The importance of character

The importance of character

Posted on Wednesday, July 18 2012 at 2:21 PM

Credit scoring agencies have come up with a way of calculating a borrower’s ‘debt character’ and their likelihood of repaying a loan, according to one expert.

Each lender has its own process for determining whether someone is a suitable candidate for a mortgage, according to Smartline Personal Mortgage Advisers executive director Joe Sirianni.

While the exact methods for making that determination are

closely guarded secrets, there are five areas that will most likely come into

play, he says.

Lenders will scrutinise your capacity to repay, your access

to capital, the availability of collateral, the conditions of the agreement and

your character.

“Assessing the first four is relatively straightforward,”

Sirianni says. “It’s your character that has always been a challenge for

lenders, as it’s difficult to measure your attitude.

“Lenders have always wanted the

ability to be able to accurately measure your intention to pay back their loan

and it appears they’ve now pretty much done it.”

For example, one agency rates character on a scale of zero

to 1200. Scoring 600 is passable, but might cause a bank to think twice about

approving your loan, he says.

How do you judge the character of a person? Lenders and

credit agencies won’t say. However Sirianni believes there are certain factors

that might cause a borrower to achieve a lower score. They include:

- The

number of times you’ve applied for credit (including mobile phone plans) - Whether

you’ve defaulted or been made bankrupt - Your

repayment conduct – i.e. if you’ve fallen behind on bills - How

many different credit providers you’re using - The

amount of credit you’ve sought.

“Every lender is different and no two appear to take the

same approach to credit scoring,” he says.

“It’s very true to say that one bank’s trash is another’s

treasure… some are reluctant to lend to some types of borrowers, others are

more than happy to lend to these customers.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/28M5Guq-gWM/the-importance-of-character

Brisbane most affordable mainland capital

Brisbane most affordable mainland capital

Posted on Friday, July 27 2012 at 9:26 AM

The majority of Australian capital cities bottomed out in the December quarter, evidenced by the modest price rises to follow for the first two quarters of 2012 in Sydney, Melbourne, Perth, Canberra, Hobart and Darwin, according to Australian Property Monitors senior economist Andrew Wilson.

“This trend can be

expected to continue in most capital city markets over the second half of 2012,

underpinned by the prospects of an active spring selling season signalled by

recent improvements in auction clearance rates and recent interest rate cuts,” Wilson

says.

While the majority of

capitals have seen price growth since the December 2011 quarter, Canberra,

Perth, Darwin and Hobart have recorded median house price increases over the

entire year to June 2012.

Canberra appears to be

the most resilient capital, it also happens to be the standout for growth in

median house prices for the June 2012 quarter, up 1.1 per cent, to be 0.3 per

cent higher than the previous peak recorded in March 2011.

Melbourne and Adelaide

have recorded falls over the year to June 2012, while Brisbane goes one step

further, with falls over eight consecutive quarters to remain the most

affordable mainland capital.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Brisbane most affordable mainland capital

Small office space in big demand in Adelaide

Gold Coast land sales rise in June quarter

Queensland rental market remains tight

Big announcement for Broome

The importance of character

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/iLQWgWQ3n3M/brisbane-most-affordable-mainland-capital

Small office space in big demand in Adelaide

Small office space in big demand in Adelaide

Posted on Wednesday, July 25 2012 at 12:33 PM

The proposed Olympic Dam expansion is predicted to be a key driver of the Adelaide CBD market for the next 15 years if given the go ahead, according to Jones Lang La Salle.

Director of

research and consulting David Snoswell says demand for Adelaide CBD office

space could increase by 35 per cent.

“We forecast an

additional 75,000 square metres of office space demand as a direct result of

the Olympic Dam expansion,” he says.

“This is the

equivalent to three new office buildings being developed in a response to

increased demand from the Olympic Dam expansion project.”

Managing director

Jamie Guerra adds the project could also build confidence across the business

community, which would also help the state’s economy.

“The Olympic Dam

expansion will provide long-term benefits to the South Australian economy and

property sectors, significantly improving the state’s finances – help to fund

critical infrastructure and reducing reliance on property based taxes,” he

says.

