The catch with mortgagee in possession sales

The catch with mortgagee in possession sales

Posted on Thursday, July 05 2012 at 12:04 PM

A lazy half a million dollars can go a long way at a mortgagee auction, however buyers should scrutinise every detail of a property and its contract, according to Herron Todd White’s (HTW) July edition of The Month in Review report.

It’s prime time to buy a good

quality, centrally located Gold Coast property for under $500,000, with

Burleigh Waters, Mermaid Waters and Miami perfect examples, says HTW’s Gold

Coast and New South Wales far north coast director Tod Gillespie.

He says Gold Coast investors are

certainly responding to the reduced prices, with a 50 per cent increase in the

number of valuations for May since November last year. “We also expect July to

be a strong month – with activities from buyers who have been waiting for the

owner-occupier stamp duty concession to be reinstated.”

Increasingly buyers are taking

advantage of significantly reduced priced properties as a result of mortgagee

in possession sales, particularly because the distressed vendor has little

option when negotiating a sale, says Gillespie.

While administrators

and mortgagees owe a duty of care to dispossessed owners to achieve the highest

price possible, the distressed vendor is negotiating from a weakened bargaining

position in that, unlike a normal vendor, they can’t withdraw the property from

the market if the offers to purchase aren’t to their liking, he says. “They

just have to press on and get the best price they can.”

The longer the

mortgagee property sits on the market, the more the mortgagee’s bargaining

position slides due to interest accrual on the debt and the cost to maintain

the property in a saleable condition, explains Gillespie.

“This means

that if you have pre-approved finance or, for the lucky few, cash, you’re in a

strong bargaining position. A fair offer, cash unconditional with a short

settlement would be a very attractive proposition for a distressed vendor.

“Even if the

bidding doesn’t make it to the reserve, as the highest bidder you have first

right to negotiate following the sale, giving you the edge over those buyers

that can’t or won’t bid at auction. Our research shows that many of these properties

will be sold at up to 10 per cent less than the reserve on auction day.”

Just because

the bargain price might be pushing emotions to a record high, buyers shouldn’t

lose their heads and forget to undertake due diligence as with any other

property, says Gillespie.

Buyers should

also seek legal advice on the contract of sale because many mortgagees will

insert non-standard clauses into the sale contract to protect their position,

he says.

“They will

often sell a property with known defects and insist on a sale ‘as-is, where-is’

with no warranties as to known or unknown issues, which may affect the

property. Make sure you’re happy with the terms and conditions offered.”

Rob Balanda of

Gold Coast-based MBA Lawyers says he’s observed an increase in the volume of

mortgagee in possession sales since the global financial crisis.

He says the

non-standard clauses have actually become standard for contracts on properties

in mortgagee possession.

They include:

the buyer’s acceptance of the property in its present condition; no guarantees

or warranties provided, nor disclosure if the property has been earmarked for

resumption, or affected by road dedication and road widening; no disclosure if

approvals are required or have been rejected for non-compliance; no disclosure

of hazardous substances existence; no disclosure of the property’s area and

dimensions; no disclosure of the ability to construct any extensions on the

property.

What this means

is the buyer will need to undertake a long list of checks and searches to

protect oneself, so adding in a due diligence clause is crucial, Balanda says.

He adds that

buyers should first check if lenders are prepared to accept a ‘buy as is’

contract.

Buyers should

always keep perspective, says Gillespie. “Just because a property is being sold

by a mortgagee doesn’t make it a bargain. If it’s on the main road, next to a

train line, under a flight path, full of defects, it may not be the bargain you

think it is. Conversely, the property may be in a tightly held area or have

particularly strong attributes, which leads to strong competition among buyers.

The mortgagee may achieve a very good sale price as a result.”

Spending a few

hundred dollars on an independent valuation of the property will sort out if

it’s really a bargain or not, he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/wXq08I7_PRo/the-catch-with-mortgagee-in-possession-sales

More incentives for green investment

More incentives for green investment

Posted on Thursday, July 05 2012 at 1:02 PM

A new plan released by the City of Sydney today proposes extra incentives for developers who incorporate environmentally friendly features in their projects.

Property owners and developers who invest

in water and energy saving measures, green roofs and facilities for bike riders

would be able to apply for exemptions from the Development Contribution Levy.

At the moment, city central projects worth

more than $200,000 are subject to a one per cent charge.

Since it was introduced in 1997, the levy

has collected more than $90 million.

It’s hoped the concession will boost the

number of green developments and help achieve objectives outlined in the Sustainable Sydney

2030 plan, Lord Mayor Clover Moore says.

