More signs of a housing market recovery

More signs of a housing market recovery

Posted on Friday, February 01 2013 at 3:04 PM

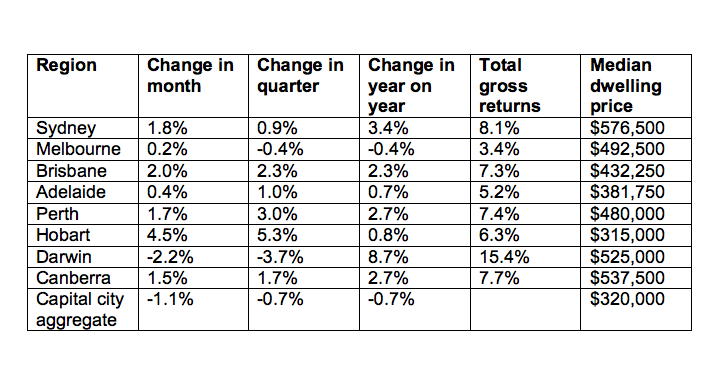

Did you invest in property last year? You might’ve jumped in at just the right time, with new data released today showing home prices across Australia rose by 1.8 per cent across 2012.

In further signs

of a looming recovery, capital city dwelling values rose by 1.2 per cent in

January, largely thanks to gains in the Sydney, Perth and Brisbane markets.

RP Data reports that

every capital city recorded an increase in dwelling values over the past 12

months, with the exception of Melbourne, which was down 0.4 per cent.

The firm’s research

director Tim Lawless says the housing market has started the year on a strong

foot.

“These strong

January results are likely to have seen some upwards seasonal bias, however the

housing market has been on a clear recovery trend since June last year,”

Lawless says.

“The latest

housing market data adds weight to the argument that interest rates may be at

the bottom of the cycle. The Reserve Bank will be watching the performance of

the housing market closely and the positive trend in housing values will dampen

calls for further interest rate cuts.”

Additional data

is also pointing towards an improvement in the Australia housing market. The

average number of days it takes to sell a property was steadily decreasing

prior to the seasonal slowdown in December and January and the rate of vendor

discounting was also on a clear trend of improvement.

“The typical

capital city house took 50 days to sell in December last year, a vast

improvement from the recent high of 76 days recorded in February last year.”

Additionally,

vendors are now discounting their initial asking prices by an average of 6.6

per cent compared with 7.3 per cent a year ago.

“With stock

levels (still) high, it’s likely to remain a buyers’ market for some time,

however I think we’re now seeing some balance return to the negotiation table. Buyers

are losing some of their negotiation power and homes are selling faster.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

More signs of a housing market recovery

Strong 2012 finish for construction sector

House prices on the rise

Nature’s fury slows market recovery

Coober Pedy strikes black gold

Door open for February interest rate cut

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/e2bOanTjf3I/more-signs-of-a-housing-market-recovery

Strong 2012 finish for construction sector

Strong 2012 finish for construction sector

Posted on Thursday, January 31 2013 at 4:36 PM

An increase in new home sales in December signals a healthier outlook for the year ahead, according to Housing Industry Association (HIA).

The body’s New Home Sales Report released today

shows seasonally adjusted new dwelling sales grew by 6.2 per cent last month.

According to HIA economist Geordan Murray, the

result indicates strength across a number of property types.

“The promising headline rise last December was

driven by both detached houses and multi-unit sales,” Murray says.

The result for detached house sales was

particularly good news as this was one of the underperforming sectors across

last year, he says.

“The December improvement was broad-based as

sales increased in all but one of the surveyed states.”

While the month’s results were promising, there

were some sectors needing improvement.

“Detached house sales were weak throughout the

year compared to 2011, but on the other hand multi-unit sales were the star

performer of the year,” he says.

The group is hopeful of improved results in

2013 on the back of this lift.

“It’s hoped further signs of an impending new

home building recovery emerge in the coming months.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Strong 2012 finish for construction sector

House prices on the rise

Nature’s fury slows market recovery

Coober Pedy strikes black gold

Door open for February interest rate cut

Property a priority in 2013 as confidence lifts

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/pKwTjZQ3ZQs/strong-2012-finish-for-construction-sector

Strong 2012 finish for construction sector

Strong 2012 finish for construction sector

Posted on Thursday, January 31 2013 at 4:36 PM

An increase in new home sales in December signals a healthier outlook for the year ahead, according to Housing Industry Association (HIA).

