Slow rises forecast for 2016

Slow rises forecast for 2016

Posted on Monday, October 19 2015 at 11:51 AM

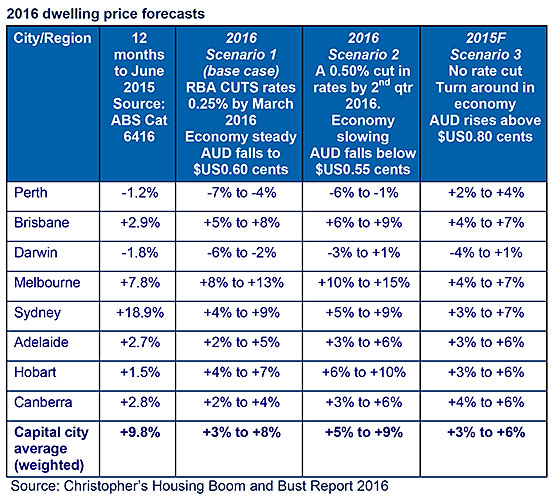

Australian dwelling prices are forecast to rise next year at the slowest pace recorded since 2012. SQM Research has today released its 2016 Housing Boom and Bust Report, which predicts that average capital city dwelling prices will rise between 3 per cent and 8 per cent for the full calendar year. That’s is down from the current 9.8 per cent recorded for the 12 months to June 2015.

The slowdown will occur predominantly as a result of a slowing Sydney property market, which is forecast to rise between 4 per cent and 9 per cent. Melbourne is forecast to overtake Sydney and be the best outperforming capital city in 2016, with a predicted rise in dwelling prices of between 8 and 13 per cent

Other contributing factors to this slowdown include:

- An ongoing housing market correction in the resources-exposed capital cities of Perth and Darwin.

- The APRA actions (announced mid-2015) of restricting credit growth.

- A slower Australian economy, with nominal GDP forecast to rise between 1.2 per cent and 1.7 per cent.

- The recent announcement by a leading major bank that it’s lifting variable home loan rates out of sync with the current cash rate.

On the plus side, SQM Research believes it’s highly unlikely that an across-the-board correction will occur next year, based on the following factors:

- The Australian dollar is likely to stay at current low levels and indeed may fall further, thereby providing a buffer to the economy and the housing market.

- An ongoing low interest rate environment and the possibility of a rate cut in early 2016.

- An ongoing robust Melbourne housing market, which is forecast to rise by 8 to 13 per cent.

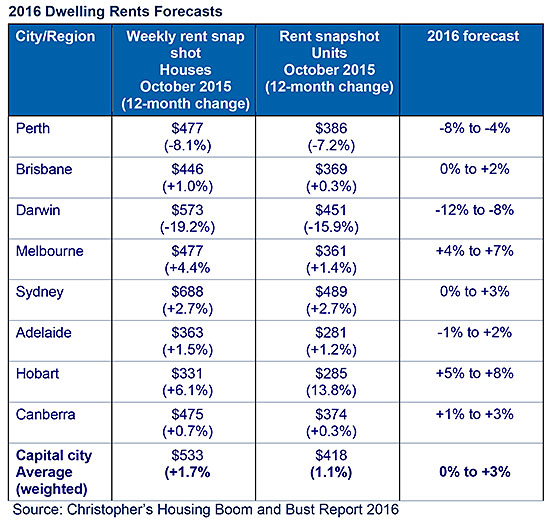

Nationally, the rental market is likely to see a continued flat market with expected rental changes of between 0 and 3 per cent. Darwin is tipped to record another year of significant declines in rents of -12 per cent to -8 per cent, while Hobart’s tipped to record the fastest rental growth of all capital cities at between 5 and 8 per cent.

Speaking of the new forecasts for 2016, SQM Research managing director Louis Christopher says: “We forecast the national residential housing market will slowdown in 2016, predominantly as a result of a slowing Sydney housing market. However, we do not believe the market will record a fall in prices for the year. There might be one quarter, perhaps, where Sydney records a marginal decline, but that should be it.

“Perth and Darwin will record falls again next year, however we believe by the end of the year, both those cities may reach the bottom of their four-year downturn.

“We believe that Melbourne will be the outperformer of the year followed by the Gold Coast and Hobart. Each of these respective cities are benefiting from the lower Australian dollar.”

Christopher goes on to say: “One of the key risks to the housing market over the medium- to long-term is the looming threat of global deflation and this is quite a danger to our markets here, given the level of debt in the housing market right now, which we note has risen again against incomes over the course of 2014/2015 to be at all-time highs.

“This threat became all too apparent this week when Westpac lifted its variable home loan lending rate. In a global deflationary environment the risk premiums banks would require on their lending book would most likely skyrocket due to the greater threat of defaults and falling asset prices.

“For 2016 we believe the RBA has some ammunition to offset this looming risk, however we are concerned about their ability to handle the issue over the medium- to long-term.

“This year, it has become quite apparent that rents have slowed, possibly as a result of the lower inflationary environment. We believe there’s evidence that rents will slow further in 2016.

“We believe the threat of a massive oversupply in Melbourne has been overstated. Indeed, our vacancy rates for that city have fallen for the year as population growth and housing formation have quickly absorbed the new stock being completed.”

Capital city forecasts

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Wl4vAXs61aI/slow-rises-forecast-for-2016