“Developers need to be innovative when

designing for the future and it’s essential for them to consider sustainable

initiatives such as green energy, water harvesting and active transport,” Moore

says.

The draft plan is now open for public

consultation and can be viewed at www.cityofsydney.nsw.gov.au/Council/OnExhibition

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/y3X7H55tK-M/more-incentives-for-green-investment

Final flood report handed down

Final flood report handed down

Posted on Wednesday, July 04 2012 at 9:09 AM

Queensland Premier Campbell Newman has given his full support to the recommendations handed down to his government in the Queensland Floods Commission’s final report in response to last year’s devastating floods.

Of the 177 recommendations handed over to the Queensland

Government, 123 are state-related.

The recommendations cover areas ranging from the management

of Wivenhoe Dam during the floods, floodplain management, land use planning,

and the emergency response to the floods.

According to Newman, the Queensland Government will provide

$40 million in support to councils over three years to achieve their

recommendations.

“An additional $40 million will come from a new Floodplain

Security Scheme through our Royalties for the Regions initiative. We will also

be asking the Federal Government to contribute significantly to addressing

recommendations,” says Newman.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ak8nqbRydQE/final-flood-report-handed-down

Home values rebound

Home values rebound

Posted on Monday, July 02 2012 at 4:29 PM

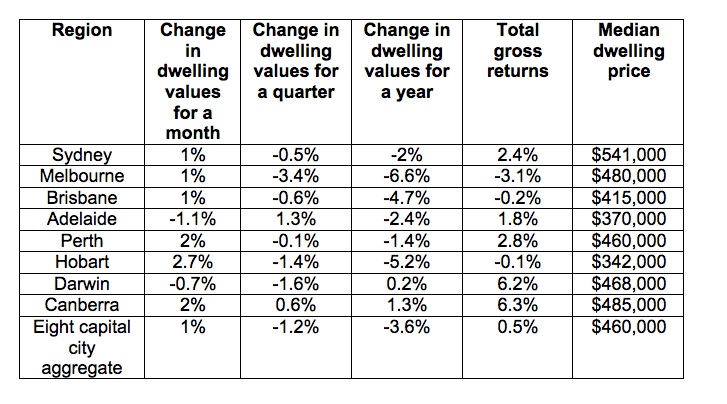

Property prices in most capital cities are on the up, after increasing by one per cent or more in the traditionally slow month of June

RP Data reports home

values rose in Sydney (one per cent), Melbourne (one per cent), Brisbane (one per

cent), Perth (two per cent), Canberra (two per cent) and Hobart (2.7 per cent).

Research director

Tim Lawless says the increases have been helped along by interest rate cuts

over May and June.

“The RP

Data-Rismark daily index across the eight major capitals has been consistently

rising over the month, foreshadowing this positive month-on-month result. The

increase in capital city dwelling values is an encouraging sign that the market

appears to be responding to improved housing affordability and lower interest

rates,” he says.

While there were

signs of weakness in Darwin (-0.7 per cent) and Adelaide (-1.1 per cent),

dwelling values in both these cities started flat lining or rising again over

the second half of June.

Rismark chief

executive officer Ben Skilbeck says the most significant insight is the rebound

in the Melbourne housing market, which has recovered by 1.7 per cent since June

11.

“The rebound in

capital city home values during June indicates that the Reserve Bank of

Australia’s (RBA) relaxed monetary policy stance may have reached the point of

inflating asset prices despite households remaining cautious about the

economy,” Skilbeck says.

“The housing

market’s fundamentals are increasingly solid; Rismark’s dwelling

price-to-income ratio is at its lowest level since March 2003, while the RBA’s

Guy Debelle has said the default rates are low and there’s no evidence of

overbuilding. If interest rates continue to be pushed lower, as they have been

since November, with total cash rate cuts of 1.25 percentage points, then asset

prices will inevitably respond to the stimulus. The fact is that mortgage rates

are well below their long-term averages, with three year fixed rates as low as

5.75 per cent.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ergWN4YOQ1w/home-values-rebound

How women drove house price growth

How women drove house price growth

Posted on Friday, June 29 2012 at 2:28 PM

Housing is as affordable now as it has ever been in relation to our salaries, according to a KPMG study commissioned by Commonwealth Bank to celebrate its centenary.

Housing is as affordable now as it has ever

been in relation to our salaries, according to a KPMG study commissioned by

Commonwealth Bank to celebrate its centenary.

