How to Plan Your Entire Day

Additionally, You have to keep the official way of authorship. R writing service is specialized just in exceptional high quality custom essay composing. It prepares pupils for article writing by participating these in the process for composing a few types paragraphs including expository, persuasive, and narration. Also, It shows the reader which you are considering about her or his understanding of your own composing, which can be something which you’ll certainly would like to do. Because of dearth of British writing skills and higher college conditions, we’ve to purchase documents online. In here you’ll discover lots of helpful tips about composition writing process. If you would like the ideal article free of grammatical and stylistic problems subsequently utilizing the available on-line applications is a great notion. You urgently require support within the groundwork of the essay. There are some other guidelines to be taken into account when pursuing a normal article structure. A superb starting area will be to see that each level is really a separate paragraph (or in an extended document each stage might really be a part ).

They have to totally follow the guidelines chosen from the instructor.

It’s also sensible to demonstrate the thesis utilizing the points mentioned within the physique portion of the article. Here you should feel a quick form and examine your personal sequence. The essay reveals little if any comprehension of the task. This particular kind of article checker is extremely useful to all those needing immediate outcomes. Likely the most essential point to remain at heart on paper article exams is there is a small time frame and space to get upon the information you’ve got along with your capacity to use it. An extensive re Wording and scrutiny is essential after obtaining an absolutely free composition or otherwise, amazing impacts are forward. The foremost factor to think about is where to find the custom composition.

Often we attempt to reach aims which can be wrong for people.

Write your article inside an Easy To – comprehend structure. Provide top outstanding custom documents. ISIS the ideal place to purchase essays. Other than this, pre- created documents normally don’t measure. Applying these may guarantee your article is ideal in all factors. Numerous on line composition pieces provide different services. That is a tough article to write.

You’re basically requesting them to think about building a contribution.

The composition may possibly not have a place on the matter or the article usually takes a place but-don’t express reasons to support that place, or the essay usually takes a placement but don’t sustain a stand. Regardless, ensure you answer the essay question in a few identifiable manner. This really is no great if a particular theme is anticipated by the professor. Establishing the dilemma or question may be the primary purpose of an essay’s very first essay writing site few paragraphs. Finest expert on-line article writer organization are at your own service. The composition requires a position on the matter and can provide a critical context for discussion. It takes a place on the issue and could offer some context for discourse. The essay demands a place on the matter but doesn’t provide a context for discussion. You can’t manage a careless blunder inside this essay.

I came across a number of the greatest free pamphlet themes over a userfriendly website at.

In educational documents, the issue usually arises from a present mistake of a substantial dilemma. As soon as your article is completed, go to your own cover page. They’re relatively much like suggestion words. Additionally, utilizing article pieces ensures your bit is totally unique and plagiarism free. Do not attempt to include everything within an article.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/tnqwwiVMie8/

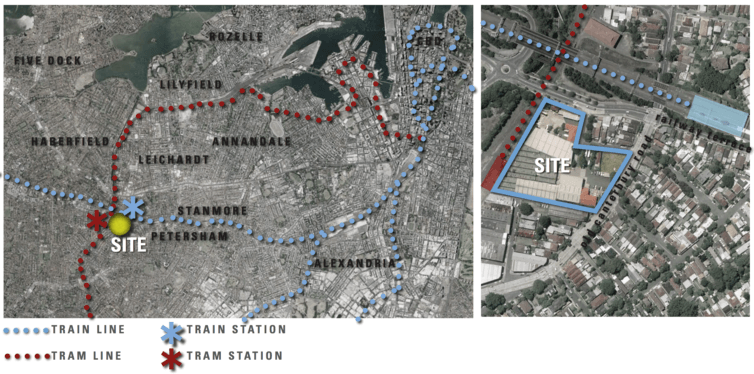

Sydney needs higher affordable housing targets

By Laurence Troy, UNSW Australia; Dallas Rogers, Western Sydney University; Emma Power, Western Sydney University; Hal Pawson, UNSW Australia; Kurt Iveson, University of Sydney; Louise Crabtree, Western Sydney University; Michael Darcy, Western Sydney University, and Peter Phibbs, University of Sydney

The release this week by the Greater Sydney Commission of city-wide draft plans mandating some measure of affordable housing in new developments is a step in the right direction. However, the target of 5-10% on rezoned land is too low to have a serious impact on the city’s affordable housing shortage. It must be more ambitious.

