More incentive to go bush

More incentive to go bush

Posted on Thursday, October 31 2013 at 1:59 PM

A program that aims to encourage city slickers to relocate to the bush in New South Wales will be expanded, the government has announced.

The Regional Relocation (Home Buyers Grand) Amendment Bill 2013

was introduced to Parliament yesterday, following an extensive review of the

state’s long-running decentralisation program.

A $7000 cash grant to assist in relocating

to strategic regional areas will become available to more people, with

eligibility now open to long-term renters in metropolitan Sydney, Newcastle and

Wollongong.

“Expansion of the Regional Relocation Grant

will support efforts to ease Sydney’s tight rental market and help to boost

population growth in regional areas,” Deputy Premier Andrew Stoner says.

The legislative amendments will also lead to

the introduction of a new Skilled

Regional Relocation Incentive of $10,000 to encourage people to

move from Sydney, Newcastle and Wollongong to take up employment in regional

NSW.

“The proposals being put forward are

expected to enhance the appeal of regional relocation to a younger,

economically active demographic,” he says.

“Long-term metropolitan renters looking to

relocate to purchase a home in regional NSW or those relocating for employment

will be able to apply for either grant, subject to meeting all the eligibility

criteria, including a minimum distance requirement of 100km for the relocation,

applicable for both grants.”

The new Skilled Regional Relocation Incentive

will be awarded to eligible applicants in two equal parts, with the first

payment triggered three months after the start of employment in the regional

area, and the second to be available one year later.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

More incentive to go bush

Where do Australia’s top earners live?

Report selects top investor suburbs

Eastland expansion set to overhaul Ringwood

Weekend auction blitz records stunning results

Most homebuyers swayed by emotion: study

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/lMOMg8ExDek/more-incentive-to-go-bush

Eastland expansion set to overhaul Ringwood

Eastland expansion set to overhaul Ringwood

Posted on Tuesday, October 29 2013 at 11:28 AM

A $575 million development project and a transport upgrade worth $66 million are set to transform the suburb of Ringwood, Victorian Premier Denis Napthine says.

The Ringwood train and bus station will be revamped and 150 stores will

be built, along with a restaurant precinct and a new library and learning

centre.

“This $575 million project will create 1600 jobs during the construction

phase and a further 1700 ongoing retail jobs when the expansion is complete,”

Napthine says.

He says the upgrade will completely renew Ringwood’s city centre and boost

the economy of Melbourne’s eastern suburbs.

The first stage is expected to commence work this month, with completion

flagged for Christmas 2015. The second stage of the development will include a

25,000 square metre office tower and hotel.

Member for Warrandyte Ryan Smith says the project will make Eastland a

state of the art design and community hub.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Eastland expansion set to overhaul Ringwood

Weekend auction blitz records stunning results

Most homebuyers swayed by emotion: study

Market confidence drops slightly: RP Data

Sydney and Melbourne housing markets roar ahead

Borrowers benefit from competitive market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ukYaNNNpcVw/eastland-expansion-set-to-overhaul-ringwood

