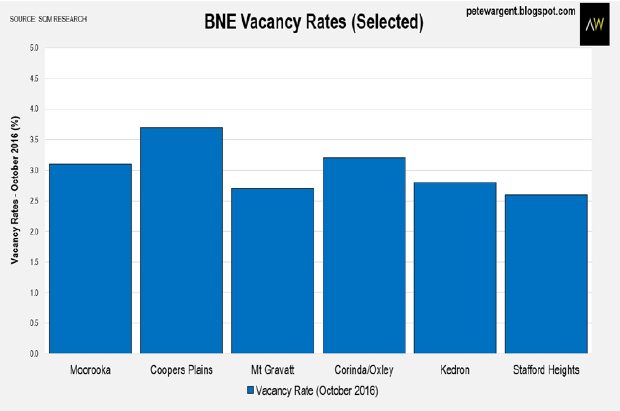

Rental returns in suburbs close to the city are generally not strong, so even with low mortgage rates initial post-tax cash flows for leveraged investors can be negative, perhaps by 1 per cent to 2 per cent in the first year of ownership.

This can be exacerbated by soft rental markets as LMR zones are developed with new units, townhouses and duplexes over time, while further rezoning can be a risk.

Another temporary but literal headache can be construction noise and disruption as streetscapes are developed, and over time it’s inevitable that LMR zones will become denser localities, with more traffic and parked cars than those streets zoned as low-density residential.

Two ways to win

No individual strategy can be suitable for all investors, and if you want a strong rental return you should look at other locations and strategies, and possibly newer property types, which have more attractive depreciation benefits.

There are also alternative strategies that investors can use to manufacture capital growth, including a straightforward renovation or upgrade, subdivision of a larger block, the addition of a granny flat, or in some markets simply knocking down an old weatherboard home to replace it with a new build.

However, buying the right type of house in an LMR precinct can offer investors two viable ways to realise a profit, either by holding a rental house that will retain an inherent scarcity value as the suburb is developed with units, or by developing the asset into multiple dwellings.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VczDl6lueLU/