Queensland Budget dubbed ‘once in a generation’

Queensland Budget dubbed ‘once in a generation’

Posted on Tuesday, September 11 2012 at 4:31 PM

Regaining Queensland’s AAA-credit rating and returning the balance sheet to surplus sooner have defined the Newman Government’s first Budget.

Addressing the state’s Parliament today, Treasurer Tim Nicholls described it as “the most important budget in a generation”.

As reported yesterday, the government has

scrapped the $7000 First Home Owner Grant in favour of a new $15,000 First Home

Construction Grant.

Real Estate Institute of Queensland (REIQ)

chief executive Anton Kardash says the measure, designed to spark activity in

the state’s struggling construction sector, is unlikely to work.

An analysis of official data shows only 24

per cent of first homebuyers bought a new home when the government offered

$21,000 grants for new builds during the global financial crisis, Kardash says.

“The main reason for this is new homes are

usually too expensive for first-time buyers and located in outlying suburbs

where young people don’t necessarily want to live.

“New units and townhouses can also be more

expensive than established (properties) and often have higher body corporate

fees than older apartments.”

Master Builders Queensland applauded the

measure, which it says will boost “disappointing” housing approval figures plaguing

much of the state.

The top stamp duty threshold for properties

will increase to $1 million, but so too will the rate – to 5.75 per cent.

Nicholls outlined a range of other

cost-cutting measures, including the confirmed retrenchment of 14,000 public sector

employees across every government department.

The move is expected to cost $800 million

in redundancy payouts and provide long-term savings, and the final figure is

less than the originally flagged 20,000 jobs Premier Campbell Newman claimed

the state could not afford.

“We acknowledge this has been a difficult

and challenging time for many people, however we need the right sized public

service that provides services to Queenslanders at a price they’re prepared to

pay,” he said.

The government will increase coal mining

royalties, which is expected to pump an additional $1.6 billion a year into

treasury’s coffers.

The rate of royalties will rise by 12.5 per

cent for exports valued between $100 and $150 per tonne, and 15 per cent for

values over $150 per tonne.

Despite the timing of the jump, at a time

when commodity prices are sending jitters through the resources industry,

Nicholls says the industry will take certainty from his pledge to not increase

royalties for 10 years.

Included in the Budget were downgraded

economic growth projections – down to four per cent this year from the

previously forecast figure of five per cent.

Unemployment is also expected to pass six

per cent in the coming year – no doubt thanks in part to the impact of mass

public sector job cuts.

However Nicholls says the “tough decisions”

will see Queensland return to a slim surplus of $17 million in 2013-14.

There was some good news, in the form of

the $495 million Royalties to the Regions program that will focus on investment

in infrastructure.

Nicholls also outlined funding for research

to boost the state’s agricultural industry and allocated money to boost tourism

initiatives.

Funds were also put towards the 2018

Commonwealth Games on the Gold Coast.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/dHR4jljENi8/queensland-budget-dubbed-once-in-a-generation

Unit and townhouse prices on the increase in Queensland

Posted on Friday, September 07 2012 at 2:10 PM

The median price of units and townhouses increased across many parts of Queensland in the June quarter, according to the Real Estate Institute of Queensland (REIQ).

First homebuyers and investors also appear

to have emerged from the woods, with increased activity in the market, REIQ

chief executive Anthon Kardash says.

“Given the affordability of units and

townhouses, as well as their (typically) more central locations, first-time

buyers and investors often compete for this type of property which may be

partly responsible for the increases in median prices,” Kardash says.

Brisbane saw its unit and townhouse median

increase by 3.8 per cent to $402,500. There was also a jump in the number of

high-end unit sales in Brisbane’s CBD and city fringe suburbs, he says.

The suburb of Morningside, about eight

kilometres east of the CBD, posted a median increase of 10.8 per cent to

$460,000 over the quarter, up 4.1 per cent over the past year.

The top Queensland performer for unit and

townhouse median price growth was Gladstone, which recorded an increase of 6.1

per cent to $380,000.

The regional town, which continues to

benefit from major investment in liquefied natural gas operations, has

experienced increased unit and townhouse development activity in recent years

due to growing demand for accommodation.

Gladstone’s median house price sits at

$475,000 so smaller dwellings are a more affordable option for many buyers,

Kardash says.

The Whitsunday region also performed well

over the quarter, recording a median unit and townhouse increase of 5.3 per

cent to $300,000.

“As was the

case with the house market, there was reduced unit and townhouse sales activity

over the June quarter as many buyers waited for the return of the stamp duty

concession on July 1.

“However, as

first homebuyers and investors were unaffected by the stamp duty change, these

buyers were more prominent over the June quarter.”