“The expansion

gives the South Australian mining and resources sector a critical mass, which

may see new companies committing for the first time to South Australia, or

running additional business activities from South Australia.”

The project is

awaiting final board approval from BHP Billiton, with a decision expected

before the end of the year.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Small office space in big demand in Adelaide

Gold Coast land sales rise in June quarter

Queensland rental market remains tight

Big announcement for Broome

The importance of character

RBA sees positive signs locally

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/BulzCldxnFM/small-office-space-in-big-demand-in-adelaide

Gold Coast land sales rise in June quarter

Gold Coast land sales rise in June quarter

Posted on Tuesday, July 24 2012 at 3:29 PM

Vacant land sales on the Gold Coast rose 30 per cent in Queensland in the June quarter, according to data released today.

The Prodap Report shows most

transactions were within housing estates in the suburbs of Pimpama and Coomera.

The increase in volume comes off a low base

of 159 sales in the March quarter, report author Bill Morris says.

There were 208 sales in the three months to

June this year.

Morris also believes some buyers delayed

signing purchase contracts until after stamp duty concessions were officially

reinstated.

That trend likely “camouflaged underlying

demand over the June quarter,” he says.

House sale prices averaged $527,000 at June

30, down 12 per cent from two years earlier, he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Gold Coast land sales rise in June quarter

Queensland rental market remains tight

Big announcement for Broome

The importance of character

RBA sees positive signs locally

Melbourne market stabilises as vacancy rate tightens

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ad06r91BW4Q/gold-coast-land-sales-rise-in-june-quarter

Queensland rental market remains tight

Queensland rental market remains tight

Posted on Friday, July 20 2012 at 12:43 PM

Demand for rental properties still exceeds supply in many parts of Queensland, according to data released today.

Figures compiled by the Real Estate

Institute of Queensland (REIQ) show a number of regions across the state have a

rental vacancy rate below three per cent. That benchmark is considered an

indicator of a balanced market.

“While we’re seeing an increase in the

number of first homebuyers and investors in the sales market, their activity

will take some time to flow through to the rental market,” the REIQ’s chief

executive Anton Kardash says.

The vacancy rate in Brisbane was 2.1 per

cent, a slight improvement on the 1.7 per cent figure recorded in March. The

inner city market saw its vacancy rate fall to 1.6 per cent, with reports from

agents that stronger demand is pushing up prices, Kardash says.

A continuing influx of people in regional

towns near major mining centres is seeing supply dry up, he says.

For the second time this year, Rockhampton

recorded the tightest rental market in the state at just 1.1 per cent. The

central Queensland city’s more affordable rental market, compared to

neighbouring Gladstone and nearby Mackay, could be responsible for the rush of

new residents.

Toowoomba, west of Brisbane, recorded

Queensland’s second lowest vacancy rate at just 1.2 per cent.

Lower investor activity in Cairns is

believed to be responsible for the northern city’s vacancy rate dropping to 1.9

per cent.

Similarly, the Gold Coast’s vacancy rate

increase slightly to four per cent while the Sunshine Coast also saw a small

rise to 3.3 per cent over the same period.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/aGTkWXHc9_0/queensland-rental-market-remains-tight

Big announcement for Broome

Big announcement for Broome

Posted on Thursday, July 19 2012 at 10:55 AM

Broome’s controversial James Price Point liquefied natural gas (LNG) processing plant is one step closer to moving ahead, following conditional approval from the Environmental Protection Authority (EPA) on Monday.

The decision to base the gas

processing hub onshore south of James Price Point in Broome, with direct access

to the Browse Basin, has divided the community – one half of the community is

outraged over the potential damage to the pristine Kimberley land and surrounding

sea environment, while others prefer to look at the issue from a dollar

perspective and the enormous job opportunities to flow into the town.

WA Acting Premier Kim Hames says

Woodside Energy and the Western Australian Government have spent four years

studying the environmental and natural heritage issues.

In late 2010 the results of

environmental studies and proposed strategies for managing environmental

impacts were released for a 15-week public comment period, says Hames.