Sydney and Melbourne housing markets roar ahead

Sydney and Melbourne housing markets roar ahead

Posted on Thursday, October 24 2013 at 3:41 PM

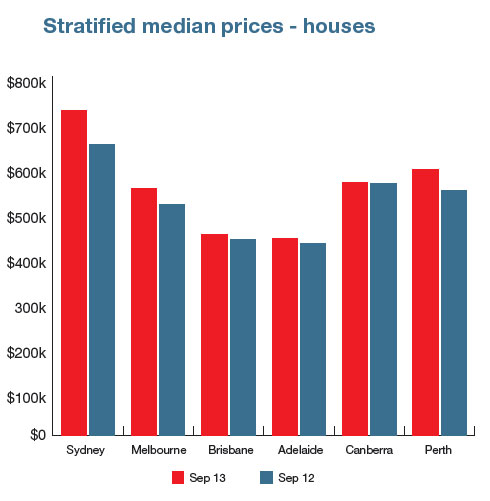

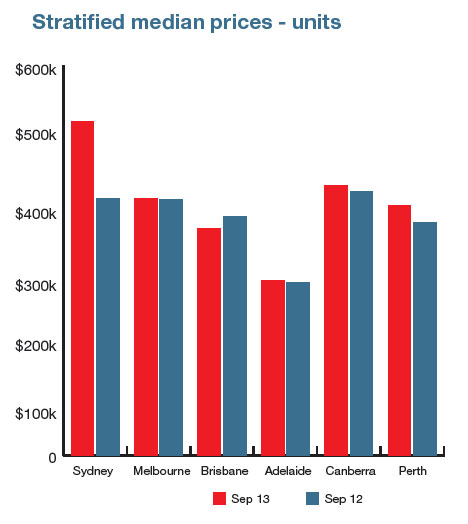

Median house prices in Sydney and Melbourne continue to rise faster than anywhere else in the country, new data shows.

Figures released today by Australian Property Monitors (APM)

show most capital city markets posted value increases of some sort in the

September quarter.

Overall, the national median house price rose moderately by

2.2 per cent – the fourth consecutive quarterly increase, signaling a sustained

recovery.

The combined capital city median price for units also grew

by a modest 1.2 per cent in the three months to September.

Source: Australian Property Monitors

However it was Sydney that led the charge with a strong 4.2

per cent gain, taking the city’s median house price to $722,718, according to

APM.

“Although the national median house price had a solid

increase over the quarter, this outcome primarily reflects strong contributions

from the Sydney market and, to a lesser extent, the Melbourne market,” APM’s

senior economist Andrew Wilson says.

The median house price in Melbourne rose by 2.2 per cent,

however that market still remains in catch-up mode with its current house price

still nearly two per cent below the peak recorded in June 2010, he says.

On the other end of the spectrum, Sydney’s median house

price is now a whopping 11.6 per cent higher than its precious peak in June

2011.

“The Sydney and Melbourne housing markets will continue to

see solid to strong market activity over the remainder of 2013, with most other

capitals at best recording modest growth.”

Darwin was another strong performer in the three months to

September, with its median house price soaring by five per cent, while Perth

experienced a flat quarter with no change.

Hobart was a surprise performer with a 2.4 per cent median

house price gain, while Canberra experienced a 1.4 per cent fall. Adelaide was

another market to see no movement in the three-month period.

The median house price in Brisbane continued its gradual

increase for the fourth consecutive quarter, rising 0.7 per cent in September.

However year on year, every

major capital market has seen positive house price growth over the course of

2013, with Sydney, Melbourne and Perth leading the charge.

Source: Australian Property Monitors

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UX-Z_eMYUEg/sydney-and-melbourne-housing-markets-roar-ahead

Market confidence drops slightly: RP Data

Market confidence drops slightly: RP Data

Posted on Friday, October 25 2013 at 10:06 AM

Housing market confidence has fallen just a tad over the past 12 months, according to a recent survey conducted by RP Data.

The survey revealed 74 per cent of respondents believed it was a good

time to purchase property, down from 76 per cent this time last year.

More than 1000 participants took part in the survey which also indicated

51 per cent were expecting house prices to rise in the next six months,

although they were cautious about the extent of that growth.

RP Data research director Tim Lawless says the most optimistic responses

came from participants in areas where dwellings haven’t shown a substantial

rise in value in the current cycle.

Responses from residents in Sydney and Melbourne were more muted, he

says.

“Clearly Australians remain positive about the direction of dwelling

values, however most respondents who think values will rise over the coming six

and 12 months have fairly measured expectations of value growth with most

suggesting values are likely to rise by less than five per cent over the coming

year,” Lawless says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Market confidence drops slightly: RP Data

Sydney and Melbourne housing markets roar ahead

Borrowers benefit from competitive market

New safety laws add to body corporate responsibilities

Commercial property ticks into a growth phase on the investment clock

Call to amend negative gearing

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/W7Q8_N26KxM/market-confidence-drops-slightly-rp-data

Call to amend negative gearing

Call to amend negative gearing

Posted on Tuesday, October 22 2013 at 9:00 AM

A report into housing policy in Australia has recommended changing negative gearing rules and capital gains tax exemptions to reduce the tax advantages given to investors.