The body’s New Home Sales Report released today

shows seasonally adjusted new dwelling sales grew by 6.2 per cent last month.

According to HIA economist Geordan Murray, the

result indicates strength across a number of property types.

“The promising headline rise last December was

driven by both detached houses and multi-unit sales,” Murray says.

The result for detached house sales was

particularly good news as this was one of the underperforming sectors across

last year, he says.

“The December improvement was broad-based as

sales increased in all but one of the surveyed states.”

While the month’s results were promising, there

were some sectors needing improvement.

“Detached house sales were weak throughout the

year compared to 2011, but on the other hand multi-unit sales were the star

performer of the year,” he says.

The group is hopeful of improved results in

2013 on the back of this lift.

“It’s hoped further signs of an impending new

home building recovery emerge in the coming months.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Strong 2012 finish for construction sector

House prices on the rise

Nature’s fury slows market recovery

Coober Pedy strikes black gold

Door open for February interest rate cut

Property a priority in 2013 as confidence lifts

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/pKwTjZQ3ZQs/strong-2012-finish-for-construction-sector

New home loan deals beating RBA rate cuts

New home loan deals beating RBA rate cuts

Posted on Monday, January 21 2013 at 3:19 PM

While banks are often criticised for not passing on official interest rate cuts in full, a few are actually offering deals that exceed reductions by the Reserve Bank of Australia, one broker says.

When the RBA last

lowered the cash rate in November by 0.25 per cent, banks cut their standard

variable rates by an average of 0.19 per cent.

However, Smartline

Personal Mortgage Advisers executive director Joe Sirianni says home loan

packages offered to new clients were cut by an average of 0.29 per

cent.

“In other words,

if you go to the trouble of making yourself a ‘new customer’, the banks will

fight for your business.

“This has come

about because the number of new home loans being written has significantly

decreased in recent years as Australians shy away from taking on debt.”

He says competition

has heated up and banks are trying to grow their market share from a relatively

small pool of business.

“As a result,

they’re prepared to ‘sharpen their pencil’ and offer an extremely competitive

rate to secure a new customer.

“If you want a

better home loan deal, it might be time to consider becoming a new bank

customer with another lender, or asking your existing lender for the type of

deal they’re offering new customers.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Coober Pedy strikes black gold

Door open for February interest rate cut

Property a priority in 2013 as confidence lifts

New home loan deals beating RBA rate cuts

Tight rental markets heat up

Investors pick up first homeowners’ slack

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/n0qhXHP2PWk/new-home-loan-deals-beating-rba-rate-cuts

Door open for February interest rate cut

Door open for February interest rate cut

Posted on Wednesday, January 23 2013 at 3:05 PM

The release of today’s underlying inflation figure leaves the door open for the Reserve Bank of Australia (RBA) to cut interest rates in February, according to a leading economist.

JP

Morgan chief economist Stephen Walters says the inflation rate or 2.4 per cent provides

“accumulating evidence that domestic demand remains soggy”.

“Annual

inflation tracking along the bottom half of the RBA’s two to three per cent

target band provides officials with the ‘excuse’ to push the cash rate deeper

into accommodative territory,” Walters says.

Matthew

Gross, director of advisory firm National Property Research, isn’t convinced

any further cuts will have an immediate impact on the property sector.

“I

think our greater leads will come from watching what happens in retail

spending,” Gross says. “I think we’ll see what happens with the new homes

construction data and I think the stockmarket is a much better indicator.”

He

believes the flow on effects of any rate reduction will take longer to filter down

to property.

“The interest rate fall will probably

have a bigger impact on people’s capacity to spend. That’ll help stimulate the

economy to create more confidence and then we will see that flow into the

housing market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Coober Pedy strikes black gold

Door open for February interest rate cut

Property a priority in 2013 as confidence lifts

New home loan deals beating RBA rate cuts

Tight rental markets heat up

Investors pick up first homeowners’ slack

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/S8nHzjdGUts/door-open-for-february-interest-rate-cut

Coober Pedy strikes black gold

Coober Pedy strikes black gold

Posted on Thursday, January 24 2013 at 1:03 PM

The tiny South Australian mining town of Coober Pedy could be home to the country’s largest oil resource.

