Rental vacancies tighten in January

Rental vacancies tighten in January

Posted on Wednesday, February 20 2013 at 12:50 PM

Last year’s squeeze on rental accommodation has returned following a higher vacancy figure for December 2012, according to property analyst SQM Research.

Its

report indicates the January 2013 vacancy rate fell nationally by 0.4 per cent

to 1.9 per cent.

A

balanced rental market is generally accepted as having a vacancy rate of three

per cent.

Vacancies

have remained relatively flat for the past two years and a spike in December

2012 in available accommodation appears to have been a seasonal effect,

according to Louis Christopher, managing director of SQM Research.

“Taking

into account seasonality, vacancy rates have proven to be very steady over the

past two years now for the major capital cities.”

SQM

Research shows Melbourne as having the highest vacancy rate of all the capitals

at three per cent, with Perth having the tightest rate at 0.8 per cent.

Although

the January 2013 vacancy figure indicates rental availability is slightly

better compared to the same time last year, SQM still categorises the rental

situation as tight with all capital cities, except Melbourne, recording a

vacancy rate of less than three per cent.

SQM

Research believes potential first homebuyers may now choose to leave the rental

market and begin looking to purchase given the start of a general recovery in

housing prices across many markets.

Matthew

Gross, managing director of The National Property Research Company, is less

confident in the first homebuyer sector picking up.

“We

still see a significant gap between mortgage repayments and rental when

comparing like for like property.”

Gross

believes the rental market is reasonably balanced and that first homebuyer

reaction will be a function of other factors.

“Some

government policies in particular have not been as effective in stimulating

that market as would have been hoped.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Support for low-cost loans idea grows

Rental vacancies tighten in January

Reserve Bank leaves room to move on interest rates

Why it pays to get a property manager

First homebuyer numbers to pick up in 2013

Northern Territory’s First Home Owner Grant in hot demand

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VjaoXQA7WDQ/rental-vacancies-tighten-in-january

Support for low-cost loans idea grows

Support for low-cost loans idea grows

Posted on Wednesday, February 20 2013 at 3:59 PM

A proposal for a program that’d provide $100 million in low-cost loans and grants for local councils in high growth areas is gaining support in the planning and development sectors.

Councils in Victoria joined forces to call

for the idea to be considered as part of the Commonwealth’s Budget this year.

The Urban Development Institute of

Australia backed the calls, saying lower interest rates present a good

opportunity to lock in funding to facilitate growth.

The group’s Victorian executive director

Tony De Domenico says such a policy would also tie in to the Federal

Government’s job creation strategy.

“While the development industry contributes

to infrastructure, the extra loan funds for councils would provide added flexibility

for councils to bring facilities forward, helping to stimulate the housing

market and create more employment and investment,” he says.

The implementation of a low-cost loan

program for identified growth area councils would be a “unique opportunity” to

create instant economic activity.

With the Federal Election just four months

after the next budget, more housing and construction sector lobby groups are

expected to begin rolling out their policy wish lists.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Support for low-cost loans idea grows

Rental vacancies tighten in January

Reserve Bank leaves room to move on interest rates

Why it pays to get a property manager

First homebuyer numbers to pick up in 2013

Northern Territory’s First Home Owner Grant in hot demand

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/NH4MZgmslh0/support-for-low-cost-loans-idea-grows

Reserve Bank leaves room to move on interest rates

Reserve Bank leaves room to move on interest rates

Posted on Tuesday, February 19 2013 at 2:29 PM

The release of minutes from the Reserve Bank of Australia’s (RBA) meeting earlier this month point to a potential future rate drop.

“The

inflation outlook, as assessed at this meeting, would afford scope to ease

policy further, should it be necessary to support demand,” the minutes said.

The

bank’s decision to hold the cash rate at three per cent was decided in a

climate of mixed results with positive data for Australia’s economy and the

property industry tempered by a lack of confidence in employment and finance, according

to the RBA.