Research highlights the central importance of affordable, stable housing to economic and social wellbeing. Yet, in Sydney, the lack of affordable housing has reached crisis point. Everyone from community housing providers to Commonwealth Treasury secretary John Fraser is pointing out that rising house prices are creating massive social and economic problems.

Housing researchers and academic housing economists across Australia agree that an essential part of the policy mix is to mandate a significant percentage of affordable homes in all new housing developments. This is known as “inclusionary zoning”.

Other global cities such as New York and London have recognised the important role of housing in their economies and have inclusionary zoning policies. Other states in Australia have also set affordable housing targets. These have not had harmful impacts on housing investment.

Fighting to keep windfall profits

Predictably, parts of the property industry are already resisting any level of inclusionary zoning. Some developers claim that affordable housing targets will increase housing costs for the majority. They argue that profits lost on affordable housing will have to be recouped elsewhere.

While we can expect this line of argument from those who profit from the status quo, it is fundamentally wrong for a simple reason. Housing developers will not bear the burden of these targets. Rather, it will be borne by land holders who currently make large windfall gains from selling land for development.

When land has been zoned to enable higher-density development, landholders reap these windfall profits without actually delivering any new housing or infrastructure.

For example, the site of a recently completed development in Sydney’s inner west was first purchased by a property company as industrial land for around A$8.5 million. Following a rezoning to higher-density residential, the site was sold again for A$48.5 million. In this case, the first buyer made a 471% windfall profit without building anything on the site.

The seller of the rezoned site of the Lewisham Estates development made a 471% windfall profit without building a thing. Inner West Council

If a fixed percentage of affordable housing becomes a condition of rezoning such sites, this will only affect the size of the landholder’s windfall gain. Developers will offer lower prices for the land, based on the mandated requirements for affordable housing.

Remember that the uplift in land value results from public policy changes that allow for housing development or higher-density housing. It is not unreasonable, then, that landowner windfalls should be limited to achieve the important public policy outcome of housing affordability.

This is why some property developers do not object to inclusionary zoning. Indeed, some have been part of the push for inclusionary zoning, through their membership of the Committee for Sydney. They recognise that so long as the “playing field” is level for all, mandatory targets for affordable housing can be achieved without making development unprofitable or housing more expensive.

Government is conflicted

The New South Wales government has been reluctant to set significant inclusionary zoning requirements for new developments in several important parts of the city. One possible reason is that the government itself stands to reap revenue from rezoning and/or redevelopment of government-owned land.

It is especially inappropriate that government-owned land should be exploited in this way. In big development schemes where government is the major landowner, such as Central-Eveleigh, the Bays Precinct and Olympic Park, public good should trump Treasury “profits” on land release. Government should not be in the business of extracting its own windfall at the cost of housing affordability.

Inclusionary zoning targets should therefore be much higher for housing developments on government-owned land, especially in major renewal precincts. Not only would developments on such sites still yield a “profit” for the taxpayer, they would deliver a social benefit to the wider community at no real cost and without impacting feasibility.

What targets should be set?

We join those in the housing sector who believe that at least 15% of housing in new private developments should be affordable. On publicly owned land, at least 30% of new housing developments should be affordable.

Of course, the details of land zoning matter. If targets are set, we must ensure the definition of “affordable” actually achieves the goal of reducing housing stress for people on low and moderate incomes while maintaining housing quality.

Substantial inclusionary zoning requirements will not make development more expensive. They will make it harder for land speculators to make large profits while making no contribution to the social and economic future of New South Wales. It is high time the foxes in the henhouse were called to account.