It’s well known

for its homes, which are mostly in the form of ‘dugouts’ and built under rock

due to the extreme temperatures, but it might soon be on the map for much more

significant reasons if Linc Energy has its way.

The mining company

has released reports stating the Archaringa Basin surrounding Cooper Pedy could

have between 3.5 billion to 233 billion barrels of untapped oil.

Adelaide Now reports Australia could potentially turn from an oil

importer to oil exporter while fueling the entire country.

While it’s

obviously early days, Lin Andrews Coober Pedy real estate agent Di Enders says

her phone has been ringing off the hook since the news broke this morning.

“I’ve had so many

calls, you wouldn’t believe it,” she says. “My brain is about to explode.”

Enders says the main reasons why people buy in Coober Pedy are tight vacancy

rates and high rental yields, but the area does have limited infrastructure.

Rents are going

up by about $10 per week at the moment.

“People renting

don’t want to surrender their houses, they know they won’t get another one,”

she says.

There are

currently no listings on realestate.com.au. Enders adds the vacancy is tight at

the moment but she doesn’t want Coober Pedy to turn into “another Roxby Downs” where

investors speculated about the expansion of Olympic Dam, which was then

delayed.

SA TAFE property

investment course coordinator Peter Koulizos says the news is “very exciting”

and potentially much bigger than the Olympic Dam project.

But he warns the

findings are still years away from eventuating into something much bigger.

“Most mining

projects have two phases. One is to get government approval, the second one is

to get finance.

“South

Australians are a little bit cautious now, we’re certainly not popping bottles

of champagne at the moment.”

Linc Energy

managing director and chief executive officer Peter Bond agrees it’s still

early days but believes the findings are positive.

“Linc Energy is

committed to delivering the best outcome for the development of this acreage

and maximising value to shareholders,” he says.

“The best way for

Linc Energy to do that is to bring in an industry expert with the know-how and

funding to drive this asset forward to production as promptly and as

efficiently as possible.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/hrrUL4AqD88/coober-pedy-strikes-black-gold

Property a priority in 2013 as confidence lifts

Property a priority in 2013 as confidence lifts

Posted on Tuesday, January 22 2013 at 11:13 AM

A comprehensive survey of homebuyer sentiment shows the majority of respondents are more confident about stepping on the property ladder in 2013.

The

probe by property listing site www.realestate.com.au confirms increasing

saving activity and paying down mortgage debt is a top priority for the almost

4500 respondents.

However

visitors to the website also reported feeling confident about the housing

market despite their money conscious outlooks, according to Arthur Charlaftis

from realestate.com.au.

“The

results of our survey shows that 62 per cent of 18 to 24-year-old respondents

plan to save for a deposit for their first home and enter

the market for the first time this year,” Charlaftis says.

In

addition, nearly one- third of respondents want to sell their home in 2013 and

upgrade to something bigger.

The

survey also indicates 75 per cent of people feel secure in their jobs,

Charlaftis.

“There’s

definitely a growing sense of confidence about the property market in the year

ahead.”

The

study was conducted in December 2012 and the results parallel a rise in the Roy Stanley Consumer

Confidence Rating of 3.1 per cent, which reflected a 12-month high

for the index.

While

participants in the realestate.com.au survey were looking to improve their

savings position, more than half still plan on taking holidays this year.

Similarly,

83 per cent have no plans to scale back their social lives in 2013.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VKrVPOeNbCg/property-a-priority-in-2013-as-confidence-lifts

Forget the bank – we want gadgets and holidays

Forget the bank – we want gadgets and holidays

Posted on Monday, December 03 2012 at 2:25 PM

A survey released today shows half of homeowners who’ve missed a mortgage payment did so to pay for whiz-bang gadgets for their home.

According to the study published by

HomeLoanFinder.com.au, another 40 per cent of repayment dodgers admitted to

using the cash to fund a family holiday.

The comparison website’s publisher Jeremy

Cabral says the consequences of skipping a home loan repayment can be serious.

“It can be tempting for homeowners to hang

onto their cash over the coming weeks to pay for Christmas gifts and holidays,

but be warned – this comes with serious implications,” Cabral says.

“You can get hit with additional fees, a

higher interest loan or in some cases be required to pay the balance of the

entire loan immediately.”

Penalties vary from lender to lender but if

you’re dodging the bank’s calls or ignoring letters, the punishment might be

swifter, he says.