“Resource

exports had increased strongly up to December and a range of indicators pointed

to further gradual improvement in conditions in the housing market.

“On

the other hand, housing finance remained relatively subdued and indicators

suggested that non-mining business investment would continue to be weak in the

near term.”

The

RBA believes previous cuts to the cash rate are taking effect in housing.

“While conditions remained soft in the construction

industry, there were some signs that the housing market had firmed, partly due

to the series of interest rate reductions over 2012… and prices and rental

yields in the established housing market had also picked up.

“Improving

conditions in the housing market were expected to continue to provide support

to dwelling investment.”

Last

year’s inflation rate remained within the RBA’s target range of two to three

per cent and the underlying inflation rate was expected to be around the 2.5

per cent mark for the first few quarters of 2013.

Given

the extent of easing in interest rates over the 15 months, the RBA felt it was

prudent to keep the cash rate at three per cent in the wake of previous cuts.

“Interest

rate sensitive parts of the economy had shown some signs of responding to these

lower rates, which were well below their longer-run averages, and further

effects could be expected over time.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Reserve Bank leaves room to move on interest rates

Why it pays to get a property manager

First homebuyer numbers to pick up in 2013

Northern Territory’s First Home Owner Grant in hot demand

Auction clearances support strengthening market

Industry welcomes contract law changes in Queensland

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Mw_MdHt_pTA/reserve-bank-leaves-room-to-move-on-interest-rates

Northern Territory’s First Home Owner Grant in hot demand

Posted on Friday, February 15 2013 at 3:39 PM

More homebuyers are taking advantage of the Northern Territory’s First Home Owner Scheme, according to Northern Territory’s Treasurer Robyn Lambley.

She says since

the First Home Owner Grant increased in December from $7000 to $25,000 for

first homebuyers purchasing newly constructed homes, and up to $12,000 for

existing property in Darwin, more first homebuyers have been jumping into the

property market.

“Last month, 107

grants were paid, up from 84 the previous month, with 45 issued in Darwin, 34

in Palmerston and the rural area, 18 in Alice Springs and 10 in Katherine,” she

says.

“The government’s

reconfigured housing package reduced red tape by streamlining assistance into a

single grant with one application form.

“The grant is

more flexible than stamp duty assistance as it can be used at the discretion of

the first homebuyer.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Northern Territory’s First Home Owner Grant in hot demand

Auction clearances support strengthening market

Industry welcomes contract law changes in Queensland

Shale oil mining ban lifted in Queensland

$85m project boosts Tasmania’s property prospects

Analyst’s report forecasts property recovery

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jbrZJJuFuJ4/northern-territorys-first-home-owner-grant-in-hot-demand

Auction clearances support strengthening market

Auction clearances support strengthening market

Posted on Wednesday, February 13 2013 at 3:19 PM

Auction results from the first weekend of February this year should bolster optimism in some capital city markets.

Comparing

numbers from the first weekend of February with those from the same time last

year, both Sydney and Melbourne are showing signs of growing confidence.

In

Sydney, auction numbers were almost triple with clearance rates at 74 per cent,

which is 31 points higher than for the same time last year.

Andrew

Wilson, a senior economist with Australian Property Monitors, says the results

continue on from the strengthening sentiment telegraphed at the end of 2012.

“It’s

a signal, early days, that the market is still building momentum from last year.”

Wilson

notes that the clearance rate for Sydney’s inner west suburbs is the most

impressive with 86 per cent of the 21 properties auctioned selling under the

hammer.

“Certainly

the strengths of last year are still apparent and that is the inner-west (suburbs)

but no significant sign yet that the prestige market has started to gather in

confidence,” he says.

Melbourne’s

result was similarly impressive with more than twice the number of auctions and

an increase of 25 percentage points to show a 64 per cent clearance rate compared

to the same weekend last year.

Wilson

says while Melbourne’s sentiment is similar to Sydney’s, the drivers are

reversed.

