Property a major player in retirement plans

Property a major player in retirement plans

Posted on Wednesday, February 18 2015 at 3:07 PM

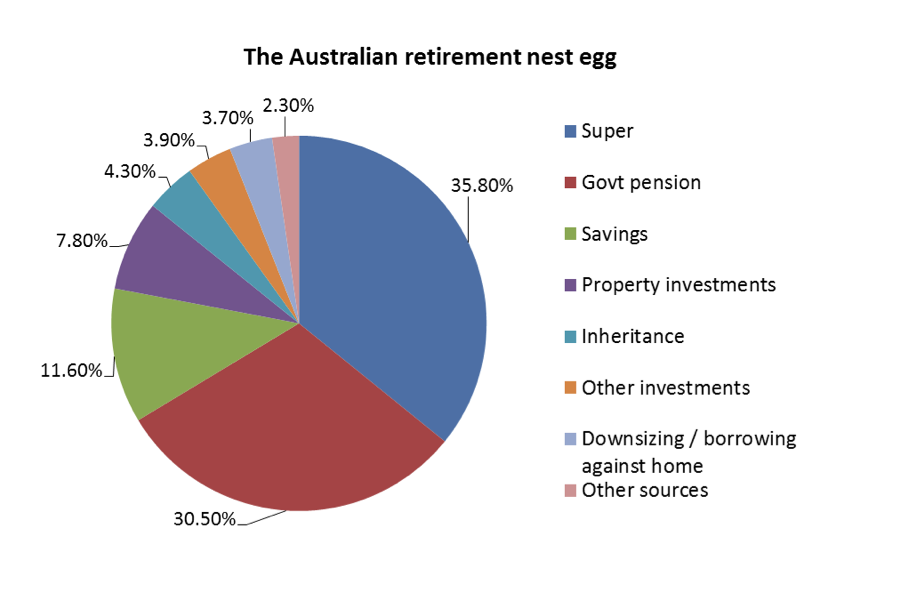

Property investment is seen as a way to boost superannuation retirement savings by most Australians, according to a survey by ING Direct.

The financier has released

figures showing Australians believe their superannuation will provide just only

around one-third of their retirement nest egg with pensions, savings and

property filing out the top four income sources.

Property investment is

expected to provide almost eight per cent of retirement saving according to the

research.

John Arnott, an executive

director at ING Direct, says superannuation should play a bigger role in

retirement plans.

“Working Australians are

contributing almost one tenth of their salary into super every year.

“That’s a significant investment

over a working life and yet people still have limited belief in their super to

support their retirement.”

Arnott says Australians seem

more comfortable with traditional forms of investment.

“It all comes down to a fear

of the unfamiliar.

“We don’t see or hear about

our super every day, so we put our faith in things we know – things like

property and savings.”

A breakdown of the

Australian retirement nest egg as sourced from ING Direct reflects:

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Property a major player in retirement plans

Lending showing real strength

Prices up, volumes down in WA

First homebuyer numbers rise after reporting error found

RBA cuts rate in first announcement of year

Renovations not on the radar

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/roO2D4rGf2E/property-a-major-player-in-retirement-plans