Home loans rising across the board

Home loans rising across the board

Posted on Friday, October 23 2015 at 1:54 PM

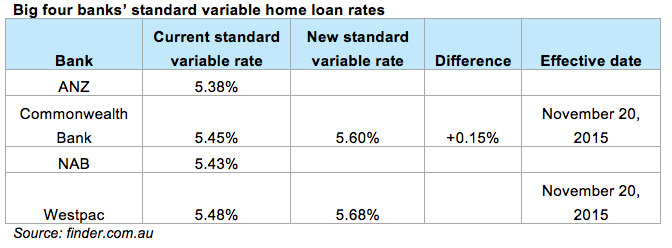

Westpac’s announcement last week that it’s increasing its variable home loan rate by 0.2 per cent prompted the predicted similar movements by the other Big 4 banks, with Commonwealth Bank announcing its 0.15 per cent raise yesterday and the National Australia Bank (NAB) and ANZ saying today that their variable rates will rise by 17 and 18 basis points respectively.

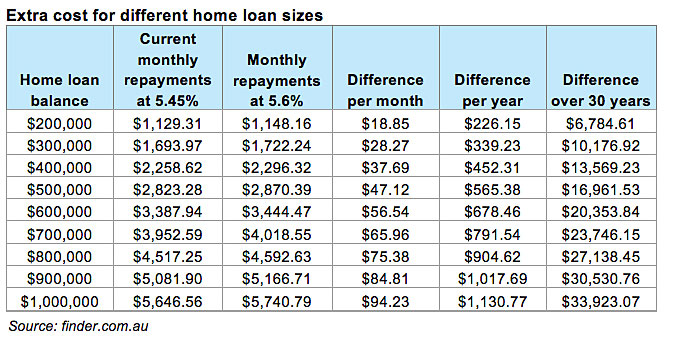

Money expert at comparison website finder.com.au Michelle Hutchison expressed little surprise at the announcements, saying: “Commonwealth Bank announced it will increase its standard variable home loan rate by 0.15 percentage points, effective November 20, the same day as Westpac’s 0.20 percentage point rate rise… this will cost a mortgage holder with a $300,000 home loan an extra $28 per month, $339 per year or potentially $10,177 over the life of a 30-year loan.

“Commonwealth Bank is the biggest home loan lender in Australia, with over $239 billion of home loans financed to households across the country (according to the latest APRA data). This increase will potentially be an extra $22.5 million per month, over $270.5 million in 12 months or over $8.1 billion over 30 years.

“However, despite Commonwealth Bank’s bigger household mortgage book,” she adds, “Westpac’s higher standard variable rate and larger rate increase means it’s expected to make a bigger return on the latest rate rise than Commonwealth Bank.”

In fact, according to finder.com.au, it’s likely Westpac will make an extra $23.9 million per month or potentially $8.6 billion over 30 years.

“It’s likely… other lenders will increase their variable home loan rates out of cycle,” Hutchison adds, “so it’s important for borrowers to watch their rates and compare their home loan to other lenders in the market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Home loans rising across the board

Softer September quarter signals end of southeast’s boom

Slow rises forecast for 2016

Underquoting in NSW tackled as bill passes

Home loan rates are on the move

Home loan numbers high but investors’ loans drop

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/aLPvf0q6UEA/home-loans-rising-across-the-board