“In the year since, public

submissions have been considered, responses prepared and new studies and

monitoring undertaken and provided to the EPA.”

On Monday this week the EPA gave

the green light to the project, with environmental conditions in place.

The EPA’s report will now be open

for a 14-day public consultation period before the WA Environment Minister Bill

Marmion will consider the findings and determine any appeals, including those

from environmental lobby groups, before making a final decision.

From this point the project start

is subject to Commonwealth approval and also Woodside’s final investment

decision, which the company claims is on track to happen in the first half of

next year.

If all goes ahead, Woodside

Energy estimates it will build and operate a 12-million-tonne per annum LNG processing

facility at the site.

While the volume is significant,

Woodside says it will still be smaller than its North West Shelf LNG project

located at Karratha, though if it expands it could exceed it.

Residential valuer Stephen

Incerti of Opteon Broome doesn’t expect major price surges if the LNG project

goes ahead near James Price Point.

Firstly, he says the WA

Government has already released blocks of land to cater for the population

growth anticipated from the LNG project, enough to “double the size of Broome”.

He adds that the government has

enough land to release for another 15 years, though when or if the final go

ahead is given there may be an initial price spike while housing is being

constructed and investors flood the market.

“On the other hand, if the

project doesn’t go ahead it could mean a fair bit of oversupply for Broome.”

The WA Government is releasing

large supplies of land in anticipation of the project, with the first stage

almost sold out in the Broome North suburb development, says Incerti.

Investors must remember that the

government has strict conditions on releasing these blocks to avoid speculators

flooding the market – buyers must occupy the new home for a minimum of 36

months before renting it out, he says.

The other consideration investors

need to make is if the LNG project does go ahead Woodside will build a workers

camp for its construction workers near the James Price Point site, says

Incerti.

A Woodside Energy spokespersons

reports that a 6000-bed, fully self-contained accommodation facility with a

wide range of amenities would be constructed for the construction stage to

accommodate the expected onshore construction workforce of about 6000.

Once LNG production begins

between 400 and 600 permanent jobs are expected.

“We’re talking 60 kilometres away

from Broome. Though once you have a project of this scale on your doorstep it

stimulates other industry, which means even more jobs for the area,” says

Incerti.

Helen Collier-Kogtevs of Real

Wealth Australia says investors should hold off on speculating in Broome at

this stage.

“Until the project is a done deal

and the money is on the table and the final contracts are signed and jobs are

starting, investors shouldn’t get caught up in hype of big announcements.”

She adds that investors need to

thoroughly investigate the market including the land supply.

“I would rather my clients pay

$50,000 more for an investment property once it’s a sure thing rather than

being a fox and trying to get ahead of the pack and getting unstuck because it

didn’t happen and they couldn’t get a tenant.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/v5G5gaBQ8_g/big-announcement-for-broome

Signs of growth in Adelaide

Signs of growth in Adelaide

Posted on Tuesday, July 17 2012 at 10:24 AM

Sales volumes are edging up, showing stronger activity in the Adelaide market, according to the Real Estate Institute of South Australia (REISA).

Based on the SA

Government June data, REISA president Greg Moulton says preliminary data has

recorded nearly 3800 sales in the June quarter.

As data is finalised,

the figure is expected to climb and end up stronger than for the same quarter

in 2011.

Moulton says sales

activity is the really important driver in the property market. “So this is a

positive change, especially after two recent interest rate cuts.”

Adelaide’s median

house price also rose for the quarter, a good sign for the second half of 2012,

says Moulton.

“Over the past

quarter, the median house price in Adelaide has risen by 3.1 per cent and we

are only looking at a 1.4 per cent decrease on the same time last year, so I

think we’re starting to see the end of some really tough times in real estate.

“It will be a slow

recovery as the general economy is weak, but people are starting to think

property again, for both investment and a different lifestyle.”

Adelaide’s strongest performers

for the 12 months to June are Semaphore, Parkside and Highbury.

“In Semaphore,

looking at the sales for the quarter, it’s clear that some big properties have

changed hands which has driven the significant spike in median house price, but

equally, it shows the demand for the suburb,” says Moulton.