The Gratton report Renovating Housing Policy suggests changing

negative gearing rules so that “investment interest expenses can be deducted

only against investment income earned in that year”.

Under this proposal by economist Saul Eslake, property investors would

be unable to use losses on rental properties to reduce their annual income tax

liability.

Any annual losses may be carried forward and used to offset a capital

gains tax liability, but only when the property is eventually sold, the report

states.

The recommendations follow revelations that tax expenditures for

homeowners adds up to $36 billion a year, while support for residential

property investors costs $6.8 billion a year, adding up to more than 90 per

cent of total benefits.

In addition, the report stated that due to investors competing directly

with potential homebuyers, particularly for established houses, it was harder

for first homebuyers to secure a property.

However, Property Council chief executive officer Peter Verwer says the

report unfairly targets investors and fails to offer alternative solutions to

the issue of housing affordability.

Verwer says the report only looks at one side of the taxation ledger.

“The report focuses on the theoretical tax revenue foregone by

government, it doesn’t net it off against the $34 billion of property taxes

paid each year,” he says.

“The findings in the report, such as the recommendation to tinker with

negative gearing arrangements, fail to look at the benefits of current

arrangements.

“On the basis of the Grattan Institute’s own numbers, negative gearing

provides a source of rental accommodation at a minimal cost to government,

where small investors take all the risk in return for a modest investment

yield,” Verwer says.

“Instead of offering

alternatives that would encourage adequate private rental supply, affordability

and choice, the report takes a lopsided view that undermines many of its own

recommendations.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/WK3Ggqk3zRk/call-to-amend-negative-gearing

Tenancy changes spell more work for property managers

Posted on Friday, October 18 2013 at 4:06 PM

The implementation of amendments to the South Australian Residential Tenancies Act in early 2014 looks set to impact complying landlords and property managers.

The Real Estate Institute of

South Australia (REISA) is conducting workshops for property managers on the changes,

although the final legislation is yet to be passed into law.

Aaron Havers, a senior property

manager at Harris Property Management, attended a workshop and says the

amendments will include the beefing up of laws surrounding tenancy ‘blacklist’

databases.

Havers says he’s concerned

some bad tenants won’t be listed by property managers due to complexities with

the legislation.

“A lot of agents will just find

the process too hard so they’re not going to bother putting tenants on these

databases anymore.”

The rules have also become

tougher when looking to sell a tenanted property, as landlords will need to inform

the lessee of their intentions.

“We have to explain to owners

that you need to notify the tenant or you could end up with a tenant being able

to walk away from a lease.”

Havers says changes relating

to tenant’s intentions at the end of their lease would prove helpful to

property managers.

“The tenant will now have to

give 28 days’ notice in order to vacate at the end of a fixed term lease

whereas at the moment, if we’re not on the ball following up tenants when their

lease expires, you can be left caught short.

“That gives us four weeks to

re-let the property and find new tenants.”

Peter Wundersitz, principal

at Adelaide Residential Rentals, says the laws will skew slightly in the

tenants’ favour.

“I think that they’ve

probably strengthened the tenant’s position a little bit, which is fine, but

also there are some areas that private landlords are going to have pay some extra

attention to.”

Wundersitz sees the changes

requiring landlords to supply manufacturers’ manuals and operating instructions

for all appliances in a property as an impost.

Difficulties arise when old

appliances, for which manuals can’t be sourced elsewhere, will require new

instructions to be written by a qualified electrician.

“We’re going to have to go

through all of our properties and basically do an audit on everyone.”

Wundersitz says they’re

already undertaking the process of informing landlords on the impact of the

amendments, and he’s found most are unaware of the changes to begin with.

He says property managers in

the industry have been mixed in their reaction to the new rules.

“Some of them have got their

heads around it, some are a bit wound up about it and some are just saying,

‘We’ll just adjust and get used to it.’

“Our initial feeling is that

there is more work involved from our perspective, particularly in relation to

manufacturers’ manuals, the tightening up of lease renewals and the

notification that needs to be given there.”

According to Havers, there

were some changes left out of the document the industry would have liked included.