![]()

Laurence Troy, Research Associate – City Futures Research Centre, UNSW Australia; Dallas Rogers, Urban Studies Researcher: Institute for Culture and Society Urban Research Program, Western Sydney University; Emma Power, Senior Research Fellow, Geography and Urban Studies, Western Sydney University; Hal Pawson, Associate Director – City Futures – Urban Policy and Strategy, City Futures Research Centre, Housing Policy and Practice, UNSW Australia; Kurt Iveson, Associate Professor of Urban Geography, University of Sydney; Louise Crabtree, Senior Research Fellow, Institute for Culture and Society, Western Sydney University; Michael Darcy, Professor, Urban Research Program, Western Sydney University, and Peter Phibbs, Chair of Urban Planning and Policy, University of Sydney

This article was originally published on The Conversation. Read the original article.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/oy1SzNFg-HM/

Bending the rules can help stop urban sprawl

By Jennie Officer, University of Western Australia

This is the fourth piece in our series, Reinventing density, co-published with Future West (Australian Urbanism).

The story of Perth’s low-density composition and growth is well understood. The increasingly urgent need to develop infill housing for a growing population that results in a more compact city form has been well communicated and forms an inevitable part of the discussion about density. In the last decade, this reasoning has become broadly accepted.

However, understanding the problem is one thing; exploring its potential solutions is another. Economics, stigma, inertia and layers of legislation mean Perth is substantially failing to meet the state government target of 47% infill for new residential development across the metropolitan area by 2031.

The primary mechanism that local governments have used to implement the top-down long-term vision for more infill housing is “upcoding”; that is, identifying and increasing sites with higher development potential. This has a number of consequences:

- increasing friction between supporters of market-driven speculation and those calling for affordable housing;

- the entrenchment of NIMBYism;

- built-form policies that prevent sites from reaching their potential; and

- questioning of whether infill density is improving or dismantling the spatial and cultural qualities of our suburbs.

It is debatable whether more or less regulation might help to achieve the infill targets. On the one hand, further top-down regulation may be needed to force targets to be met. On the other, the bluntness of the instruments used for housing delivery may prevent innovative approaches to density and development from appearing.

Is there an alternative? Can regulation ever be expected to deal adequately with the complexities of how people could, should and want to live together?

Can current regulation become an instrument to support non-standard approaches to achieving density? Can individual buildings be prototypes that permit a range of possibilities for planning legislation? Could density conditions be negotiated rather than preordained? And, if they can be, what might happen?

A fresh take on density

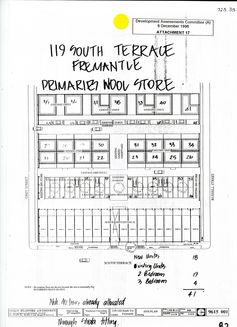

Near the famous cappuccino strip: a 1995 newspaper ad for The Primaries. Fremantle City Library History Centre

It is worth considering a project where these questions have come into play.

Built in 1923 as a wool and hide store, the Primaries warehouse in Fremantle was used to stored wool for 70 years until it was purchased for conversion into residential units. In 1993, approval was granted for 17 dwellings on the site. This was in addition to 23 dwellings that had been approved three years prior and subsequently built.

The resultant 40 grouped dwellings doubled the allowable density of the R35 site (the R35 code stipulates a minimum site area of 220m² per dwelling). This was made possible through a density bonus, granted under a clause of the town planning scheme relating to “places, buildings and objects of historical or scientific interest”.

Council could relax any provision of the scheme, including the density of a site, where part of an existing building deemed to be significant was being preserved. In this instance, it was proposed to retain the roof structure and external walls of the 6,070m² warehouse. As a result, the site density was varied considerably, as were the required setbacks and the private open space requirements.

Brian Klopper, a local architect becoming increasingly known for his canny, idiosyncratic residential projects, was engaged to design both stages of the development. Stage 2 sold in just eight weeks.