“The market is

patchy at the moment, so there’s a bit of volatility quarter to quarter but

with activity rising and prices starting to stabilise we’re heading in the

right direction.”

Moulton says the

amount of stock on the market is still very high, which equals longer times on

market, but the flip side for buyers is there are more choices and cheaper

prices.

“When thinking real estate,

it has to be a medium to long-term investment and history will show that you

can’t beat the stability and reliability of bricks and mortar,” he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/PjzIjB7qYsU/signs-of-growth-in-adelaide

Queensland builders see red as warranty insurance premiums rise by 7%

Posted on Thursday, July 12 2012 at 10:02 AM

Queenslanders already pay up to four times more in home warranty insurance premiums than in most other states and territories, and on contracts signed from July 23 this year the state’s construction industry and new homeowners and renovators will be hit even harder as the insurance premiums soar by a further seven per cent.

This month has been a confusing

one for builders across Australia. Despite many of their suppliers announcing

significant rate rises from July 1, because of the Australian Competition and

Consumer Commission’s (ACCC) heavy-handed censorship crackdown, these

businesses can’t legally tell their customers it’s due to the carbon tax,

unless of course they can satisfy the ACCC with sufficient evidence – a tough

task.

As building supply rates rise,

regardless of if it’s due to the carbon tax or generally reduced demand for

goods, the building sector is expected to absorb the brunt of the price

increases, because it still needs to meet the market – a market that knows it

currently has an enormous supply of builders hungry for the work and can pay

substantially less than at the market peak in 2008.

Brisbane-based builder and

renovation expert David Clarke of Renovation Right just learned of the increase

this week. He says any rise in building costs to the market will make it even

harder to secure work and it will undoubtedly create a ripple effect throughout

the sector.

“We’re the dummies in the middle

– the guinea pigs – having to deliver the news of these insurance costs to the

clients. We tell our clients what the quote is, then we have to tell them to

add on an extra percentage for the insurance. So we’re the ones who lose out,”

Clarke says.

“I think we’re just being swept

along in another government money grab. What the government should be doing is

encouraging people to spend on construction, not discourage it.”

On construction work valued over

$3300, the Queensland Home Warranty Scheme at question provides customers with

protection if the builder becomes bankrupt or winds up in liquidation, if the

builder fails to complete the contracted works, or if the builder provides

defective work. Ultimately it’s the consumer – new homeowner or renovator – who

pays the premium, but it’s an added cost the builder needs to present to the

client.

Queensland’s Building Services

Authority (BSA) is responsible for the seven per cent increase. It states that

the increase in the Home Warranty insurance premiums on building contracts

signed from July 23 is necessary to ensure the scheme remains financially

sustainable.

BSA general manager Ian Jennings

says the increase is due to a number of factors. Firstly, “the number and

complexity of claims” over the past year; secondly, the number of contractors

becoming insolvent due to the global financial crisis, hence more claims being

made by consumers; thirdly, the number of subsidence claims “due to changing

climatic conditions – years of drought followed by flooding rains”; fourthly,

the number of large-scale townhouse and unit development claims; and finally,

the legal costs due to escalating numbers of contractors and consumers

challenging insurance claims decisions.

The Housing Industry Association

chief executive Graham Wolfe prefers to look at the bigger picture and consider

what the premiums currently are and how they compare to other states even

before the increase.

“Over the past six months we’ve

seen some premium increases in WA, SA and the ACT, but the premium in those

states are about one quarter of Queensland’s premium… and now the BSA is

putting it up by another seven per cent!”

Wolfe says NSW’s premium is

about half of Queensland’s premium. “While there are some price adjustments

happening in NSW, because the government is trying to get the builders

currently on the lower premiums up to a single premium base so all builders are

at parity, rather than increasing the premium in one hit like in Queensland, in

NSW it’s happening over five years and was announced in 2010.

“So at the end of the day, yes,

there have been some increases across other states, however what it clearly

shows is that Queensland is by far the most expensive and that it’s clearly an

inefficient scheme.”

Wolfe puts it down to the

“recurrent expenditure” in Queensland’s scheme due to the policies being

administered through a single government-funded arm rather than through one or

more private enterprises, where competition can keep prices down and business

can be diversified. “It’s not only the cost of the policy but the administering

of the system.”