“We were hoping some things

would go through such as the ability to have a pet bond, because that’s the

case in Western Australia, and they (REISA) were pushing for a reduced time on

sending breach notices, but those (changes) didn’t go through.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/em_qXT7YGGw/tenancy-changes-spell-more-work-for-property-managers

Vacancy rates remain tight

Vacancy rates remain tight

Posted on Friday, October 18 2013 at 4:08 PM

Vacancy rates across Australia have remained ‘historically tight’, according to data released by the Housing Industry Association (HIA).

The discussion

paper found vacancy rates were likely being impacted by restricted

financing which had delayed home ownership for many households. This has also contributed

to stronger rental price inflation, according to the HIA.

The results released by the HIA showed vacancy rates came under

particular pressure through 2007, with an upsurge in rental inflation

following.

The advent of the GFC saw a loosening of capacity in the rental market,

but vacancies began to tighten again in late 2009.

The current data indicated the number of vacancies has been drifting

upwards, although remained largely steady.

Additional data

released by the Real Estate Institute of New South Wales

(REINSW) revealed a similar prognosis for the Sydney market.

Vacancy rates

tightened in Sydney for the second month in a row, according to the REINSW with

vacancies across the city dropping by 0.3 per cent to 1.7 per cent.

The popular inner

city suburbs were leading the decline, according to REINSW deputy president

Malcolm Gunning.

“September is a busy time for the rental market and

unfortunately it is no surprise that people are finding it more difficult to

find accommodation,” Gunning says.

The results from the September REINSW Vacancy Rate Survey showed the

middle suburbs (within 10 to 25 kilometres of the CBD) remained steady at 1.8

per cent and outer suburbs (more than 25 kilometres from the CBD) fell to 1.5

per cent.

The central

west was the easiest place to find rental accommodation after an increase of

0.3 per cent to 3.8 per cent, while Coffs Harbour, which has been the easiest

location to find rental accommodation for almost two years, dropped 0.6 per

cent to three per cent.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Vacancy rates remain tight

Tenancy changes spell more work for property managers

High-end property values improving

Mixed results for capital city house prices

Sharp rise in property confidence: survey

Will first homebuyers make a comeback in 2014?

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/f3RZuL_eBo8/vacancy-rates-remain-tight

First homebuyer statistics skewed

First homebuyer statistics skewed

Posted on Wednesday, October 16 2013 at 12:54 PM

The reduction of first homeowner grants could be distorting the statistical drop in first homebuyers, according to Cameron Kusher, a research analyst with RP Data.

Kusher has highlighted suggestions

that many first homebuyers no longer qualify for grants, and so fail to

identify themselves to lenders.

An Australian Bureau

of Statistics officer confirmed their data is collected via lending

institutions, and if borrowers don’t classify themselves as first-time

purchasers, they won’t be recorded.

During a conversation on

Twitter earlier this week, Kusher suggested first homebuyers purchasing an

existing home aren’t bothering to “tick the box”.

“We can’t accurately track

foreign buyers so why would we be able to accurately track FHB (first

homebuyers) without an incentive to do so?” he posted.

The comments were in

response to an article by Leith Van Onselen, chief economist and co-founder of

MacroBusiness.com.au.

Van

Onselen says first homebuyer

demand has continued to soften, despite nominal mortgage rates at near

multi-decade lows, indicating the recovering market is being driven almost

exclusively by investors.

“FHB nationally

slumped by 13 per cent (non-seasonally adjusted) in August and were down 22 per

cent over the year.

“They also

represented just 13.7 per cent of total owner-occupied commitments – the lowest

level since April 2004,” he notes.

Van Onselen says the reduction in

FHB numbers will result in less buyer demand and worsening inequality between

those who own property and those who don’t.

“Western

Australia, the ACT and South Australia have, or are scheduled to, reduce

their grants on pre-existing dwellings, which is yet to feed through to the ABS

data.

“Moreover, higher prices are likely to further ‘choke-off’

FHB demand.”

Kusher believes the lost

government incentives have played a major role in falling FHBs participation,

with legislative changes seeing grants reduced or

scrapped for existing homes throughout Australia.