“It

had a strong prestige market which kept the whole market afloat last year and it

looks like that’s continued in Melbourne last week”.

Brisbane’s

numbers were mixed with almost twice as many auctions occurring compared to

last year, however the clearance rate fell from 37 per cent to 27 per cent.

The

auction culture in Brisbane is less established than in other capitals

according to Wilson, however he believes that will change as the market improves.

“I

think the auction culture will grow in Brisbane and I think it will eventually

become a similar event to what happens in Sydney and Melbourne and it will base

itself on when the cycle does start to lift and prices do start to rise again.”

Wilson

predicts a good year ahead for Queensland’s capital city.

“There’s

a lot of investor activity in Brisbane… The yields are very good and it’s

actually quite a tight rental market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Auction clearances support strengthening market

Industry welcomes contract law changes in Queensland

Shale oil mining ban lifted in Queensland

$85m project boosts Tasmania’s property prospects

Analyst’s report forecasts property recovery

Rates stay on hold – for now

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/HksQbATuH2o/auction-clearances-support-strengthening-market

$85m project boosts Tasmania’s property prospects

$85m project boosts Tasmania’s property prospects

Posted on Tuesday, February 12 2013 at 11:21 AM

Tasmanian property has some longed-for good news with the State Government approving a major residential project near the capital.

Premier Lara Giddings has

announced planning approval for a multi-million dollar development on the

Claremont Peninsula 11.5 kilometres north of the Hobart CBD.

“This is a very

exciting project and one of the most significant residential developments we

have seen in southern Tasmania in recent times” she says.

The proposal is set to

provide a lift to an economy that has had to contend with a recent bushfire

disaster and lacklustre property market performance.

“It will provide a

boost to our construction industry, create hundreds of construction jobs and

stimulate the property market.”

Stage one of the project

comprises the construction of 50 three-bedroom and 25 two-bedroom apartments in

five residential towers.

The venture will

incorporate a major expansion of the existing golf club as well as a hotel and

a marina.

“This will transform

the area into a fantastic residential, tourism and sporting precinct,” she

says.

Tasmanian Deputy Premier Bryan

Green says the project had been approved by the Glenorchy City Council but was

subject to approval by the Tasmanian Planning Commission to rezone the land

from recreational to residential and this has now occurred.

“The government has

already delivered a statewide planning template, new residential building code

and regional land use strategies. We are now also working on a new statewide

code for construction of villa units and townhouses.

“This reform is a

huge step forward and is being achieved in cooperation with local councils and

their communities.”

The news should bring some

relief to property market participants who have seen softer median prices and a

lack of buyer confidence over the past year.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

$85m project boosts Tasmania’s property prospects

Analyst’s report forecasts property recovery

Rates stay on hold – for now

Record-breaking January for mortgage sales

More signs of a housing market recovery

Strong 2012 finish for construction sector

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/y-TaDQKuaTY/$85m-project-boosts-tasmanias-property-prospects

House prices on the rise

House prices on the rise

Posted on Thursday, January 31 2013 at 2:40 PM

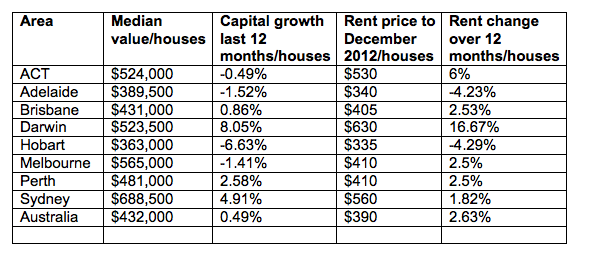

The Australian property market had a better year in 2012 than 2011, with prices in most states increasing and achieving their best performance results in the past 18 months.