Site plan showing stage 2 of the warehouse conversion. Fremantle City Library History Centre

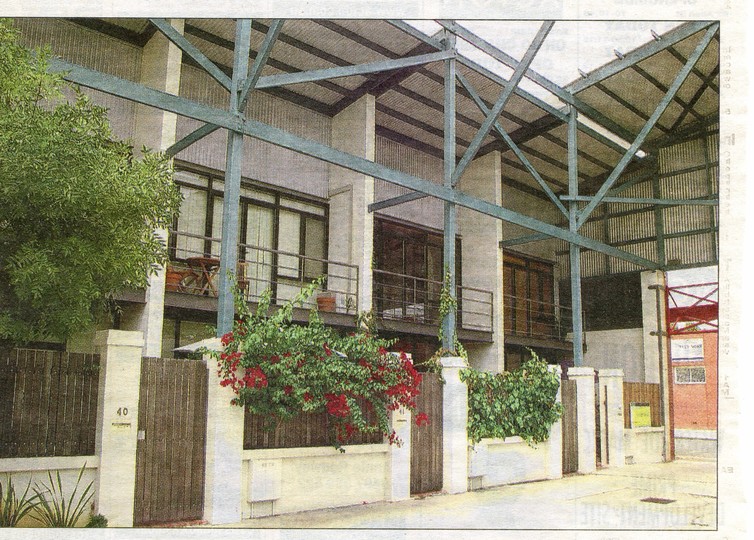

Within the boundary perimeter walls, Klopper inserted three rows of grouped housing and two large open courts. The courts function as inner streets, open to the sky. They allow for pedestrian and car access, for open car parking, for shared gardens, for each dwelling to address.

The houses are built in rows, with party walls at right angles to the perimeter walls and terminated on the inner court ends by full-height curtain glass walls. This is a terrace-house typology, expanded vertically and flooded with light.

Multifunctional and multifarious, the two-and-a-half-storey units have adaptable spaces. Occupants are able to use these as houses or for office or retail purposes, with little or no modification.

The most compelling aspect of the Primaries project, with the most enduring relevance, is its deft balancing of communality and privacy. It is a remarkable exemplar of medium-density development because it maintains the ideals of an individual house – privacy, comfort and customisability – within the compact dimensions of a collective residential cluster.

The defining feature of the inner courts is public space. Connectivity, so often suppressed in multi-unit developments, is enhanced.

Private and common space are balanced, with shared courts retaining the roofing framework from the old warehouse. Fremantle City Library History Centre/Mark Brophy Estate Agent

Flexible rules expand possibilities

This is a propositional project. It proposes a way of living in the city and of approaching density. The density bonus provision allowed the developer, architect and planners to establish the rules and conditions of the site, rather having to follow rules.

Negotiated conditions were necessary due to the unique nature of the warehouse. It’s worth considering that if the warehouse had not existed on the site, the scheme, even in identical form, would have been unlikely to be approved.

It’s also worth reconsidering subdivision. We are accustomed to subdivision being about land; to density codes being related to minimum site areas and plot ratios. Perhaps density is more about people than buildings; about occupation, not containers.

We may need to consider new ways of subdividing all sorts of buildings, rather than land. And we may need to build things that are subdivisible from the outset.

It’s possible to imagine other projects initiating progressive planning conditions. It’s possible to imagine height and setback provisions being varied for projects that demonstrate exceptional solar access and ventilation. It’s possible to imagine density bonuses based on performance, adaptability, communality or affordability.

With these sorts of expanded parameters for density bonuses, at once specific and wide-ranging, initiated and tested by project, new forms of housing may emerge that more effectively serve our contemporary, changing city.

The Conversation is co-publishing articles with Future West (Australian Urbanism), produced by the University of Western Australia’s Faculty of Architecture, Landscape and Visual Arts. These articles look towards the future of urbanism, taking Perth and Western Australia as its reference point. You can read other articles here.

![]()

Jennie Officer, Senior Lecturer in Architecture, University of Western Australia

This article was originally published on The Conversation. Read the original article.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/cDQoPkO8vOQ/

Fixed rates could be on the way up

Australia’s lenders will soon start raising their interest rates – that’s what Mortgage Choice chief executive officer John Flavell believes.

“There is growing speculation that the United States’ Federal Reserve will lift the official cash rate at its next board meeting on December 14,” he says.

“Furthermore, other central banks from across the globe are now signalling that the bias for easing monetary policy is over.