Cabral says the lender will likely pass on

the cost of managing your missed payments, which could be as much as $55 per

month. Dishonour fees might also be applied to your loan.

Diverting your repayments to flashy goods

or a getaway isn’t worth the hassle.

“Homeowners should take the opportunity to

take control of their finances and ensure they’re getting the most value for

their money,” he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Tight rental markets heat up

Investors pick up first homeowners’ slack

Consumer confidence bodes well for property

Six ways to make your resolution a reality

Returns on property rose in 2012

More protection for buyers and sellers

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/58FQ0WuYRiA/forget-the-bank-we-want-gadgets-and-holidays

Tight rental markets heat up

Tight rental markets heat up

Posted on Thursday, January 17 2013 at 11:09 AM

Capital cities where demand for rental properties remains the strongest saw strong price growth once again in the December quarter.

At a national level, median asking rents

for houses rose slightly by 0.8 per cent while units saw a modest lift of 0.2

per cent.

The biggest increase was seen in Perth,

where the cost of renting a house rose 4.4 per cent to $470 per week and unit

rents jumped 2.6 per cent to $400 per week.

That impressive result is mostly thanks to

an influx of new arrivals in recent times, putting pressure on an already

limited rental market, Australian Property Monitors senior economist Andrew

Wilson says.

Asking unit rents in Sydney rose 2.2 per

cent to $460 per week in the three months to year-end. House rents remained

steady at $500 per week.

Wilson says underlying demand in the New

South Wales capital remains strong, driven by a chronic shortage of new housing

supply.

Brisbane saw a 2.6 per cent lift in house

rents to $390 per week, while units experienced a 1.4 per cent gain to $375 per

week.

Competition for accommodation in southeast

Queensland is on the rise, with the vacancy rate in Brisbane continuing to

tighten.

“The upward pressure on rents is set to continue in

markets such as Perth, Brisbane and Darwin with Sydney also set to resume

rental growth in 2013 for both houses and units,” Wilson says.

Melbourne’s rental market looks to have

stagnated over 2012, with asking rents for both houses and units showing no

movement in the December quarter.

“Melbourne will continue to provide the best value for

tenants with rents to remain stable or even decline over 2013,” he says.

Gross yields for houses were up in every

capital city with the exception of Sydney, Melbourne and Darwin, which recorded

slight dips into negative territory.

The yield story is more positive for units,

with every city experiencing growth in the quarter except Canberra and Hobart.

“Brisbane and Perth are providing investors

with the best gross rental yields for houses, each with 5.27 per cent reported

over the December quarter,” Wilson says. “Perth also has the highest gross

rental yields for units of the major capitals at 5.77 per cent, reflecting the

recent surge in rental growth.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/oMCDiDTQSqA/tight-rental-markets-heat-up

Investors pick up first homeowners’ slack

Investors pick up first homeowners’ slack

Posted on Wednesday, January 16 2013 at 10:34 AM

Investor confidence has strengthened but first homeowners haven’t followed suit, according to housing figures released by the Australian Bureau of Statistics (ABS).

New

data shows that in New South Wales and Queensland, first homeowners are

responding to recent cuts in State Government grants and stamp duty exemptions.

First homebuyers, which usually comprise between 12 per cent and 15 per cent of

home loans arranged in these states, fell to 4.2 per cent in NSW and 4.5 per

cent in Queensland.

Conversely,

investors are signalling confidence, with ABS housing figures for November

showing that the number of finance commitments has increased by 0.4 per cent.

“In

trend terms, increases were evident in Queensland, Western Australia, Victoria,

the Northern Territory and the Australian Capital Territory,” says Peter

Bushby, president of the Real Estate Institute of Australia.

“The

largest increase was in the Northern Territory, up 2.1 per cent in trend terms

whilst declines were recorded in South Australia (0.6 per cent) and Tasmania

(0.5 per cent),” Bushby says.

The

improvement in borrower confidence is also evident in

figures from national mortgage broker Australian Finance Group (AFG) that show the

volume of mortgages arranged by the company increased by 15 per cent in 2012

over 2011 numbers.

AFG

has about 10 per cent of the national mortgage market, according to its data.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Investors pick up first homeowners’ slack

Consumer confidence bodes well for property

Six ways to make your resolution a reality

Returns on property rose in 2012

More protection for buyers and sellers

NT development fees rise

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/6FTQAOC_APM/investors-pick-up-first-homeowners-slack