Signs of improvement for NSW, ACT and WA property markets

Posted on Thursday, December 13 2012 at 11:26 AM

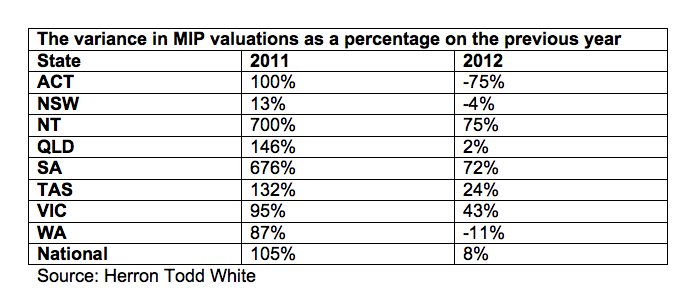

Residential property markets in New South Wales, the Australian Capital Territory and Western Australia are demonstrating strong signs of improvement with mortgagee in possession valuations on the decrease, according to Herron Todd White (HTW).

HTW’s in-house valuation records demonstrate a

decrease in demand for mortgagee in possession (MIP) valuations across three

states/territories this year, while the rest of the nation is still just a

little behind.

Queensland has seen an increase of only two per cent

in MIP valuations, demonstrating it has held relatively steady, while the

Northern Territory and South Australia saw the largest national increases in

MIP valuations (75 per cent and 72 per cent respectively).

While still a

significant increase, Victoria saw a slightly smaller rise (43 per cent) in MIP

valuations compared to the NT and SA, and Tasmania saw a 24 per cent rise in

MIP valuations.

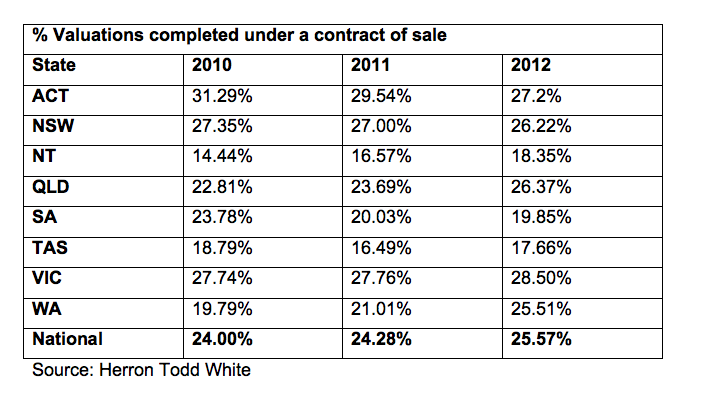

HTW’s Paul Gates says that nationally,

over the past three years, an increase has occurred in the percentage of

valuations required to support a purchase of the valued property “with only

NSW, ACT and SA against the trend”.

Valuations aren’t always required on

property purchases, particularly when a buyer has a solid cash or equity

position, so what this could indicate is that traditionally cashed-up property

buyers have shied away this year.

Gates says compared to the national

increase in valuations for property purchases in 2012, a reduction in refinance

and ‘upstamp valuations’ (when borrowers pay a higher stamp duty to increase

borrowings with the same lender, say, for a renovation) has been observed, due

to what has probably been “a general reluctance by homeowners to increase their

borrowing levels” on an already purchased property.

WBP Property Group’s Victorian residential valuations

manager Brendan Smith says it’s been an interesting year for property

valuations, with 2013 looking much rosier as sales transactions pick up the

pace and provide valuers with more transactions for comparison purposes.

Unlike HTW, WBP Property Group anecdotally reports a

pick up in refinance valuations in 2012, due to what Smith says is the result

of property owners looking for better finance deals at a time when saving some

dollars has become particularly important.

Smith says a rise in mortgagee in possession

valuations have also been noticeable across most of the nation this year, but

that could also have something to do with the total volume of valuations having

increased over 2012 for a handful of larger valuation companies due to

consolidation and mergers happening in the valuations sector.

He adds that some lenders have consolidated their

valuation supplier list, preferring to deal with mostly larger valuation

companies to minimise their risk exposure.

At a more micro level, in the auction state of

Victoria, demand for renovation finance valuations has seen a slide, “though

pre-sale valuations have seen a surge from potential buyers, to ensure they’re

going to auction with more certainty of the price they’re willing to bid on”,

Smith says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/RKFwZfTjcn4/signs-of-improvement-for-nsw-act-and-wa-property-markets