“Closer to home, the Reserve Bank of Australia strongly suggested at its November board meeting that the time for easing monetary policy has now passed.

“This idea is supported by the fact that long-term bond rates have started to move slightly higher and we’ve already seen increases in some of the fixed rates on offer domestically.”

Flavell says it’s “very likely” that home loan rates have already hit the bottom of the interest rate cycle.

“If people have been waiting for the bottom of the rate cycle, it may well have already passed,” he says.

“The fact that we’ve seen some lenders starting to increase their fixed-rate pricing would suggest we have hit the bottom of the rate cycle, and are now at the point where rates will soon rise.

“Of course, even if rates do rise in the near future, it is important that borrowers don’t panic.

“The reality is, interest rates are incredibly low by long-term standards. So, even if rates do rise over the coming months, they’ll continue to hover around all-time lows.”

Flavell says anyone concerned about the future trajectory of their home loan interest rate could potentially look to fix all or part of their mortgage.

“There is a case to lock in to a fixed-rate mortgage while home loan rates are still sitting below 4 per cent. By locking in to a fixed-rate mortgage, borrowers could beat any potential rate rises.

“In addition to avoiding future rate rises, borrowers who choose to fix their mortgage will be given a sense of security around their ongoing mortgage repayments.”

Before making any home loan decisions, however, Flavell points out that it’s important for borrowers to consult a mortgage professional.

“Your local broker can help you determine whether or not switching home loans is the right financial move.

“They can do all of the legwork and make sure that whatever choice you make, it’s the right one for your needs.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/fSoV5VFsDs4/

Former financial adviser banned

The Australian Securities and Investments Commission (ASIC) has banned Anthony Bishop of Chelmer, Queensland, from providing financial services for eight years.

The ban came about as a result of ASIC’s Wealth Management Project, which was established in October 2014 with the objective of lifting standards by major financial advice providers.

ASIC found that during the period July 2010 to April 2014, when he was an employee representative of Westpac Financial Consultants Ltd (a part of the Westpac Banking Corporation), Bishop was involved in the provision of inappropriate advice to clients and also involved in the failure to provide one client with a written statement of advice.

ASIC found that Bishop implemented a “one size fits all” advice strategy that didn’t tailor advice to clients’ personal and financial circumstances and led to clients being overinsured with inappropriate level of premiums.

Bishop was also found to have made one misrepresentation concerning tax savings and to not be competent to provide financial services.

ASIC deputy chair Peter Kell says: “Advice needs to be tailored to the client’s needs and circumstances, and an advice provider must not lose sight of the needs of their client.”

Bishop’s behaviour was originally reported to ASIC in May 2014.

A customer remediation process was undertaken and 29 former clients were paid a total of $1,127,543 made up of advice fees, refunds of premiums for inappropriate advice and market loss relating to investments.

The Wealth Management Project focuses on the conduct of the largest financial advice firms (NAB, Westpac, CBA, ANZ, AMP and Macquarie).

The project covers a number of areas including:

- Working with the largest financial advice firms to address the identification and remediation of non-compliant advice

- Seeking regulatory outcomes, when appropriate, against licensees and advisers.

The following advisers from the financial services industry have been banned as part of the Wealth Management Project, in addition to Bishop:

Rommel Panganiban

Anthony Jason Sourris

Sarah Kate Gardner

Nicholas Kerr

Craig Scott Miller

Wayne Meadth

Hardik Bhimani

Gerard McCormack

Shane Thompson

Ben Rickman

Ben Cheung

Mark Tidbury

Amanda Ritchie

Stuart Murray Jamieson

Sharnie Kent

Alfie Chong

Martin Hodgetts

Shawn Hickman

Brett O’Malley

Brian Farber

Rebecca Locksley

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/8wuSrUidHJo/

A new online toolkit developed by the Australian Securities and Investments Commission’s MoneySmart will enable Australians to better understand and navigate the financial advice process.

ASIC’s MoneySmart Financial Advice Toolkit is a free educational tool that breaks down the complexity within the financial advice process. It will assist consumers with their research and help them evaluate the financial advice they receive.