The finding is one of four key themes

contained in the report, which examined the changing nature of home ownership

in Australia since 1946 when home loans were first introduced.

When looking at the average cost of a

family home compared to our salaries, it appears property is just as affordable

in 2012 as it was more than 60 years ago.

In 1950 the average cost of a house was

roughly seven times the average yearly income. Today it’s slightly less at 6.9

per cent.

“It can no longer be said that house prices

have become disproportionate to salaries,” the report says. “Rather they have

stayed on par with previous generations.”

The role of women in home ownership was

also examined. When legislation began to change in the 1960s and 1970s and

women were able to pursue a career, it had a major effect on housing, the study

found.

“The introduction of female breadwinners

has increased household incomes and that in turn has increased the value of the

typical suburban home.

“In other words, it’s this social change

that has been a major driver of price growth in housing – women returning to

the work force has made us all richer and has enabled the average household to

pay more for housing costs.”

The study also found the backyard has

become an endangered species, shrinking significantly in Melbourne, Perth and

Sydney since 1950.

Brisbane is the only capital city where

average block sizes have risen in the past 60 years.

Changing block sizes don’t mean houses are

getting smaller – quite the opposite. In 1971 only 13 per cent of detached

homes had four bedrooms, but by 2008 that figure had risen to 36 per cent.

It’s not just the size of homes that’s

increasing, but the number of people buying property.

The number of housing loans accepted by

lenders between 1980 and 1989 was 2.9 million compared with a staggering 6.4

million between 2000 and 2009.

“Even taking population growth into

account, there has been a significant growth and this growth has come from

‘everyday Australians’.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Y4ZCcTxevGk/how-women-drove-house-price-growth

Time to ditch that underperforming property?

Time to ditch that underperforming property?

Posted on Thursday, June 28 2012 at 4:31 PM

Should it stay or should it go? This is the question many investors with underperforming properties are pondering as capital growth takes a snooze.

Property

adviser Damian Collins of Perth-based Momentum Wealth says many investors are

keen to free up borrowing power to reinvest in a property with greater

potential for growth.

“Whether

to stick with or quit a property lemon is a question that seems to be on a lot

of peoples’ lips right now,” Collins says.

“When presented

with this question I generally ask people if they’d buy the same property

today. If the answer is no then it’s a good idea to start

crunching the numbers to assess whether they’re better to quit and reinvest.”

Collins believes some novice investors find

it difficult to admit they hadn’t bought wisely and tend to hold on to poor

performing assets in the hope they eventually come good.

In some cases it’s better to take a loss.

It’s important to first weigh up the cost of doing so – for example, the selling

agent’s fees, stamp duty and the possibility of capital gains tax.

“If getting out of the property only

results in a loss of around six to seven per cent of its value, then it may be

worth considering.”

Buyers agent Liz Wilcox of Hot Property Specialists

believes while it’s not the best time to ditch a property, it’s a good time to

buy – if an investor decides to cut their losses they should buy a in the same

market to minimise the loss and maximise the buying power.

Wilcox says many investors blame the

property but at the end of the day it comes back to thorough property planning

and research.

“Investors really need to talk to an expert

about what they want to achieve. For example, do they want to build a portfolio

in a high growth area over a shorter period? Or are they prepared to wait for

long-term growth?

“Ipswich (in Queensland) is a good example

of this. Yes, Ipswich will see growth over the next 10 years but can the

investor wait that long or is it better to sell and buy in a capital city where

they know growth will happen sooner?”

IProperty Plan’s Mark Armstrong says when

selling an underperforming property investors should consider their tax

position.

“If the investor decides to sell more than

one property, perhaps they should sell through different financial years to

minimise tax… for some, actually holding on to a property with a loss could be

an advantage from a tax perspective.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nTNhpXubMss/time-to-ditch-that-underperforming-property

July interest rate cut shouldn’t be ruled out

July interest rate cut shouldn’t be ruled out

Posted on Tuesday, June 26 2012 at 11:04 AM

Despite the Reserve Bank of Australia (RBA) Board indicating in its recent minutes that a July rate cut was highly unlikely following better than forecasted domestic economic conditions, mortgage holders shouldn’t rule it out, said Westpac Institutional Bank chief economist Bill Evans.

This could have something to do

with the March quarter GDP (gross domestic product) report released shortly

after the June meeting of the RBA, which detailed economic growth of 1.3 per

cent in Australia, mostly driven by consumer spending, said Evans

“Other components were quite weak with residential investment, equipment

investment, commercial building, exports and hours worked all contracting,” he

said.