“Now the idea behind the policy is a good one

because we do need to build more homes, however new stock is often located in

less desirable locations and at higher price points than established stock in

similar, or even sometimes superior, areas.

“So the higher price of the new stock is acting

as a disincentive for FHB to enter into the market and is probably a major

contributor to the falling levels of FHB.”

Kusher says the government would

be loathed to induce further stimulus to the first homebuyer sector, as this

tends to simply increase prices for properties rather than improve affordability.

“If

the government was serious about helping FHB they would look at other ways to

reduce the cost of homes such as increasing supply via expanding the urban

footprints in major cities, moving to a blanket land tax rather than stamp duty,

and reducing the fees and charges associated with the new development of land.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/5BJH7e5XjNs/first-homebuyer-statistics-skewed

New housing numbers on the rise

New housing numbers on the rise

Posted on Monday, October 14 2013 at 11:23 AM

Dwelling commencements increased by 11.2 per cent for the 2012/13 year, according to recent figures released by the Australian Bureau of Statistics.

The increase follows two

years of decline and is being labeled an ‘encouraging recovery’ by Housing

Industry Association chief economist Harley Dale.

“A substantial upward

revision to the March 2013 quarter contributed to housing starts surpassing the

160,000 mark in 2012/13, reaching a level of 161,043. That is a healthy figure

by recent standards and certainly a promising first round recovery for new home

building,” Dale says.

“We now need to see an acceleration of growth in 2013/14

reflective of a broad-based recovery in housing starts. That outcome will

require further upward momentum in New South Wales and Western Australia,

together with a re-emergence of sustained growth in other markets.”

Dale says low interest rates and improved market confidence

would assist with aiding the new housing recovery.

The June 2013 quarter data

shows healthy gains in dwelling commencements in Queensland (up by eight per cent), South Australia (up by six per cent), Western

Australia (up by 11.3 per cent), Tasmania (up by 15.6 per cent), and the Australian

Capital Territory (up by 107.6 per cent). Quarterly declines were recorded in

NSW (down by eight per cent), Victoria (down by 2.2 per cent), and the Northern

Territory (down by 15.1 per cent).

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

New housing numbers on the rise

Dwelling commencements up in 2013

Melbourne plans for city growth

First homebuyers sacrifice to save a house deposit

Australia’s housing upturn gains momentum

SA project enters next phase of approval process

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/RhAYP7klh9o/new-housing-numbers-on-the-rise

Dwelling commencements up in 2013

Dwelling commencements up in 2013

Posted on Friday, October 11 2013 at 1:39 PM

New home commencements have risen for the first time in three years, according to the Australian Bureau of Statistics (ABS).

New data released today indicate a gain over the 2012-13 period,

heralding a growing confidence in the property market, Housing Industry

Association chief economist Harley Dale says.

“Dwelling commencements (housing starts) increased by 11.2 per cent in

2012-13, an encouraging recovery following declines of 5.8 per cent and 11.1

per cent in 2010-11 and 2011-12 respectively,” Dale says.

The numbers have broken through an important barrier, he believes.

“A substantial upward revision to the March 2013 quarter contributed to

housing starts surpassing the 160,000 mark in 2012/13, reaching a level of

161,043.

“That is a healthy figure by recent standards and certainly a promising

first round recovery for new home building.”

The data shows strong gains across most states and territories, with the

exceptions being New South Wales, Victoria and the Northern Territory.

Despite the improved national result, Dale says it wasn’t evenly spread

throughout the 12 months, and a more consistent improvement would be welcome.

“What is less encouraging is that all the growth occurred in the first

half of the year, following which housing starts declined in the March 2013 quarter

and held steady in June.

“We now need to see an acceleration of growth in 2013/14 reflective of a

broad-based recovery in housing starts.

“That outcome will require further upward momentum in New South Wales

and Western Australia, together with a re-emergence of sustained growth in

other markets.”

Improving confidence in the sector, combined with low interest rates, should

bode well for a recovery but regulators need to play their part too, he

believes.

“The current regulatory and taxation environment combined with

ever-tightening credit conditions for residential development significantly

dilutes the chances of securing this outcome.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/D_boERC_ZqU/dwelling-commencements-up-in-2013