In other states and territories

home warranty insurance schemes are privately managed, with perhaps some

insurance policy underwriting by governments, Wolfe says.

“Ultimately the consumer pays

the cost in the end and increases like these are never good timing but there

are many more problems in the sector than just the warranty premium debate,” he

says.

“I would suggest in this case

it’s probably good timing for an efficiency review into operating this scheme

through a government-funded arm in Queensland.”

Wolfe intends to take the issue

to Queensland Premier Campbell Newman.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/DLtmeWc-7LM/queensland-builders-see-red-as-warranty-insurance-premiums-rise-by-7

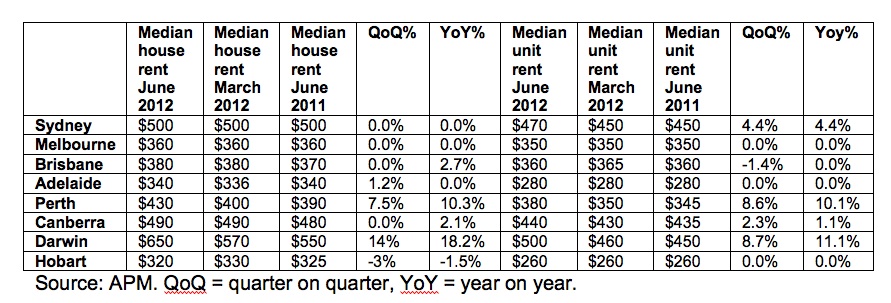

Sydney and Perth landlords benefit from increasing rents

Posted on Thursday, July 12 2012 at 12:48 PM

Investors in Sydney and Perth are experiencing rapidly rising rental yields, according to Australian Property Monitors.

Unit rental prices

in Sydney are now approaching those for houses, with the median weekly asking

rental for units increasing by 4.4 per cent to $470 per week in the past

quarter, compared with $500 per week for houses.

Sydney’s rental

market also remains highly competitive for prospective tenants, with low

vacancy rates being recorded in most areas.

Perth rental

prices have risen markedly over the past few months, up 7.5 per cent to $430

for houses and up 8.6 per cent to $380 for units.

“In the Sydney

market, the price increases in units over the quarter reflect growing demand

for this type of accommodation that typically is located closer to the CBD and

provides more established urban infrastructure,” senior economist Andrew Wilson

says.

“More widely,

particularly in Perth, Darwin and Canberra, ongoing shortages of accommodation

and low levels of new supply are placing upward pressure on rentals, which can

be expected to continue over the rest of 2012.”

Although Darwin

recorded significant rental growth for both units and houses over the June

quarter, much of this can be attributed to seasonal effects that are characterised

by extreme quarterly fluctuations typical of this market.

By contrast,

rental growth in Melbourne and Brisbane remained flat, with Brisbane unit rents

falling by 1.4 per cent. However, weekly median rents in Brisbane are actually

higher than Melbourne. The median rent for a house in Brisbane is $380 and for

a unit the median rent is $360, compared with $360 for a house or $350 for a

unit in Melbourne.

“The strong

capital growth prospects for Sydney, Perth and to a lesser degree Brisbane,

will act to dampen gross yield increases despite rent rises. They will

nonetheless prove increasingly attractive to investors seeking capital gains as

recoveries in the price cycles become increasingly evident,” Wilson says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/x8Sbdl9iLF8/sydney-and-perth-landlords-benefit-from-increasing-rents

Interest rates kept on hold

Interest rates kept on hold

Posted on Tuesday, July 03 2012 at 3:15 PM

The official cash rate remains unchanged at 3.5 per cent following today’s meeting of the Reserve Bank of Australia (RBA).

Following reductions in May and June of 50

and 25 basis points respectively, the RBA has decided to hold steady.

Economists and property industry

commentators largely anticipated today’s result. However many have tipped

further cuts later in the year if economic conditions in Europe don’t improve

or deteriorate.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/zC21zOp0A5w/interest-rates-kept-on-hold