The toolkit provides an overview of the financial advice process and gives impartial guidance on:

- Identifying financial goals and advice needs

- Tips on choosing an adviser

- Preparing to meet a financial adviser

- Understanding your Statement of Advice

- Reviewing your financial situation.

Consumers can use the toolkit to create a customised “to do” list, which they can modify to suit their personal financial needs.

It also includes links to ASIC’s Financial Advisers Register, where consumers can check an adviser’s credentials – their licence, authorisations, experience and qualifications, and whether they have ever been banned or disqualified from providing financial services.

“Australians face major financial decisions throughout their lifetime, many of which can be complex and confusing,” ASIC deputy chairman Peter Kell says. “Yet only about one in five Australians obtain financial advice. ASIC recognises the value that quality advice can deliver and wants to see this increase.

“ASIC’s new toolkit is a practical resource to help Australians assess the quality of the advice they receive and make better financial decisions.”

The new digital tool complements and supports ASIC’s regulatory and enforcement work in the financial advice sector and is designed to improve demand-side capability at critical financial moments.

The toolkit is available on ASIC’s MoneySmart website.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/sjZ1GunU5Ek/

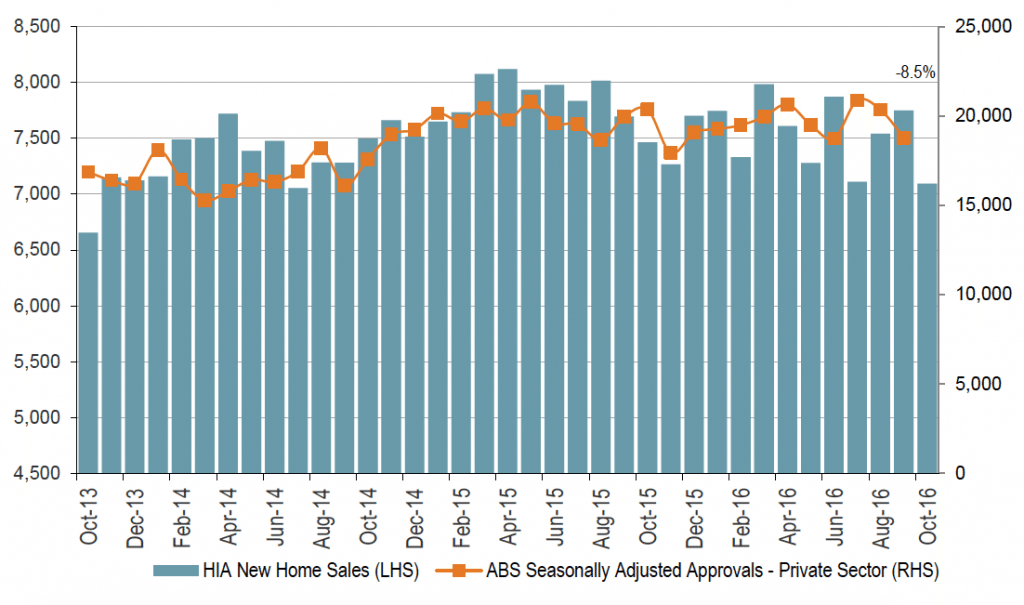

New home sales fall to two-year low

The monthly survey by the Housing Industry Association (HIA) of Australia’s largest home builders indicates that new home sales dropped to a two-year low during the month of October.

“HIA new home sales fell by some 8.5 per cent during October 2016, the lowest volume of sales since July 2014,” HIA senior economist Shane Garrett reveals.

“Sales on both sides of the market saw sizeable reductions. Detached house sales were down by 8.2 per cent during the month, while multi-unit sales fell by 9.2 per cent.”

The reduction in the volume of new home sales isn’t unexpected, given that Australia is coming to the end of its longest and strongest new home building upturn, Garrett points out.

“October’s new home sales results are consistent with HIA’s latest forecasts for new home building starts which foresee a reasonably marked reduction in activity over the next couple of years,” he explains.

“Even so, activity is projected to fall to a low point of around 172,000 new dwellings starts during 2018/19, about the same as the average of the past decade.”