The

preliminary number of unit and townhouse sales across Queensland decreased 15

per cent in the June quarter compared to the March quarter, he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Cio8enVuNfc/unit-and-townhouse-prices-on-the-increase-in-queensland

Another major boost for the Gold Coast

Another major boost for the Gold Coast

Posted on Friday, September 07 2012 at 4:54 PM

A $4.9 billion proposal for a major piece of infrastructure on the Gold Coast has received overwhelming support and could prove to be a major boost for the area.

Three in four locals

reportedly support the Southport Broadwater Wavebreak proposal, which is

currently the largest project mooted on Australia’s eastern seaboard.

It would be built

by Singapore’s largest engineering and construction group, Sembawang of

Singapore, Global Project Underwriters and become the Gold Coast’s most

significant tourism project in decades, involving a cruise ship, residential,

tourism and marina precinct.

The company

invited public comment on the proposal, resulting in more than 52,000 hits on

the Wavebreak website.

Of those who

participated in the online survey, 76.5 per cent voiced their support for the

Wavebreak proposal.

Major issues

identified by survey respondents included the belief that the proposal would

heighten the Gold Coast’s tourism potential, a need for the city to embrace

employment opportunities and a desire to have it ready for the Commonwealth

Games.

Opponents

believed the proposal would negatively impact the environment and ecology.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Another major boost for the Gold Coast

Unit and townhouse prices on the increase in Queensland

New development guidelines in WA

Government takes action on removing asbestos from houses

Interest rates hold steady

Negative gearing not a long-term strategy

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/FNh8kLy5ukc/another-major-boost-for-the-gold-coast

Interest rates hold steady

Interest rates hold steady

Posted on Tuesday, September 04 2012 at 3:55 PM

The official cash rate remains on hold at 3.5 per cent following today’s meeting of the Reserve Bank of Australia (RBA).

It’s a move largely on par with what

economists were tipping and follows recent comments by RBA Governor Glenn

Stevens that he’s comfortable with the state of the economy.

Most commentators expect a downward

movement at the RBA’s next meeting, which falls on Melbourne Cup Day.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Interest rates hold steady

Negative gearing not a long-term strategy

Land to be released in Moranbah and Blackwater

August the strongest month for mortgages in three and a half years: AFG

Farming regions on the up in SA

Big picture approach to property demand is needed

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/51Ptbo8wgdo/interest-rates-hold-steady

NT government changeover won’t rock the boat for investors

Posted on Thursday, August 30 2012 at 3:28 PM

The Country Liberal Party (CLP) claimed victory at last weekend’s election following the Labor Party’s 11-year reign in the Northern Territory, with not a lot of ‘rocking the boat’ expected for investors, according to Terry Roth of Herron Todd White NT.

Incoming Chief Minister Terry

Mills promises to grow jobs, review the My New Home scheme (Labor’s 100 per

cent home loan with zero deposit for Territorians) and set up an independent

planning commission, among other changes.

While the Labor Party initially

introduced the My New Home scheme to encourage construction and to relieve the

pressure from house prices, the CLP believes it actually has the potential to

drive up house prices, hence the new government’s decision to place the scheme

on hold until a full review has been undertaken.

The share equity scheme (where

the buyer purchases a share of a property with the NT Government) still remains

to be operational and the all-important zero land tax rate still applies on all

residential property in the NT.

The Real Estate Institute of

Northern Territory chief executive Quentin Kilian still isn’t fully convinced

that the new government has a grasp on the overall long-term plan for the NT.

Kilian says the new government

should be planning for the year 2050, for a population of one million.

Currently the NT population is just under 212,000, with more than 120,000 of

this population living in Greater Darwin.

At this stage the Greater Darwin Plan

could be scrapped, Kilian adds. “Though there’s no sense in throwing out the

baby with the bath water. The plan should be reviewed and anything valuable

should be retained.”

Kilian says if the new

government doesn’t shift to a more progressive position on land density in

Darwin, the impact will be a rolling problem of supply and demand. “Is the new

government going to deliver this then? It’s still too early to tell.”

While it may still be too early

to tell what the full effect of the government changeover will be for the

supply-demand issue, Kilian adds what has already been discussed is the speedy

construction of 2000 inner-city dwellings to be rented at below market rate.

Kilian says he’ll continue to

push hard for developers to be given more flexibility to build higher density

buildings and the concept of creating urban villages in inner Darwin suburbs.

He says the CLP will more likely

have an easier task in its land release and densification program and generally

pushing through decisions because it won’t be in an awkward position of a hung

parliament, a situation the previous government was faced with.

While public administration jobs

have been slashed in other states under incoming Liberal governments in the

past year or so, so far it doesn’t appear that this will apply in the NT to the

same extent, says Roth.

“The next 40 years will be the

most substantial years ahead for Darwin with good solid growth ahead,” says

Kilian.