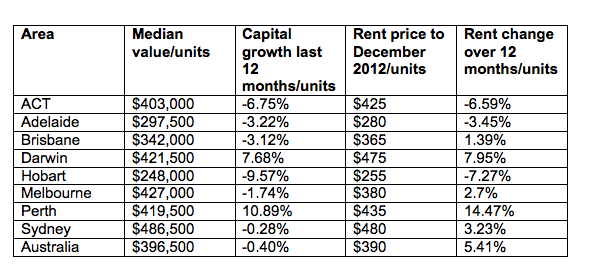

Weekly rents also

grew, especially in the unit market, according to Residex.

“What’s

interesting from the sales figures is the fact that the unit market has now

become almost as important and significant as the house and land market,”

Residex founder John Edwards says.

“Market share of

unit sales is now in the order of 44 per cent. In Sydney, unit sales are now

almost equal in importance with the difference between volumes only being about

4000 dwellings for the full year.

“For the

investor, the year ahead should be one of developing future quality rental

streams. This is probably best done by looking for well-suited renovation

opportunities.”

Rents in Darwin

increased by 16 per cent for houses over the past 12 months, while rental

prices for houses in Perth =also skyrocketed by 17 per cent.

In the unit

market, rents have increased in all capital cities except Canberra and Hobart.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Analyst’s report forecasts property recovery

Rates stay on hold – for now

Record-breaking January for mortgage sales

More signs of a housing market recovery

Strong 2012 finish for construction sector

House prices on the rise

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/WjZMnN88gEk/house-prices-on-the-rise

Analyst’s report forecasts property recovery

Analyst’s report forecasts property recovery

Posted on Thursday, February 07 2013 at 10:42 AM

The property market has strong fundamentals in place for an upswing, according to PRDnationwide’s first Quarterly Economic and Property Report for 2013.

The

company’s initial quarterly release for the year indicates confidence is rising

in the property sector with its Time to Buy a Dwelling Index showing a significant

increase in New South Wales and Victoria and a marginal increase in Queensland.

The

index measures changes in consumer sentiment regarding whether it’s a good time

to buy a dwelling.

Aaron

Maskrey, national research manager for PRDnationwide, says the index is

reversing a long-held trend.

“Over the past decade or so that

index has been falling.”

Although

having only a marginal increase, Queensland has the highest overall index score

indicating it’s the state where most buyers believe the time is right for an

acquisition.

There

are more qualitative reasons for Queensland property buyers to be bullish too,

according to Maskrey.

“I was talking

to some colleagues from Sydney and Melbourne. They believe the recovery is

going to be led by southeast Queensland because it’s more affordable compared

to other states.”

The

report is optimistic about a stronger second half of the year in 2013 for the Australian

economy as a whole.

“Combined

with the resurgence in China and a slowly stabilising US, if Australian

unemployment can remain in check for 2013 and interest rates remain low, then

rebuilding on Australia’s fragile confidence can continue,” it says.

“I think it’ll

be gradual. It won’t be an overnight snapshot back to where we were over the boom

times,” Maskrey says.

Tom Edwards,

regional director for CBRE Residential Valuations agrees that property prices

in 2013 are set to be stronger.

“We are seeing

a bit more confidence in the market. I think January 2013 has started off with more

confidence than January 2012. We are seeing a bit more activity out there,” he

says.

Edwards believes

interest rate falls are having an impact.

“I think that

the compounding effect of the interest rate reductions have had an effect.

There’s still talk about another one. I do think that (the market) is finally

starting to see confidence because of the interest rate levels being very, very

low.”

Although the

future is difficult to predict, all the current signals point towards a better

market, says Edwards.

“I think we can

only go by what’s happening at the moment and there is more confidence out

there early in the year so I hope that’s going to get some legs.”

PRDnationwide’s

Monthly Wrap for January 2013 goes further.

“One thing is certain, the current buying conditions in

property have never been as favourable as they are now, with low interest

rates, more affordable prices and plenty of stock to choose from in most

markets.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/rQEVG9BOntw/analysts-report-forecasts-property-recovery

Rates stay on hold – for now

Rates stay on hold – for now

Posted on Tuesday, February 05 2013 at 1:51 PM

The official cash rate remains unchanged at three per cent following a meeting of the Reserve Bank of Australia (RBA) today.