During October 2016, detached house sales fell in three of the five mainland states covered by the report.

The largest reduction in sales volumes during the month was in Victoria (-20.4 per cent), with new detached house sales also falling in Western Australia (-5.6 per cent) and New South Wales (-2.8 per cent).

New detached house sales rose by 4.5 per cent in Queensland during October, with a slight increase of 0.8 per cent in South Australia.

Private new dwelling sales (Australia) – seasonally adjusted

Source: ABS 8731.0 and HIA

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/JrBugRzQYEs/

By Dallas Rogers, Western Sydney University

The government is proposing changes to the foreign investment framework that will allow a foreign real estate investor to purchase an off-the-plan dwelling when another foreign investor has failed to reach settlement.

In announcing the changes, Treasurer Scott Morrison deployed a familiar narrative about foreign investment increasing housing supply and making “housing more affordable for more Australians”.

This idea is in keeping with property development lobbyists, who are focused on getting government to release more land to solve the complex long-term housing affordability problem in cities.

However, researchers have debunked this idea before (see here and here). Their conclusion is that government cannot supply its way out of the housing affordability problem in major Australian cities.

The government’s focus on the concerns of the property industry renders invisible a broader set of interested parties and a much more nuanced suite of contributing factors and solutions.

The current foreign investment rules are a blunt set of regulatory tools, held captive to the housing supply and global competitiveness debates.

Not all foreign real estate investors are the same

There are important differences between individual foreign real estate investors, which are regularly conflated in foreign investment policy and the public debate.

In broad terms, there are four investor groups. A class-based distinction defines people from the expanding middle class in countries like China. They are called the new middle class.

A disposable asset distinction, which excludes primary residences, separates the three remaining groups. High net worth individuals have disposable assets that exceed US$1 million. Ultra high net worth individuals have asset holdings in excess of US$30 million. Ultra, ultra high net worth individuals have a minimum of US$50 million in disposable assets in a wealth management fund.

In the absence of fine-grained data about which groups are investing and their differential impacts on cities and housing, the treasurer has opted to protect the development industry rather than the people and places within cities.

A regulatory environment that is sensitive to various investor groups is important in Australia because different investors impact their host cities in diverse ways.

Regulating foreign investors, sales or capital

How foreign capital intersects with local real estate markets depends on on who is investing capital, the properties in which the capital is being invested and the investment vehicles through which the capital is being transferred.

The arrival of foreign capital is not always accompanied by the arrival of new permanent residents for the city. Therefore, the investors interact with local infrastructure and shape housing supply in diverse ways.

There is a big difference between the impacts of new middle class and high net worth investors in cities compared to ultra and ultra, ultra high net worth investment.

Ultra, ultra high net worth individuals can be “free-floating” investors who travel around the world, purchasing real estate in various global cities. Rowland Atkinson argues this group has little allegiance to the host neighbourhoods.

Ultra high net worth investors might move between multiple residences and have attachments to the neighbourhoods their properties are in. The new middle class and high net worth investors might live in, or send their spouse and/or children to live in, the house they have purchased. They often have an allegiance to the cities or neighbourhoods their properties are in.

The personal motivations of foreign investors are important too. They can extend far beyond financial considerations.

An exhibitor of luxury properties in Spain speaks to a potential investor during the Luxury Property Showcase (LPS) Beijing. Ultra high net worth individuals can shop globally for investment properties. HOW HWEE YOUNG/EPA

Therefore, who is investing and their residency status will shape the neighbourhood, city and perhaps even the country into the future.

Neighbourhoods with high concentrations of ultra high net worth investors in London appear to be (or may be) devoid of people. Local businesses in these suburbs have become untenable as local patronage declines.

New middle class and high net worth investors might change the social fabric, educational institutions or employment landscape of a neighbourhood or city through habitation, for good or ill.

International evidence shows that some investors will occupy their property, others place it on the rental market, some buy multi-million-dollar trophy homes, while others increase the housing supply in a neighbourhood of absentee owners and fading businesses.