“The LNG (liquefied natural gas)

market is not as affected by the mining tax as iron ore or uranium. We also

know now that there is five to 10 times the amount of LNG out in the ocean than

what they’re currently pulling up. We have a long road ahead.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/D7ckpp-HzXA/nt-government-changeover-wont-rock-the-boat-for-investors

Big picture approach to property demand is needed

Posted on Friday, August 31 2012 at 2:35 PM

A need for a national approach to infrastructure funding for new development and strata laws to prevent redevelopment of aged and unsafe buildings have been correctly identified in the Council of Australian Governments’ Housing Supply and Affordability Reform report released this week, according to the Urban Development Institute of Australia (UDIA).

UDIA vice-president Michael

Corcoran says the report also recognises the need for improvement to the

timeframes for land rezoning and development applications and how

code-assessable development could stimulate housing supply.

“What we hope to see now is more

work on translating these findings into meaningful reforms that deliver more

housing on the ground,” says Corcoran. “As a nation our housing shortfall is

increasing every year so we don’t have time to waste in creating agreement

amongst the states about the solutions.”

Corcoran says what the report

lacks, though, is a “big picture approach” to Australia’s future housing demand

for a “growing population”.

“What we lack as a nation is a

properly robust long-term population forecast for Australia. We cannot deliver

the housing and infrastructure needed for the future if we are flying blind on

what our future demand will be.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Big picture approach to property demand is needed

NT government changeover won’t rock the boat for investors

Areas where it’s cheaper to buy than rent

Another two berths for Port Hedland

Singles make their mark in Melbourne’s bayside

Fixed rates at lowest level in three years

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/iYyfwN-iKuU/big-picture-approach-to-property-demand-is-needed

Areas where it’s cheaper to buy than rent

Areas where it’s cheaper to buy than rent

Posted on Wednesday, August 29 2012 at 2:37 PM

RP Data has released its annual Buy Versus Rent report that lists 283 suburbs and towns across Australia where it’s cheaper to service a mortgage than pay rent.

Queensland tops the list with 84 areas

across the state, including 16 in Brisbane itself. New South Wales records 54

areas, with 22 in Sydney, while Victoria fell well behind its east coast

counterparts with just 10 areas in total.

RP Data’s research director Tim Lawless

says Adelaide is one of the country’s more affordable cities, with 20 suburbs

where it’s cheaper to buy than rent. Hobart has 12 while Perth recorded three.

The list is based on a standard variable

principal and interest loan. Using an interest-only loan, the list expands to a

whopping 1320.

A number of prime spots even appear in the

rankings. The inner-Sydney suburb of Rushcutters Bay makes the list for units.

Similarly, it’s cheaper to buy a unit in West Perth than rent by about $77 a

month.

Flat property market conditions combined

with lower mortgage rates have resulted in improved housing affordability,

Lawless says.

“With lower mortgage rates, tight rental

markets resulting in some rental increases, and lower home values, many buyers

may see now as a good time to either re-enter the market or buy their first

home,” he says.

Nationally, capital city home values have

slid by 5.9 per cent since October 2010. It’s good news for those renting who

are considering stepping onto the property ladder, he says.

For the free report and suburb-by-suburb

statistics, visit www.rpdata.com.au/buyorrent

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Areas where it’s cheaper to buy than rent

Another two berths for Port Hedland

Singles make their mark in Melbourne’s bayside

Fixed rates at lowest level in three years

The factors affecting Canberra’s apartment market

Private sales on the rise

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/kKfwAk30Dpc/areas-where-its-cheaper-to-buy-than-rent

The factors affecting Canberra’s apartment market

The factors affecting Canberra’s apartment market

Posted on Thursday, August 23 2012 at 9:41 AM

New apartment oversupply in Canberra’s inner north and south should tighten due to lack of new development applications, however in the lead up to the Australian Capital Territory (ACT) election the Liberal Party’s proposed cuts to 15,000 jobs isn’t exactly putting the spring back into the investor’s step, according to Gordon Yeatman of Propell National Valuers.

The new apartment oversupply

problem that inner Canberra suburbs are facing stems back to a couple of years

ago, when the ACT Government proposed an increase to the developer’s tax by a

specific date, says Jeremy Francis of PRDnationwide Inner North Canberra.

“Its effect on the market at the

time was an unknown quantity,” he says.

He adds that at the time the

information being bandied about was that the original developer or ‘betterment

tax’ of $1200 per unit would increase by 10 times this figure to become the

‘change of use charge’.

“So developers rushed to their

architects and ACT Planning (ACTPLA) to submit development applications before

the changeover date and what resulted was a large supply of new units in the

market.

“Because of the rush back then,

architects are now twiddling their thumbs and ACTPLA is like a ghost town.”

Francis says what the ACT

Government has done is impact the market to the point that a large supply of

units approved two or so years ago are coming to market at the same time,

leading to a short-term oversupply, however beyond that, supply appears to be

nil, which is good news for the unit investor.