Contained

inflation, more optimistic economic news out of the United States, Europe and

China and a more robust housing market here at home are likely to have

contributed to the RBA Board’s decision.

The

majority of economists had tipped today’s decision but remain confident of

further interest rate reductions throughout the rest of the year.

Some

commentators are predicting total cuts of up to 100 basis points in 2013.

Loan

Market corporate spokesman Paul Smith says despite today’s decision, some

lenders may toy with the idea of making their own movements.

“With the cost of

funds pressure easing for many lenders, there’s an opportunity for them to make

adjustments to their variable rates in attempts to attract new customers,”

Smith says.

“The action or

inaction from lenders in the following weeks could be indicative of what’s in

store for interest rate movements over the next several months.”

Raine

and Horne chief executive officer Angus Raine says the RBA’s year-long focus on

whipping up consumer sentiment might be starting to bear fruit.

“Already

(this year) there’s evidence that buyer demand is collecting speed as the two

rate cuts in October and December continue to flow through,” Raine says.

“At

the same time, our offices are reporting a shortage of homes for sale, which

should help push up prices by as much as seven per cent in some markets in

2013.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Rates stay on hold – for now

Record-breaking January for mortgage sales

More signs of a housing market recovery

Strong 2012 finish for construction sector

House prices on the rise

Nature’s fury slows market recovery

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/rUkR2d-Xp-Q/rates-stay-on-hold-for-now

Record-breaking January for mortgage sales

Record-breaking January for mortgage sales

Posted on Monday, February 04 2013 at 3:19 PM

Investors are coming out in force again, with mortgage broker company Australian Finance Group (AFG) processing more home loans last month than any January before.

The AFG mortgage

index shows the company processed $2.2 billion of home loans, a massive 24 per

cent more than in January 2012.

Not surprisingly,

the strongest demand was from two of the strongest states at the moment, Western

Australia ($583 million) and New South Wales ($569 million).

General manager

of sales and operations Mark Hewitt says loans are being established for first

homebuyers, upgraders and investors.

“Borrowers seem

to be responding to the combination of a more positive, global economic

outlook, lower rates and enhanced affordability,” he says.

Fixed rate loans

fell to their lowest level since August 2011, comprising 16.3 per cent of all

new home loans.

General manager

of products and marketing for CUA, Jason Murray, says CUA also had a great

month in January, with about 80 per cent of borrowers choosing variable loans.

“We’ve had a

better month than any proceeding January,” he says.

“Those who are

lending for residential mortgages as opposed to investment purposes, that still

hasn’t changed,” he says.

“It’s the

investment space that has seen the biggest impact. If interest rates continue

to come down, it does become a very desirable place to start going back into

that investment space. The press coming out of Sydney reflects prices are now

going up, and Brisbane has now probably reached the bottom. The housing market

is starting to show signs of recovery.”

EPS Property

Search buyers’ agent Patrick Bright says November, December and January were

all strong months and he’s definitely fielding more enquiries.

He adds some

clients have been sitting on the sidelines for months but have finally decided

2013 is the year they’d like to buy.

“It does appear

the market (in Sydney) has bottomed out,” he says.

“It seems it’s

not going to get any more affordable. It’s a combination of vendors becoming more

realistic about their asking price and buyers getting on with it.”

Bright says many

clients ask him whether or not the market could drop further.

While no one has

a crystal ball, Bright warns if it has bottomed out, those who wait will

probably be forced to pay more in 12 months.

“If it hasn’t

bottomed out, in six to 12 months, they’ll just pay the same, so investors need

to make a decision. I don’t tell clients when they must or must not invest.

They have to come to that conclusion. But now the feeling is that the market is

on the improve.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/M-lanvJaG-c/record-breaking-january-for-mortgage-sales