Therefore, the impact of foreign investors on housing supply is related to the investment practises of each investor, the amount of capital they bring into Australia and how they invest it.

More dynamic foreign investment rules needed

Housing supply and global competitiveness arguments have captured the foreign real estate investment debate. Both are too simplistic and need to be augmented with additional voices, policies and data.

Governments justify their pro-foreign investment and business immigration policies through “financial benefits” arguments in times of prosperity and “economic necessity” arguments in times of hardship.

These top-down narratives position foreign real estate investment as good for the local economy, with secondary benefits such as increasing housing supply and jobs growth through targeted skill migration and business development.

The government needs to understand how foreign investment is shaping cities from the ground up. This includes: how foreign investment impacts people in the local neighbourhoods where these properties are located; how developers change the dwellings they build to suit foreign investors; how changing educational institutions are shaping foreign student investment; and the experience of first homebuyers who are looking for a home in the same property markets.

This article is based on research presented in an editorial for a journal special issue on Global Real Estate in the International Journal of Housing Policy.

![]()

Dallas Rogers, Urban Studies Researcher: Institute for Culture and Society Urban Research Program, Western Sydney University

This article was originally published on The Conversation. Read the original article.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/YChr-uHPmNc/

New strata laws for NSW come into effect today

Today’s the day – after years of consultation and review, it all finally comes to a head with reforms to New South Wales strata laws set to begin.

President of the Real Estate Institute of NSW John Cunningham says more than 90 new strata laws will make a difference to the lives of those living in in the state.

“These reforms will benefit owners, tenants and property managers and bring the laws in line with current thinking,” he says.

“They recognise the changes that have been made in technology in the last 25 years, with voting now available electronically, via Skype calls and by email.”

Simply everyday improvements such as hanging pictures or coat hooks and filling cracks can go ahead without permission required, and kitchen or bathroom renovations, installing timber or tile floors and replacing wiring or power points no longer need a special resolution by-law.

“Landlords may be held liable to their tenants for secondhand smoke exposure,” Cunningham explains.

“Owners’ corporations can also create by-laws banning smoking throughout an entire strata building.”

Orders against residents who smoke or allow their cigarette or barbecue smoke to drift into other units can also be created.

“The keeping of pets has been made easier as a request to keep a pet can’t be unreasonable refused,” he adds.

“Owners will be able to appeal to the Tribunal if they believe the request was unreasonably withheld.

“Reviewing and updating legislation is vital to ensuring that it keeps pace with changing society. We look forward to continued amendments to strata legislation over the coming years.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CzQZDA4jryg/

The Australian Government is set to implement changes under the foreign investment framework to allow foreign buyers to purchase an off-the-plan dwelling when another foreign buyer has failed to reach settlement.

The change addresses industry concerns, and means property developers won’t be left in the lurch when a foreign buyer pulls out of an off-the-plan purchase.

The idea is that markets won’t be affected negatively by an increased amount of off-the-plan sales, particularly from foreign purchasers, not being completed.

According to the government, it’s common sense that an apartment or house that has just been built, or is still under construction and for which the title has never changed hands, is not considered an established dwelling.

In the event of a failure to complete settlement, the dwelling will revert to its previous status – that is, a new dwelling.

For individual applications made by potential purchasers the policy change will be implemented immediately. Foreign buyers who apply to purchase a dwelling that’s considered established, only due to a failed settlement, will be assessed as if it was a new dwelling.

These issues also affect the current New Dwelling Exemption Certificates, which act as a pre-approval mechanism for foreign people purchasing new apartments in a specific development. A regulation change will be made at the next opportunity to enable developers to acquire a certificate that covers foreign persons purchasing a dwelling that’s considered established only due to a failed settlement.

The Commissioner of Taxation has advised no compliance action will be pursued against persons who, if not for a failed settlement preceding their purchase, would otherwise have been covered by an existing New Dwelling Exemption Certificate until the regulations are changed.

The government’s foreign investment framework allows foreigners to purchase new Australian dwellings as it encourages developers to build more houses and apartments, thereby increasing supply. Increased supply makes housing more affordable for more Australians.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/90nwUy4BbFg/