However what might urge the

Board to move the cash rate next week, Evans said, despite all of its “clear

intentions as indicated in the minutes”, are the global financial challenges

continuing to play a role in reduced business confidence, unemployment rising

from five per cent to 5.1 per cent nationally, the reported 12.6 per cent

plunge in new dwelling commencements for the March quarter and global bond

rates refusing to “step down”.

“Our argument that financial conditions are hardly stimulatory, interest

rate sensitive parts of the economy are struggling, inflation is low and that

global uncertainty will continue to undermine confidence, still support our

forecast of a further 75 basis points in RBA rate cuts,” said Evans.

“We expect the confirmation of low inflation will prompt the Board to

cut by 25 basis points following the meeting in August. A follow up move in

September now seems probable with a further ‘post CPI’ (consumer price index)

adjustment in November still likely.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/f9UEAYMGvq0/july-interest-rate-cut-shouldnt-be-ruled-out

Capitalise on the cold, expert says

Capitalise on the cold, expert says

Posted on Thursday, June 21 2012 at 1:47 PM

Homebuyers waiting for a return of warmer weather could be missing out on prime opportunities, according to buyers agent and author Patrick Bright.

Seasonal market trends show cooler months

are pretty quiet, with buyers opting to pound the pavement during summer and

spring, Bright says.

“There’s definitely a myth that winter

isn’t a great time to be buying property,” he says. “While statistically

there’s less stock, there also tends to be less buyers.”

As a result, there’s less competition for

properties and that might lead to more flexibility during negotiation.

Seeing a property at the coldest time of

the year is also advantageous for buyers who want to know how a home looks and

feels in winter.

“As a seller, if your home is warm and

inviting in the colder months then winter might be a better time for you to

sell,” he says.

Bright says property listings spike between

September and November.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/SED6DwvSN64/capitalise-on-the-cold-expert-says

The nature of Australian households

The nature of Australian households

Posted on Thursday, June 21 2012 at 2:39 PM

Today’s release of 2011 Census data reveals how Australian households have changed since the last snapshot of society five years earlier.

Across the country, there are now more than

9.1 million private dwellings – an increase from 8.42 million in the 2006

Census.

According to the data, 23.5 per cent of

Australians live in an apartment or townhouse, representing a marginal increase

in attached living.

The makeup of households remains largely

unchanged. The proportion of people in group households is also up slightly to

4.1 per cent, with a small drop in the number of single households to 24.3 per

cent.

The popularity of large homes also hasn’t

abated since 2006, with a rise in the proportion of people living in houses

with four or more bedrooms to 30.3 per cent of all dwellings.

The median weekly household income sits at

$1234 and the median monthly mortgage repayment is $1800.

Mortgage-free ownership has dipped since

2006, down to 32.1 per cent. Almost 35 per cent of all dwellings are owned with

a mortgage and 29.6 per cent are rented.

The average median weekly rent is $285.

Other key statistics include:

- Total population of 21,507,717 – 10,634,013 male and 10,873,704

female - Median age of 37-years-old

- Average of 2.6 people per dwelling

- Average of 1.9 children per family

- Total of 5,684,062 families

- Top countries of birth are Australia, England, New Zealand,

China and India.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/QRz77pRjF30/the-nature-of-australian-households

Call to ban smoking on unit balconies

Call to ban smoking on unit balconies

Posted on Tuesday, June 19 2012 at 3:52 PM

Smoking on a unit balcony could soon be banned in New South Wales if proposed changes to strata legislation are introduced.

Archers Body Corporate managing director

Andrew Staehr says moves are under way to widen smoking laws to prevent

residents from lighting up, even if they’re technically on their property.

The proposal coincides with a recent report

that found smoking on balconies or in common areas was among the most common

complaints by NSW unit residents.

In complexes where a unit balcony is in

close proximity to a neighbouring dwelling, smoking could be more than a

nuisance – it might become a health hazard, Staehr says.

“There is a case in NSW at the moment where

a body corporate and the body corporate manager are being sued by a unit owner

who believes he contracted lung cancer from second-hand smoke drifting in from

his neighbours.”

Body corporates in any state can introduce

a by-law to make their building smoke-free, but policing it could be difficult,

he says.

Unit owners concerned about smoking should

approach the body corporate to discuss possible solutions and take steps to

educate residents, he says. If that fails, some level of compromise might be

required.

“Allocated smoking areas have been

implemented in some complexes. This is a good way to create a happy medium for

those that do choose to smoke

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/YRZuabO2FnM/call-to-ban-smoking-on-unit-balconies