What this means is that the

downward pressure on rents and values in new units won’t be sustained long

term, he says.

The inner north and inner south

suburbs currently experiencing a short-term oversupply of units include

Braddon, Barton, Kingston, Dickson, O’Connor, Turner and Griffith, says

Francis.

“New unit rents and values in

these areas should tighten up again over spring and summer as workers are

transferred in and out of Canberra.

“Historically 40 per cent of

Canberra property sells in the spring market.”

However Yeatman believes it’s

likely to be a longer wait for investors, beyond the imminent ACT election due

to the job cuts being proposed by the ACT Liberals.

“We’re not out of the woods yet and when the Opposition

Party is promising to axe 15,000 jobs if it wins the election this doesn’t help

provide confidence in the Canberra property market.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Lci1WRpKuGo/the-factors-affecting-canberras-apartment-market

Singles make their mark in Melbourne’s bayside

Singles make their mark in Melbourne’s bayside

Posted on Friday, August 24 2012 at 9:06 AM

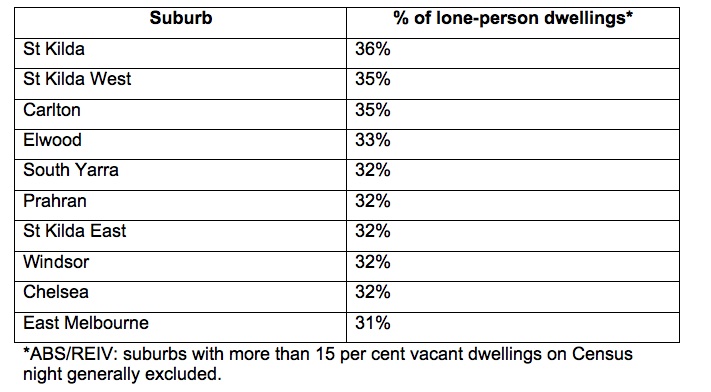

Inner Melbourne’s bayside is the hotspot for a single person, according to the Real Estate Institute of Victoria’s (REIV) analysis of the 2011 Australian Bureau of Statistics Census.

Bayside suburbs of St Kilda, St

Kilda West, Carlton, Elwood and South Yarra have the highest proportion of

single person households in Melbourne, along with Carlton in Melbourne’s inner

north, reports REIV policy and public affairs manager Robert Larocca.

These trends play an enormous

role in determining development and demand for housing, says Larocca.

“In St Kilda, St Kilda West,

Carlton, Elwood and South Yarra, at least one in three homes have only one

resident. New developments clearly respond to this demographic trend by building

residences more suited to single people.”

The data also demonstrates that

the further the suburb is from the CBD, the less likely it is that only one

person will be residing in the home, says Larocca.

“There is one interesting

exception – the Belgrave/Lilydale train line, where most suburbs have a higher

than average proportion of lone-resident households.

“At the other end of the

spectrum are the growth suburbs: Point Cook, Greenvale, Roxburgh Park, Doreen,

Narre Warren South and Narre Warren North, for instance. In those suburbs less

than 10 per cent of homes only have one resident.”

Growing families are the driving

force behind these growth areas, says Larocca.

Fixed rates at lowest level in three years

Fixed rates at lowest level in three years

Posted on Thursday, August 23 2012 at 4:31 PM

Competition between lenders for a slice of the fixed home loan market continues to heat up, with new research showing rates are at their lowest point since the global financial crisis (GFC).

An analysis by financial comparison firm

RateCity found 46 different lenders have dropped their three-year fixed loan

rates since July – including the big four banks.

The average reduction was nine basis points

but several slashed their fixed rates by between 30 and 40 basis points.

Michelle Hutchison from RateCity says some

fixed loans are becoming pretty hard to resist.

“Three-year fixed home loans, which is the

most popular term among borrowers, currently average 5.95 per cent,” Hutchison

says.

There are other deals as low as 5.5 per

cent, she says.

“We haven’t seen three-year fixed rates

this low in more than three years, when we were hit by the GFC.”

While variable home loans are still the

popular choice among borrowers, she expects the take-up of fixed rates to

increased over the coming year.

“(There’s) uncertainty about which

direction official rates will move, (so) we expect to see more borrowers taking

up fixed home loans.”

According to the Australian Bureau of

Statistics, fixed home loans finance in June accounted for just over 10 per

cent of all mortgages. That represents an increase from 6.9 per cent in the

same period last year.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Fixed rates at lowest level in three years

The factors affecting Canberra’s apartment market

Private sales on the rise

Call for crackdown on illegal parking in unit complexes

Major expansion of Bowen Basin gas project

Calls for easements to be compulsory in Queensland

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9WasgGSr6KY/fixed-rates-at-lowest-level-in-three-years